Increasing convenience for taxpayers and management agencies

On June 24, 2025, the Minister of Finance issued Circular No. 51/2025/TT-BTC regulating electronic transactions in the field of tax for exported, imported, transit goods and means of exit, entry and transit. The Circular is expected to promote digital transformation in tax and customs management, while facilitating people and businesses in the process of fulfilling tax obligations.

One of the notable new points is the pilot implementation of electronic tax collection methods through payment intermediary service providers. The expansion of this payment channel brings many options for taxpayers, in line with the Project for developing non-cash payments directed by the Prime Minister.

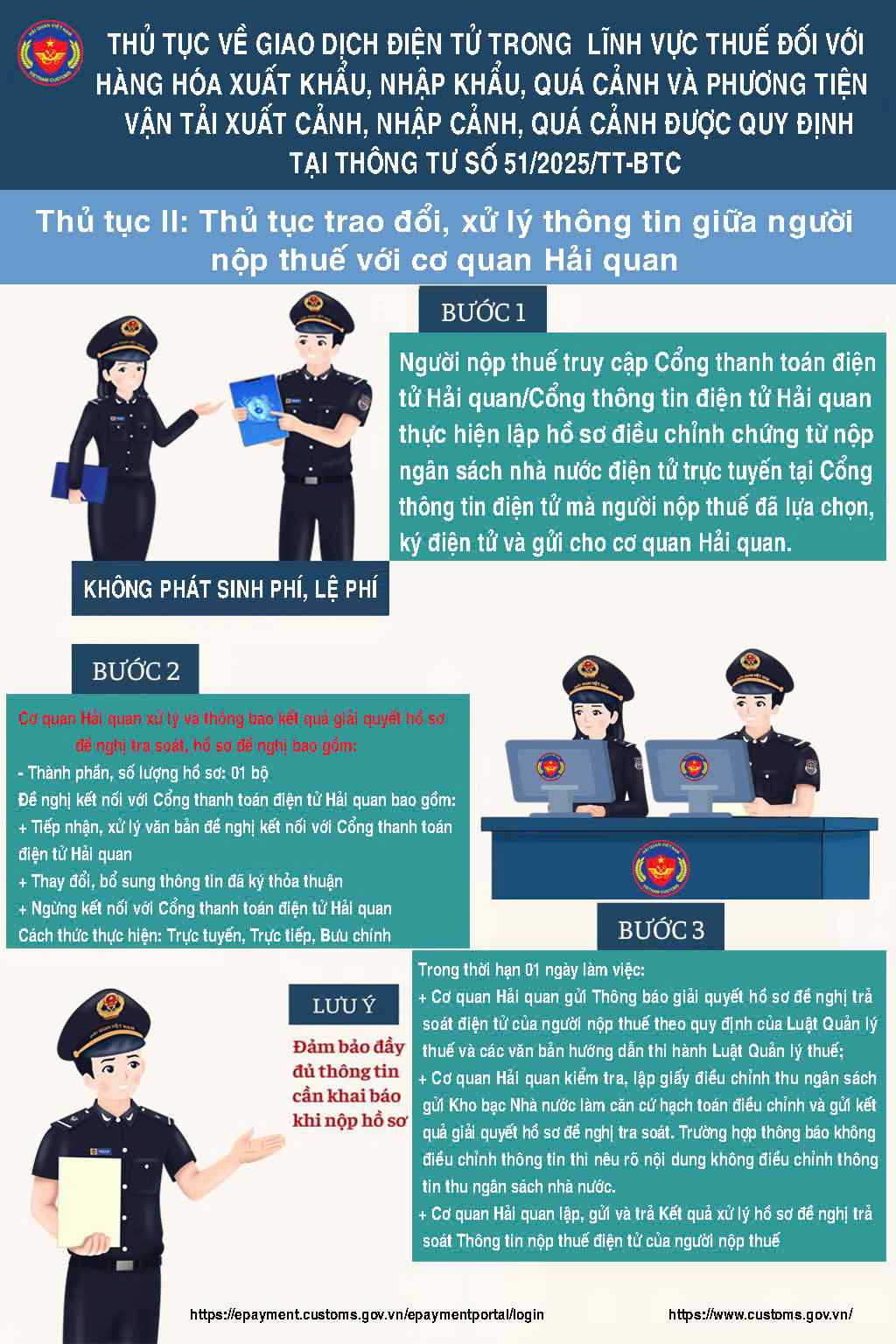

According to the new regulations, customs authorities are allowed to use budget payment information transferred by intermediaries to the Customs Electronic Payment Portal for accounting, debt collection and confirmation of tax obligations to taxpayers. This regulation helps shorten the process, reduce paperwork, and limit errors in comparison and review between relevant parties.

Increasing payment channel selection, saving time and costs

For taxpayers, the Circular allows the use of many different payment channels such as banking applications, applications of payment intermediary organizations or online on the Customs electronic transaction portal. Thanks to that, customs declarants can proactively enter payment orders at any time, regardless of the working time of commercial banks, thereby shortening customs clearance time and optimizing costs.

The Circular also paves the way for expanding the channel for budget revenue from cross-border e-commerce activities - a rapidly developing trend. Taxpayers can easily monitor and manage payments, thereby improving the effectiveness of cash flow control and tax responsibility.

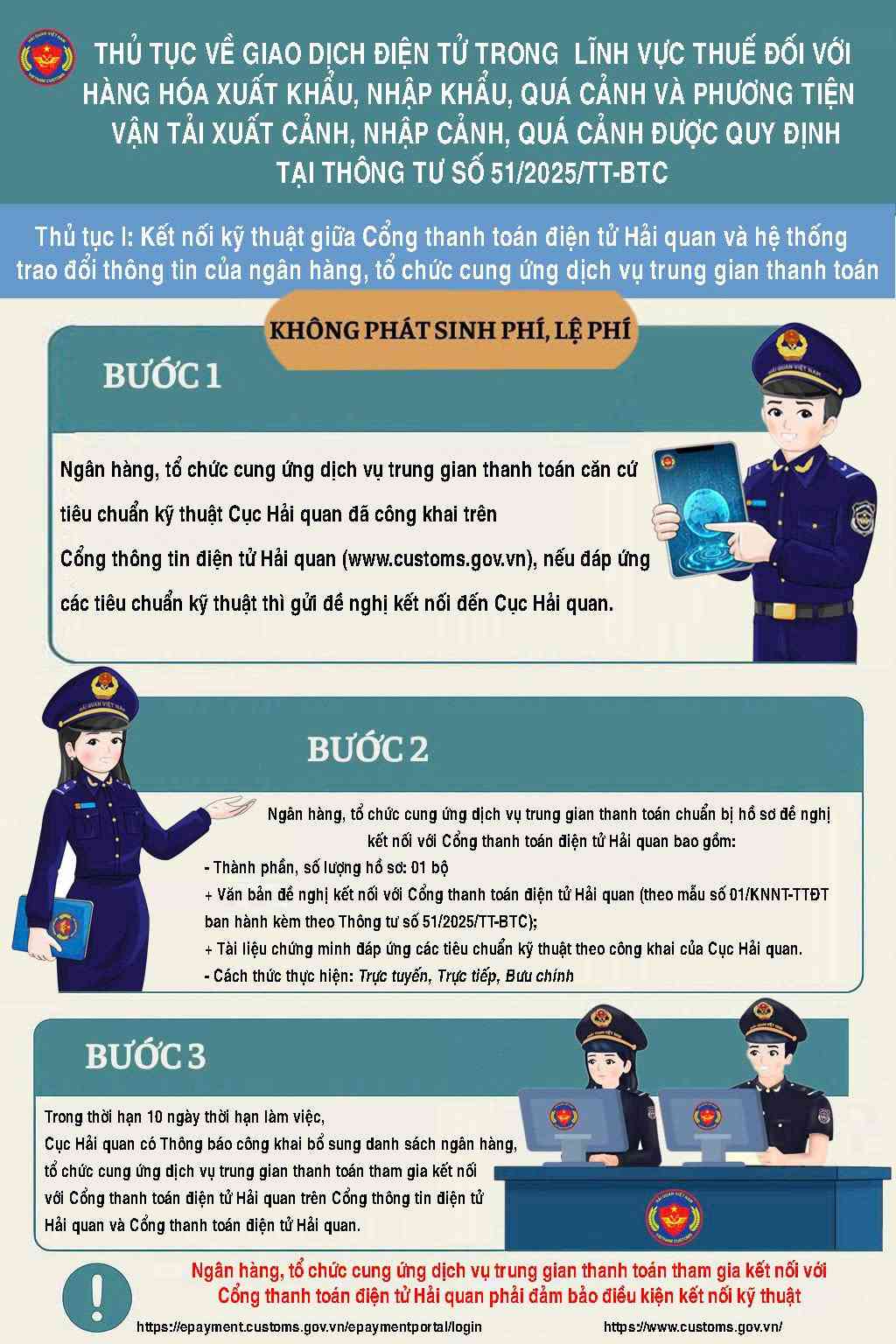

For organizations providing payment intermediary services, the Circular clearly stipulates the responsibility to prepare documents and technical infrastructure according to standards published on the Customs Electronic Information Portal, in order to minimize time and technical connection costs.

For customs authorities, the application of electronic tax collection methods through intermediaries helps simplify administrative procedures, increase service amenities and reduce tax file processing time. At the same time, create a technological foundation to improve the effectiveness of management and supervision of state budget collection and payment activities in the import-export sector.

Circular 51/2025/TT-BTC is considered an important step forward in customs modernization, implementing Resolutions No. 66-NQ/TW and 68-NQ/TW of the Politburo on administrative procedure reform, creating conditions for the development of the private economic sector and promoting the application of digital technology in state management.