The race for technical human resources and risk management

According to statistics from financial reports of 28 banks, by the end of June 2025, more than 3,400 bank employees had to be cut.

The personnel paradox is reshaping the Vietnamese banking industry. On the one hand, the wave of automation and AI has led to repeated cutbacks in professional positions. On the other hand, major banks are spending strongly and applying special policies to recruit high-quality human resources, especially in the fields of technology, risk, legal and core business.

Recruitment data from typical "big guys" such as Vietcombank, VietinBank, Agribank, BIDV, VPBank, SHB and ACB shows this clear Polarity, where money and recruitment mechanisms are used to solve talent shortages.

The shortage of digital human resources and risk management is forcing banks to compete with superior benefits, creating a new income level for experts.

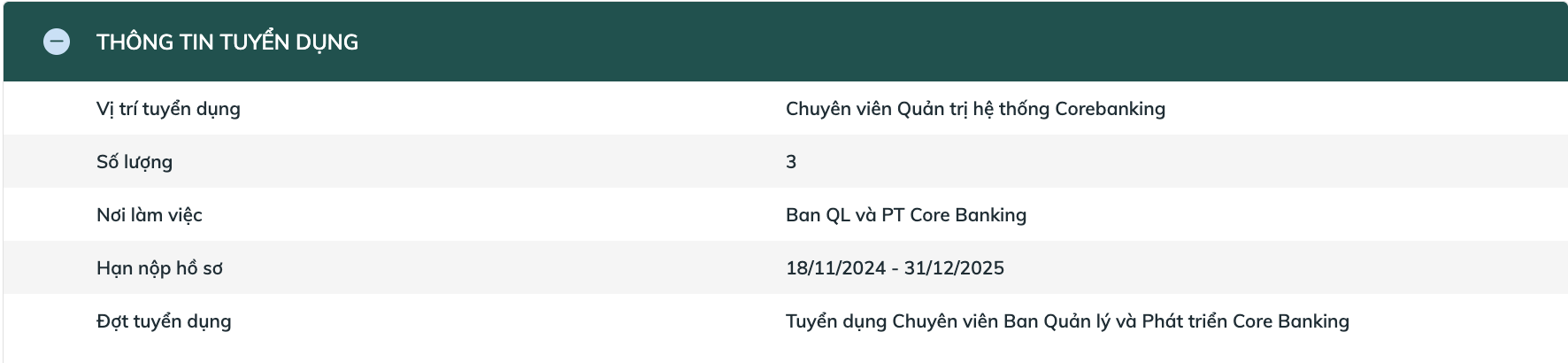

Leading state-owned banks such as BIDV are investing heavily in technology. BIDV is recruiting a large number of employees for the Information Technology & Digital Banking Bloc, including positions such as Core Banking Development Specialist, Automation Customer, and is ready to increase by 10% - 20% of income compared to the general regulations for scarce technology positions.

VietinBank also focuses on recruiting the Chief Digital Product Development Specialist for Enterprise customers (Ecosystem), a position that requires at least 3 years of experience in developing banking products and prioritizes people with experience in implementing digital projects.

The need for risk management is no less severe. VPBank is looking for a Forensic Legal Specialist with an income of up to 50 million VND/month, a competitive payment level to ensure a good team to handle legal issues and bad debts.

Focus on the elite and reshape business skills

While spending more on in-depth professional personnel, banks also restructured the way of recruiting traditional professional and business positions, accepting young human resource training for the business segment and tightening input for the business segment.

State-owned banks such as Vietcombank, Agribank and VietinBank are all simultaneously recruiting large-scale Customer Relations (QHKH) nationwide. However, they apply higher input quality barriers.

Vietcombank and Agribank apply a direct admission mechanism for "excellent students" (with high degrees and foreign languages such as IELTS 7.0) VietinBank also only recruits candidates who have graduated from prestigious universities. This distinction creates a more rigorous screening for new graduates who want to enter the professional sector.

In contrast, joint stock commercial banks are more flexible in recruiting and selling. VPBank is ready to recruit micro-enterprise Customer Relations staff with the criteria "No experience required", prioritizing candidates with business qualities and customer service thinking.

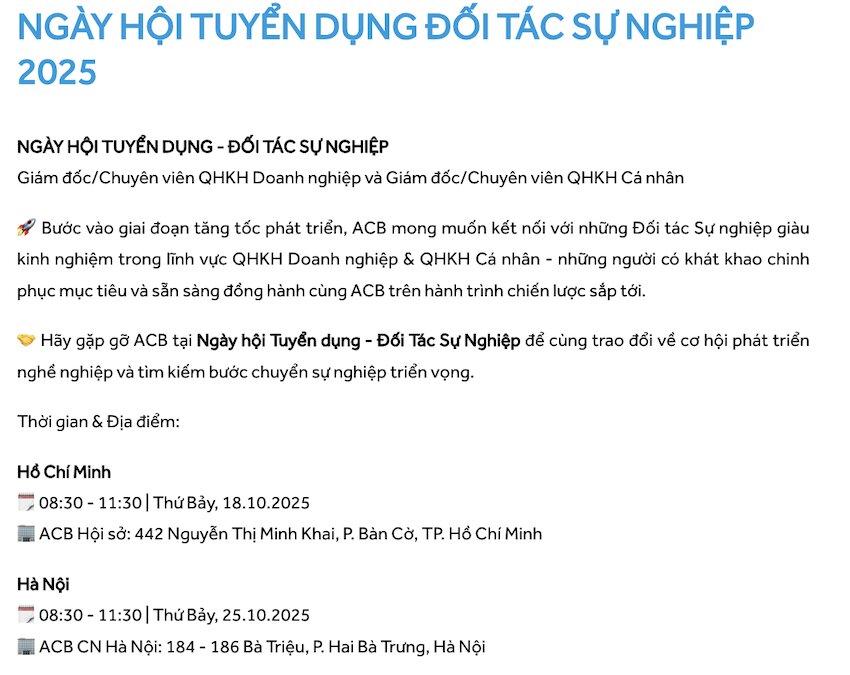

Similarly, ACB organizes the Recruitment - Career Opportunity Festival to hunt for experienced QHKH and commit to responding to interviews within 48 hours. This difference shows a two-pronged strategy: training young sales teams to expand markets and recruiting experienced senior personnel to accelerate revenue.

In short, the banking labor market is not cold but is becoming more selective than ever. A great opportunity is for those who are willing to invest in in-depth expertise, technology and risk management skills, areas that machines are unlikely to replace.