Operating block is greatly affected

In the context of the wave of artificial intelligence (AI) existing in all aspects of life, the finance - banking industry is always considered a pioneer field with the trend of Fintech financial technology, digital banking and non-cash payment platforms...

In addition to positive changes, AI is creating unprecedented "cleansing" of banking industry personnel. According to statistics, more than 3,400 bank employees have been cut and many units have narrowed their networks, AI is putting the banking industry in front of major challenges.

Sharing about the above situation, Mr. Le Ba Tiep - Deputy Director of Nam A Commercial Joint Stock Bank Trading Center (Nam A Bank) - said: "In fact, commercial banks have had major refinances, especially the operating sector has suffered a cut of nearly 50%. After receiving transactions arising from the business department, the operating block will perform a series of tasks as a apparatus, with a post-processing nature, not generating profits. This will be the first part to be affected by AI".

Mr. Tiep illustrated with a specific example: "Previously, customers who wanted to open an account would have a transactor to support them, but now, that activity has been automated with quick operations on banking applications. At that time, traders were almost no longer valuable" - Mr. Tiep pointed out.

However, according to Mr. Le Ba Tiep, artificial intelligence is a very broad field, currently banks are in the investment phase for AI. For example, the sales department still needs people to communicate directly with customers.

Some places are streamlined, some are not border-free

As Lao Dong previously reported, at the seminar "Developing human resources in the AI era" on October 8, Ms. Le Thi Thuy Sen - Editor-in-Chief of Banking Times - commented: "Students in the Vietnamese economic sector are very smart, but in the process of recruiting personnel, banks face two major weaknesses. These are limitations in foreign language and digital capabilities. These are two core requirements that current training has not met, making it difficult to recruit high-quality personnel".

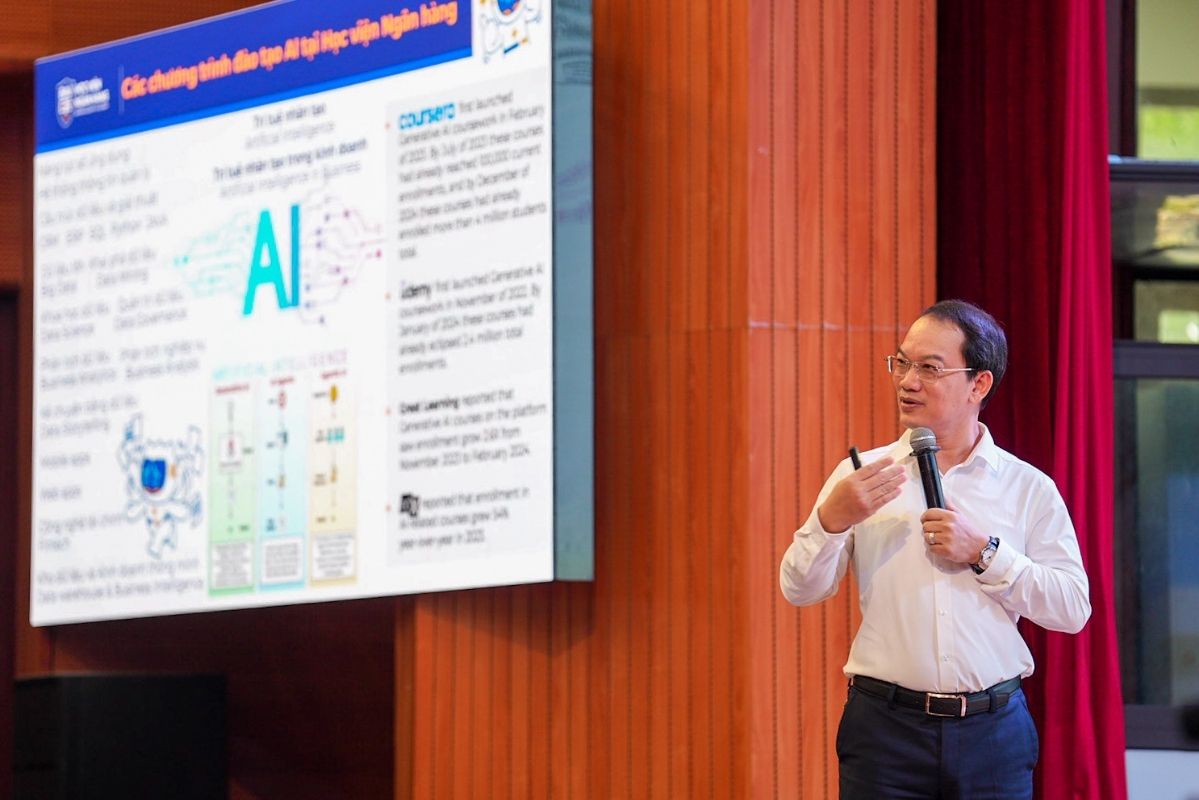

Recognizing the importance of artificial intelligence, Dr. Phan Thanh Duc - senior lecturer, Head of the Faculty of Information Technology and Digital Economics, Banking Academy - said that AI human resources in the banking industry are increasingly playing an increasingly important role in positions such as data governance, risk models, fraud, digital customers and compliance.

"The areas with serious shortage of AI human resources include: data science, AI operations engineers, security - cybersecurity, and especially experts with experience in practical implementation" - Mr. Duc emphasized.

Dr. Phan Thanh Duc also informed about some banks reducing up to 100 branches, but some units restructuring their human resources department in the direction of not being border guards.

On the side of commercial banks, many representatives said that they do not hesitate to spend large resources to invest in technology, spread digital culture throughout the system, focus on developing a systematic human resource strategy, cooperate with international consulting organizations such as BCG and KPMG to build a capacity framework, perfect a compact and effective governance model and operating process.

Notably, banks have simultaneously implemented the development of separate salary and bonus policies and comprehensive benefits for high-quality human resources.