Real estate is still the "backbone" of banking collateral assets

Statistics from the 2025 semi-annual financial report show that real estate continues to be the largest collateral asset in the mortgage portfolio of banks. At most banks, the value of real estate mortgaged and mortgaged has increased compared to the end of 2024.

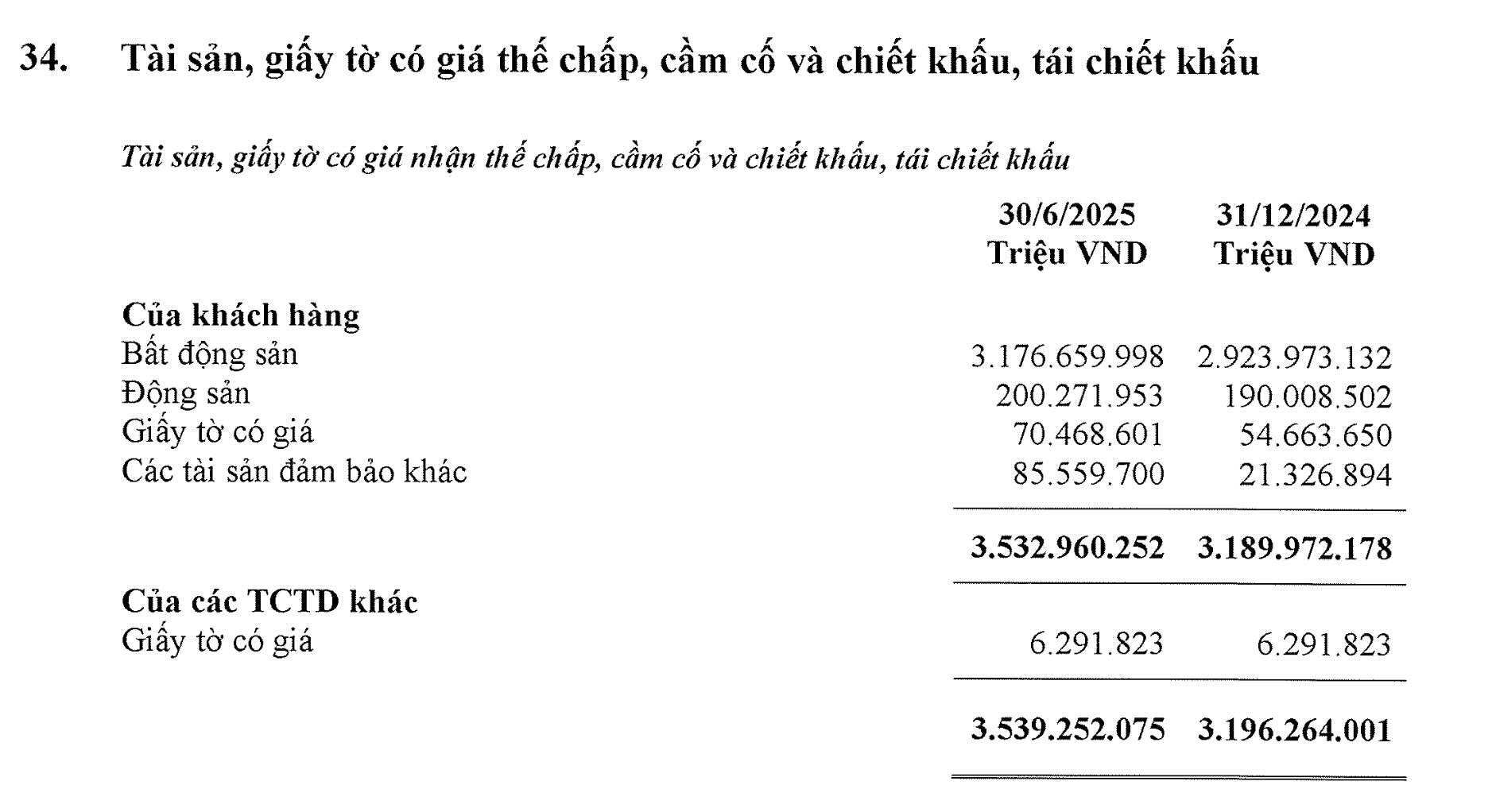

Agribank is the bank with the largest mortgage real estate value in the system, reaching more than 3.17 million billion VND. This figure is nearly double the total value of the 5 major joint stock banks combined, showing the clear superiority of the state-owned banking group. After only half a year, the value of real estate mortgaged assets at Agribank increased by nearly VND250,000 billion, equivalent to the entire mortgage portfolio of a mid-range bank.

Second place is Vietcombank with about 1.74 million billion VND, accounting for more than 66% of the total value of collateral.

If the value of the collateral assets of Techcombank, VPBank, TPBank and HDBank is added, the total scale is only equivalent to the level that Vietcombank is holding - showing the overwhelming position of the state-owned banking sector in the mortgage asset sector.

In the next group, Sacombank, MBBank and VPBank are the three most prominent names in terms of the scale of real estate-guaranteed assets.

Sacombank recorded more than VND 889,000 billion, accounting for 85% of the total value of collateral - one of the highest rates in the system.

MBBank reached VND 894,669 billion, an increase of more than VND 122,000 billion after only half a year, accounting for 52.6% of the collateral portfolio.

VPBank is ranked in the leading group with VND 648,558 billion, equivalent to 28% of the total value of collateral - an absolute higher level than many mid-range banks combined.

In addition to the leading group, many other banks also have a very high proportion of real estate in the mortgage/deposit portfolio, reflecting the large dependence on this asset class:

Techcombank: VND 565,888 billion (46%)

HDBank: VND 412,237 billion (45%)

LPBank: VND 509,571 billion (53%)

VIB: 416,693 billion VND (63%)

TPBank owns nearly VND 284,000 billion (28%)

Eximbank: VND 248,866 billion (80%)

Meanwhile, MSB (216.500 billion VND), Nam A Bank (162.709 billion VND) or ABBank and Ban Viet Bank also recorded significant increases.

Outstanding real estate loans continue to expand, increasing by nearly 24%

According to the State Bank, by July 31, 2025, outstanding real estate credit reached more than 4.1 million billion VND, an increase of 17% compared to the end of 2024 and accounting for 23.68% of total outstanding loans of the economy.

Of which: Outstanding loans for real estate business reached 1.79 million billion VND, up nearly 24%; Outstanding loans for consumer loans associated with real estate reached 2.28 million billion VND, up more than 12%.

Credit capital continues to flow strongly into the real estate sector, especially loans for business, investment and development of real estate projects.

Accordingly, Techcombank is one of the banks with the largest lending scale in the real estate sector, with VND227,000 billion, an increase of more than 21% compared to the end of 2024. This scale is nearly 3 times higher than the total outstanding real estate of ABBank, Bac A Bank and KienlongBank combined, showing a large concentration of capital in real estate.

VPBank maintains its position in the top group with VND192,821 billion in outstanding loans for real estate business, accounting for 23.3% of total outstanding loans to customers. In addition, the bank also lent individuals to buy houses at VND 108,768 billion (accounting for 13.1%) and lending for construction at VND 42,823 billion (accounting for 5.2%).

HDBank continues to expand its real estate lending strongly, as outstanding real estate business loans increased from VND 68,292 billion to VND 83,125 billion. Construction loans have also increased to VND 60,626 billion.

MBBank's real estate business lending is VND 85,532 billion (up 38%) and outstanding construction debt is VND 35,918 billion.

Sacombank also increased capital flows into real estate, with outstanding loans of VND 32,076 billion, an increase of more than VND 9,600 billion (equivalent to 42.8%) compared to the end of last year.

LPBank has outstanding loans for real estate business of VND 10,196 billion and construction of VND 32,627 billion.

Eximbank promotes real estate lending, with VND10,826 billion in business lending (up from VND6,445 billion) and VND34,207 billion in home loans (up from VND26,724 billion).

TPBank recorded VND28,176 billion in real estate business loans (up nearly 32%) and VND23,092 billion in construction loans.

MSB provided real estate and infrastructure loans of VND 19,689 billion (up from VND 17,153 billion) and construction reached VND 18,102 billion.

VIB has outstanding real estate business debt of VND 10,159 billion, nearly double at the beginning of the year.

ACB provided construction loans of VND 20,801 billion and real estate business and consulting reached VND 9,350 billion.

Some major banks such as Vietcombank, BIDV and VietinBank have not announced specific outstanding loans for real estate business activities, but have all recorded a significant increase in long-term loans (over 5 years). Long-term loans often include loans for home purchase or project development.

From the scale of over 4.1 million billion VND of outstanding real estate debt and millions of billions of VND of mortgaged assets, it can be seen that real estate is still a pillar in the banking credit structure.

However, financial and banking experts have repeatedly warned that high concentration also carries risks if the real estate market fluctuates or asset value decreases.