Outstanding real estate credit increased sharply

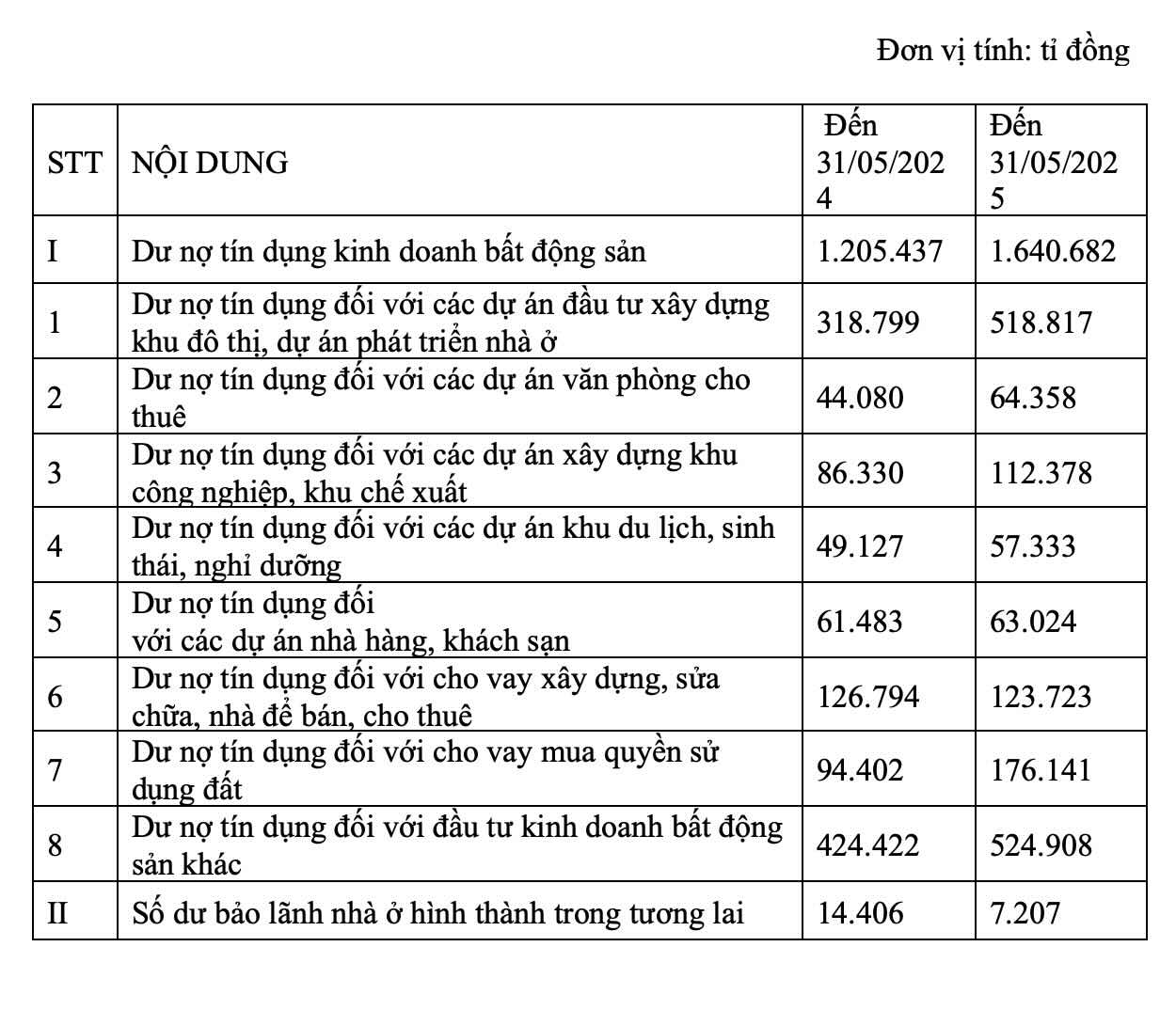

According to a report by the State Bank of Vietnam, as of May 31, 2025, outstanding credit for real estate business activities reached VND1,640,682 billion (up 36% over the same period last year), reaching the highest level since 2023.

The Ministry of Construction believes that this data shows the recovery and growth expectations this year of economic sectors, including real estate, specifically as follows:

Thus, the total outstanding real estate credit increased more strongly after 1 year (equal to more than 36% compared to the same period last year) showing that capital flow from banks in this sector is being more looser and showing signs of restoring confidence from both banks and businesses.

Real estate credit is also oriented to prioritize segments serving social security such as social housing, workers' housing and commercial projects to meet the real housing needs of the people.

Accordingly, with a credit growth target of 16% in 2025 (equivalent to about 2.5 million billion VND), there is a high possibility that real estate credit will continue to increase, especially in the context of low adjusted interest rates to support home purchases and preferential credit packages for young people.

6-month FDI in Vietnam is the highest in 5 years, real estate leads the wave

According to the report on the socio-economic situation in the second quarter and the first 6 months of 2025 of the Statistical Office (Ministry of Finance), the total registered FDI capital in Vietnam as of June 30, 2025 includes:

Newly registered capital, adjusted registered capital and the value of capital contribution and share purchase of foreign investors reached 21.52 billion USD, up 32.6% over the same period last year.

Notably, FDI capital implemented in Vietnam in the first 6 months of 2025 is estimated at 11.72 billion USD, up 8.1% over the same period last year. This is the highest amount of foreign direct investment capital implemented in 6 months in the past 5 years.

For the real estate sector: Total FDI capital for the real estate sector in the first 6 months of 2025 reached 5.17 billion USD, accounting for 24% of total registered FDI capital and increasing by more than 2 times over the same period last year (data from the Foreign Investment Agency - Ministry of Finance).

This is a positive signal for the common good, especially for the industrial real estate segment when foreign investors still assess Vietnam as a market with potential for development, this result comes from many favorable factors such as:

The macroeconomic foundation is stable, inflation and exchange rates are controlled; legal and investment policies are increasingly perfected, with amended laws taking effect from the beginning of 2025; key infrastructure systems such as the North-South Expressway, Long Thanh Airport, major belt routes in Hanoi and Ho Chi Minh City are accelerated, expanding investment space for the industrial real estate market and satellite urban areas.

In addition, the proactive economic diplomacy strategy, along with the development of new real estate segments such as logistics, smart industrial parks, green real estate, etc., has opened up new opportunities for foreign investors.

However, to maintain and promote the effectiveness of FDI attraction in the second half of the year and the next period, Vietnam needs to continue to reform investment procedures, shorten the time to approve projects with foreign factors; strengthen clean land fund planning, especially in satellite provinces with potential for development; ensure stability and transparency of laws and tax policies for foreign investors; encourage investment in sustainable real estate segments, in line with international trends...