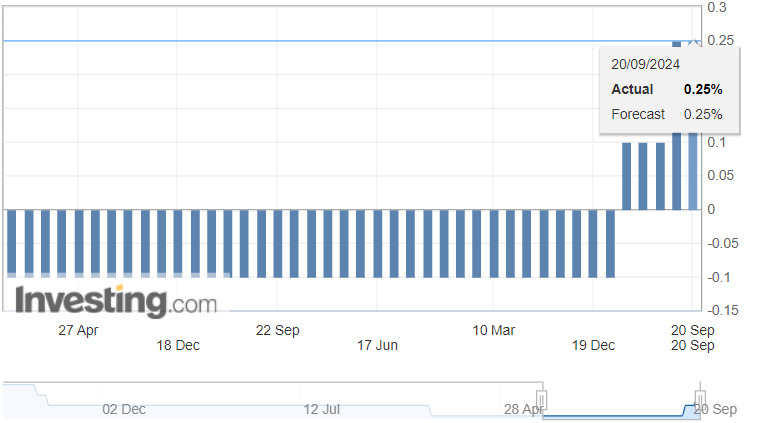

On September 20, after the meeting, the Bank of Japan (BOJ) decided to keep the interest rate unchanged. The short-term interest rate was stable at 0.25%.

"Personal consumption is showing a slight upward trend despite rising prices and other factors," the BOJ said, a more optimistic assessment than its previous view that consumption would remain stable.

The yen was on a losing streak and the Nikkei 225 index pared gains following the BOJ announcement.

Naomi Muguruma, chief bond strategist at Mitsubishi UFJ Morgan Stanley Securities, said the BOJ is optimistic that the Japanese economy is on track, largely due to rising wages, which are leading to rising household incomes. This increase in income allows households to spend more, contributing to consumption growth - an important factor in maintaining national economic growth.

“If upcoming data continues to reinforce the BOJ’s optimism, we could potentially see another rate hike in December 2024,” she added.

The Bank of Japan (BOJ) ended its negative interest rate policy in March this year and raised short-term interest rates to 0.25% in July, marking a landmark change after a decade.

Governor Kazuo Ueda has stressed that the BOJ is ready to continue raising interest rates if inflation remains at its 2% target sustainably, as the board currently forecasts.

A majority of economists surveyed by Reuters expect the BOJ to raise interest rates once more this year, with the majority predicting it will do so in December.

Some BOJ policymakers have called for close monitoring of market movements in setting policy. But they have also reiterated that the bank is ready to continue raising interest rates, with one hawkish member of the board saying short-term rates should eventually rise to around 1%.