Tet bonuses are the amount that employers reward employees based on production and business results, and the level of work completion of employees. To know exactly how much Tet bonuses you have to pay personal income tax, you need to understand the personal income tax calculation formula.

Salaries and Tet bonuses are income items subject to personal income tax according to Clause 2, Article 3 of the Personal Income Tax Law.

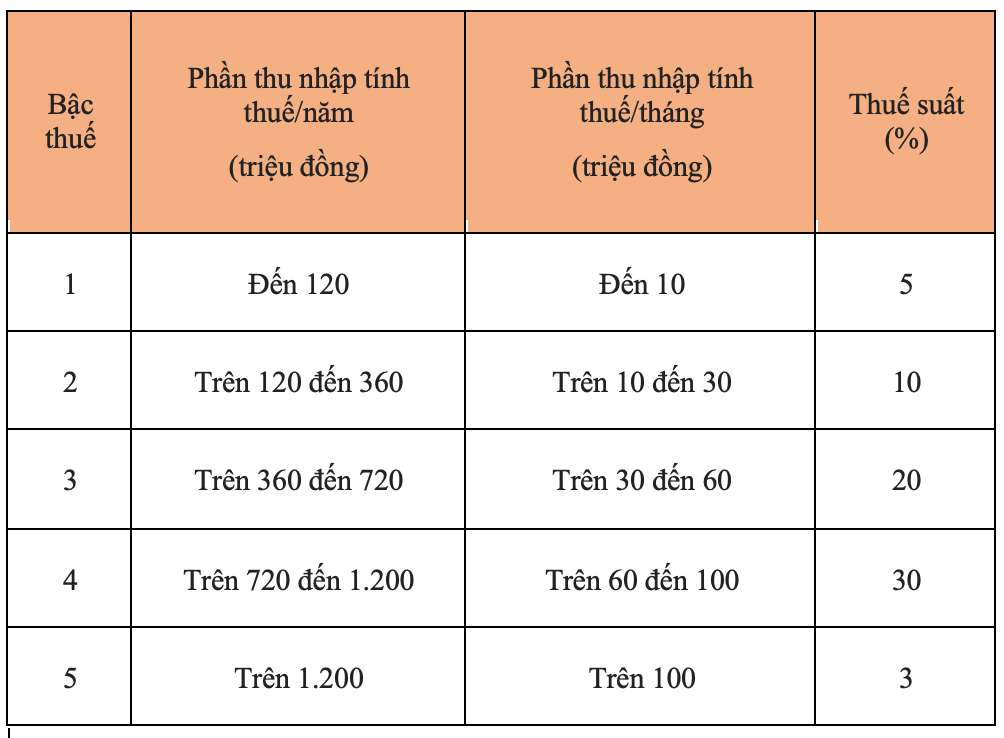

According to Article 8 of the Personal Income Tax Law, personal income tax on income from salaries and wages of resident individuals is determined by taxable income multiplied by (x) with the tax rate in the progressive tax schedule.

Personal income tax = Taxable income X Tax rate

Taxable income for income from salaries and wages is the total taxable income that taxpayers receive during the tax period, minus (-) contributions to social insurance, health insurance, unemployment insurance, occupational responsibility insurance for some industries and professions that must participate in compulsory insurance...

At the same time, according to Article 10 of the Personal Income Tax Law, before calculating tax on income from salaries and wages of taxpayers who are resident individuals, taxpayers are also allowed to deduct from taxable income the deduction level for family circumstances including:

- The deduction level for taxpayers is 15.5 million VND/month (186 million VND/year);

- The deduction level for each dependent person is 6.2 million VND/month.

Accordingly:

Taxable income = Taxable income – Insurance contributions – Family circumstance deductions

Thus, employees will have to pay tax when their taxable income is > 0. That is, the total taxable income (including salary and Tet bonus) after deducting insurance contributions and family deductions that is greater than 0, the employee must pay tax:

(Salary + Tet bonus) - Insurance contributions - Family deduction > 0

If there is taxable income, employees will calculate personal income tax according to the progressive progressive tax schedule specified in Article 9 of the Personal Income Tax Law as follows: