Allowing common tax rates to support small and medium-sized enterprises

The Tax Department said that this new Law clearly demonstrates the State's orientation in supporting small and medium-sized enterprises, strongly encouraging investment in high-tech, innovation and green economy sectors, and updating regulations to suit the development of the digital economy.

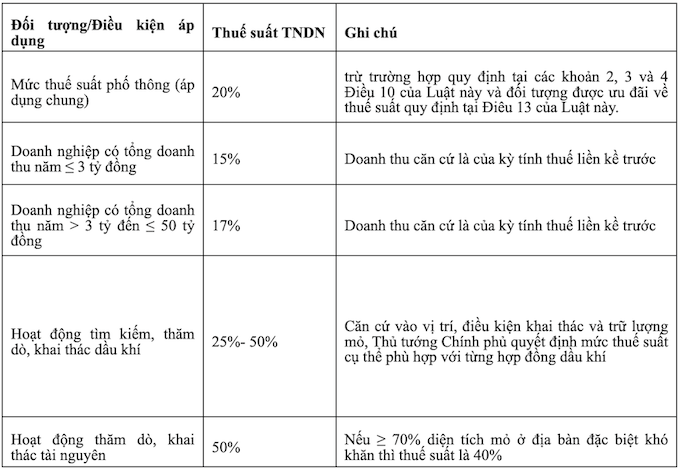

In which, the Tax rate group is 15%, 17%: Not applicable to enterprises that are subsidiaries or companies with relationships and the enterprises in the relationship are not enterprises that meet the conditions for applying preferential tax rates (based on Clause 4, Article 18 of the 2025 Law on Corporate Income Tax).

In addition, newly established enterprises from business households subject to a tax rate of 15% and 17% will be exempted from corporate income tax for 02 consecutive years from the date of taxable income.

Supplement public science and technology organizations and public higher education institutions operating for profit are exempt from tax according to Government regulations.

Clarifying tax regulations for the digital economy and foreign suppliers

Foreign enterprises not having a permanent establishment in Vietnam, including e-commerce and digital platform-based enterprises, must pay tax on taxable income arising in Vietnam.

Permanent establishments of foreign enterprises are defined to include e-commerce platforms and digital platforms through which they provide goods and services in Vietnam.

Transitional provisions

In case the law on corporate income tax is amended or supplemented and the enterprise meets the conditions for tax incentives according to the provisions of the new law and is amended or supplemented, the enterprise has the right to choose to apply corporate income tax incentives according to the provisions at the time of granting the license or according to the new regulations if it meets the conditions.

If they were not previously given incentives but under the new Law, they will be entitled to the 2025 tax calculation period for the remaining period.