The inevitable trend of the global financial industry

A few decades ago, developed financial markets witnessed the birth of sweep accounts or high-yield accounts automatic payment account models that automatically transfer idle balances to investments such as: exchange-traded market funds, short-term bonds, savings accounts bring higher yields than regular accounts while still ensuring liquidity.

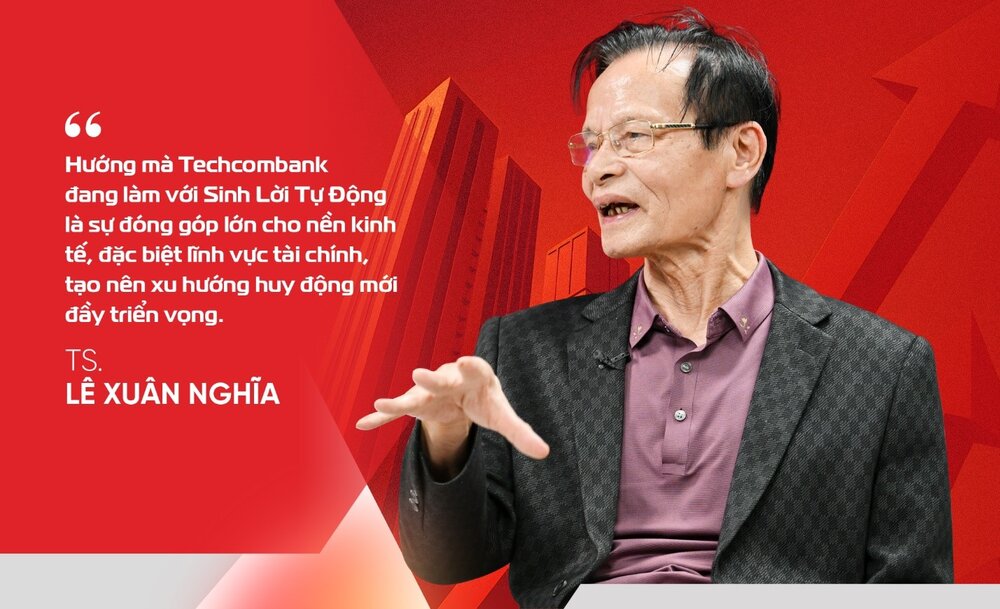

In Europe and the US, they have been implementing this model for a long time. I look forward to seeing Vietnam start doing it, Dr. Le Xuan Nghia shared in the podcast decoding the automatic profit wave.

Since the beginning of 2024, Techcombank has pioneered the implementation of this model with customizations to better suit the domestic market with outstanding advantages such as: safety, simplicity, flexibility 24/7 and more competitive yields, creating a notable difference for Techcombank Automatic Profit.

Specifically, when activating this product on the Techcombank Mobile application, customers are guaranteed the full amount of idle money and are still flexible to spend or transfer at any time without affecting the interest rate.

Continuously investing and listening to customer experiences, Techcombank Automatic Profit continues to upgrade to new versions with the ability to optimize value for customers without division or threshold limitation. A difference that is highly appreciated by experts is that banks allow optimal profit balances of up to 50 billion VND, breaking the industry's limits so far. With this model, whether the balance in the account is a few hundred million or only 1 VND, customers can enjoy a yield, up to 4.4%/year - nearly 90 times higher than the normal non-term account (0.05%/year). For example, with an average balance of about 100 million VND, instead of only receiving 50,000 VND in interest after a year, customers can receive up to 4.4 million VND - a large enough figure to see that leaving money "standing still" in their accounts is a waste.

As a legal right to bring new vitality to idle cash flow, Techcombank Automatic profits is not only a financial product, but also creates a revolution in the way Vietnamese people manage finance effectively and safely, as Dr. Le Xuan Nghia assessed: "The future trend is automatic profits, not just a savings deposit as before. The profit gap between traditional savings and Automatic profits will no longer be big enough to make people worry, Dr. Nghia predicted.

Without having to spend time opening more savings accounts, worrying about the time commitment to deposit money or having to transfer money between departments, Techcombank Automatic Profit brings unprecedented convenience. An office worker with a salary of 30 million VND/month can feel secure leaving money in his payment account, making daily profits and being willing to spend when needed while still optimizing the profit of cash flow.

Helping individual customers optimize their finances without having to spend effort researching investment channels or complex management operations is the practical value that the solution brings. And this is also the time for Vietnamese people to start changing their financial habits with Techcombank Automatic Profit.

Technology is the key to outstanding success

With more than 4 million customers enabling the feature after only 1.5 years of launch, Techcombank Automatic profits has become a trend, attracting the participation of the entire banking system in Vietnam, bringing benefits to customers. From individual customers, business households to business owners, everyone can use Techcombank Automated Profit as a useful financial tool with synchronous solutions from this bank. Dr. Le Xuan Nghia affirmed that the success of Automatic Profit cannot be separated from Techcombank's strong technology platform.

Techcombank is one of the pioneering banks in applying information technology in Vietnam. They invest heavily in technology infrastructure, data, and analysis and customer assessment systems to deploy products, said Dr. Le Xuan Nghia.

Thanks to early investment in technology infrastructure and the application of artificial intelligence (AI), Techcombank not only creates an outstanding financial product but also builds an optimal ecosystem, meeting the diverse needs of customers. Techcombank's AI system analyzes customer behavior, risk forecasting and personalizes products, thereby bringing a seamless and safe experience. In particular, the bank's superior security system is a competitive advantage that is difficult to copy. Being ahead and the long-term investment process has helped Techcombank maintain its position as a pioneer bank.

Dr. Le Xuan Nghia emphasized that in order to fully exploit the potential of the solution and create a real impact on the economy, Techcombank needs to expand and customize it for a variety of customers, especially small and medium-sized traders and businesses. At the same time, with its strength in technology and data, Techcombank will create unmitiable breakthroughs when it can classify customers into groups: such as small and medium enterprises, business households or salaried workers... and rely on payment data to provide incentives according to needs and appropriate profits, optimizing benefits for each group.

Looking further, Techcombank Automated Profit also creates a big impact on the Vietnamese financial system. According to Dr. Le Xuan Nghia, the effect of this model helps increase the liquidity of the banking system, reduce businesses' dependence on bond issuance, and support long-term loans. He gave an example of Europe, where banks have such high liquidity that they can provide home loans with a term of up to 88 years. In Vietnam, Techcombank is laying the foundation for a similar future, where flexible solutions become the standard of the financial industry.

In particular, the benefits brought to customers will make a difference and continue to lead the market: "The idle money of small businesses and large business households is very large. Expanding Autumn wins automatically for businesses will really make a real difference. Dr. Nghia affirmed.