Investment cash flow gradually returns

After major fluctuations in 2022, the corporate bond market has gone through a challenging period, with investor confidence seriously declining. However, according to experts, the market is gradually warming up with many signs of improvement.

According to Mr. Ngo Thanh Huan - Executive Director of FIDT, the value of corporate bonds maturing in 2025 is estimated to reach VND 242,000 billion, down 11% compared to 2024 and is expected to continue to decrease to VND 253,000 billion in 2026 (down 7% compared to 2024). This shows that the pressure to repay debts of enterprises has decreased, the liquidity shortage is no longer as serious as before.

An important factor that attracts corporate bonds to investors is their attractive yields, much higher than savings interest rates. In the context of low savings interest rates, cash flow from investors tends to shift to investment channels with higher yields such as corporate bonds. Bond products with assets guaranteed and issued by reputable enterprises are attracting more attention.

"In the context of corporate bond yields outperforming current savings interest rates, investors with a growth and balance risk appetite are recommended to consider allocating from 5% - 10% of their asset portfolio to safe corporate bonds. This is an opportunity to take advantage of attractive yields and improve investment efficiency" - Mr. Ngo Thanh Huan commented. Unlike the period of 2021-2022 when the market was caught up in a wave of hot investment, investors now tend to be more cautious. Cash flow focuses on less risky products, prioritizing bonds with a transparent structure, guaranteed assets or credit ratings.

Market prospects remain positive

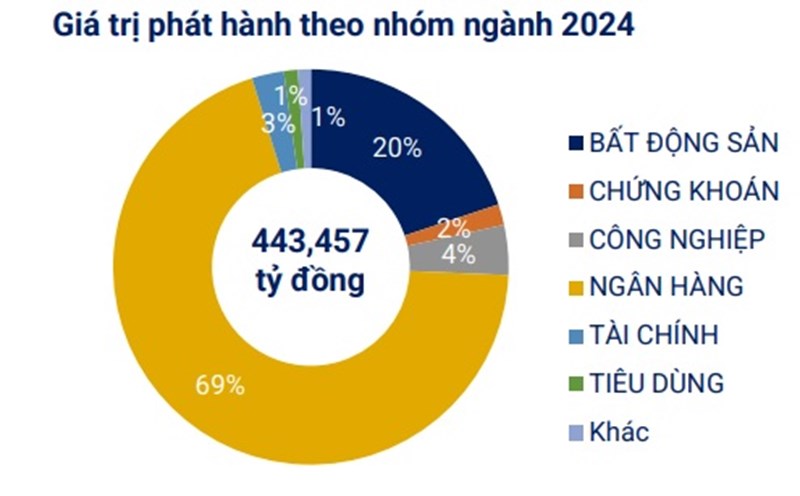

For issuers, market developments show that issuers have also taken more positive steps. New issuance volumes in 2024 grew strongly, but have not yet reached their highest level ever.

According to Mr. Ngo Thanh Huan's forecast, 2025 will continue to record an increase in new issuances, especially from real estate, manufacturing and consumer enterprises. However, unlike before, bond issuances are now more carefully prepared, with collateral or bank guarantee to create confidence with investors. One of the factors that helps the market improve is the improvement in the legal framework. The revised Securities Law effective from 2025 helps the market become more transparent, limiting the situation of mass bond issuance without guarantees for investors.

"The new regulations will help individual investors feel more secure when participating in the market. Requiring issuers to have guaranteed assets or credit ratings will be an important filter, helping capital flow into truly safer and more efficient places" - Mr. Ngo Thanh Huan assessed.

According to Mr. Ngo Thanh Huan, in 2025, investors can consider the choice between investing directly in corporate bonds with guaranteed or guaranteed assets by banks and investing in bond fund certificates.