Business strategy adjustment

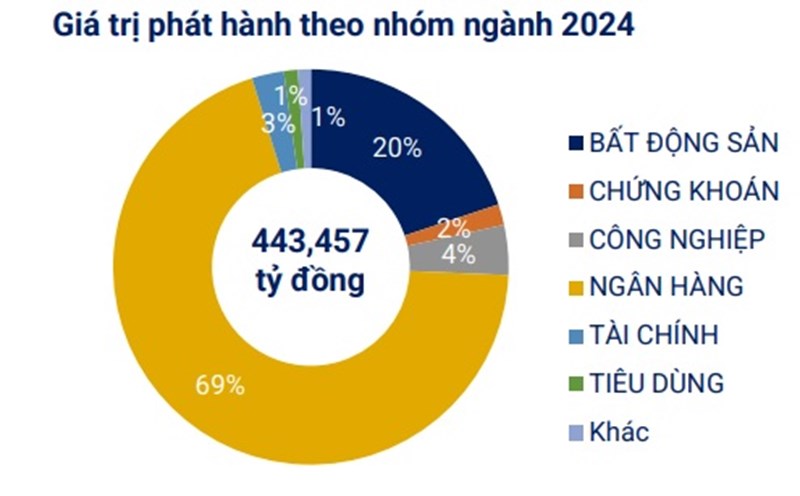

The corporate bond market is recording many remarkable positive changes with a strong recovery in issuance value, mainly coming from the banking sector - the industry group that plays a leading role in the market. Notably, the group of real estate enterprises is recovering at a slow pace but has many positive prospects in 2025.

Mr. Nguyen Quang Thuan - General Director of FiinRatings - said that the total value of outstanding real estate bonds reached VND 366,000 billion, accounting for 29% of the total value of corporate bonds in the whole market (VND 1.26 million billion) as of December 31, 2024.

However, the market witnessed a notable change in terms of maturity and interest rates. The average maturity of real estate bonds decreased to 2.64 years, compared to 3.72 years last year. The average nominal interest rate increased slightly to 11.07%, higher than the previous year's 10.46%.

These changes show that businesses are adjusting their strategies to suit the cautious sentiment of investors, in the context of risks from the real estate sector not being fully controlled. Commercial banks are still the main buyers in the changing market context, with initial signs of recovery being recorded.

“The real estate corporate bond market reflects caution through shorter maturities and high interest rates. However, with the determination of the Government and relevant ministries in removing legal obstacles for real estate projects, along with expectations from new policies including the Land Law, the Real Estate Business Law and improved credit environment, we forecast that there will be stronger signs of recovery starting from the second half of 2025,” said FiinRatings experts.

Market has many prospects for recovery

Overall, the real estate corporate bond market is in a period of transformation. Businesses are forced to adapt to the needs and caution of investors through adjusting terms and interest rates. Despite many difficulties, policy support, along with the prospect of new legal regulations, promises to create a solid foundation for the market's recovery.

According to experts, although the market is not yet vibrant, positive signs are gradually appearing. The efforts of the Government and ministries in removing legal obstacles for real estate projects are highly appreciated. The completion of legal policies and credit reforms will be an important driving force for the market to develop more sustainably in the future.

In addition, the participation of commercial banks as the main buyers of real estate corporate bonds is also a supporting factor. Although not yet clearly demonstrated on a large scale, some real estate enterprises have successfully raised capital through bonds.

Over the past year, 27 real estate businesses issued new bonds with a total issuance value increasing slightly, although pressure from old debts and the need for financial restructuring remains very large.

Assessing the liquidity of corporate bonds, Dr. Nguyen Tri Hieu - an economic expert, said that most of the bonds issued are bonds of banks. Bank bonds are classified as low risk and always have very high liquidity.