According to the financial reports of the fourth quarter of 2024 of 27 banks that have announced data, the total outstanding bad debt (group 3-5 debt) has increased by 17% compared to the beginning of the year, equivalent to VND 32,621 billion, bringing the total outstanding bad debt of the whole industry to VND 227,103 billion. Although this figure is VND 26,376 billion lower than the peak in the third quarter of 2024, the growth rate compared to the beginning of the year is still at a worrying level.

Notably, the most serious bad debt group - group 5 debt (possibly losing capital) - increased by 39.3% compared to the beginning of the year, reaching VND118,915 billion. Some banks have seen group 5 debt increase by more than 100%, reflecting the increasing pressure to handle bad debt.

Which bank has the strongest and highest increase in bad debt in 2024?

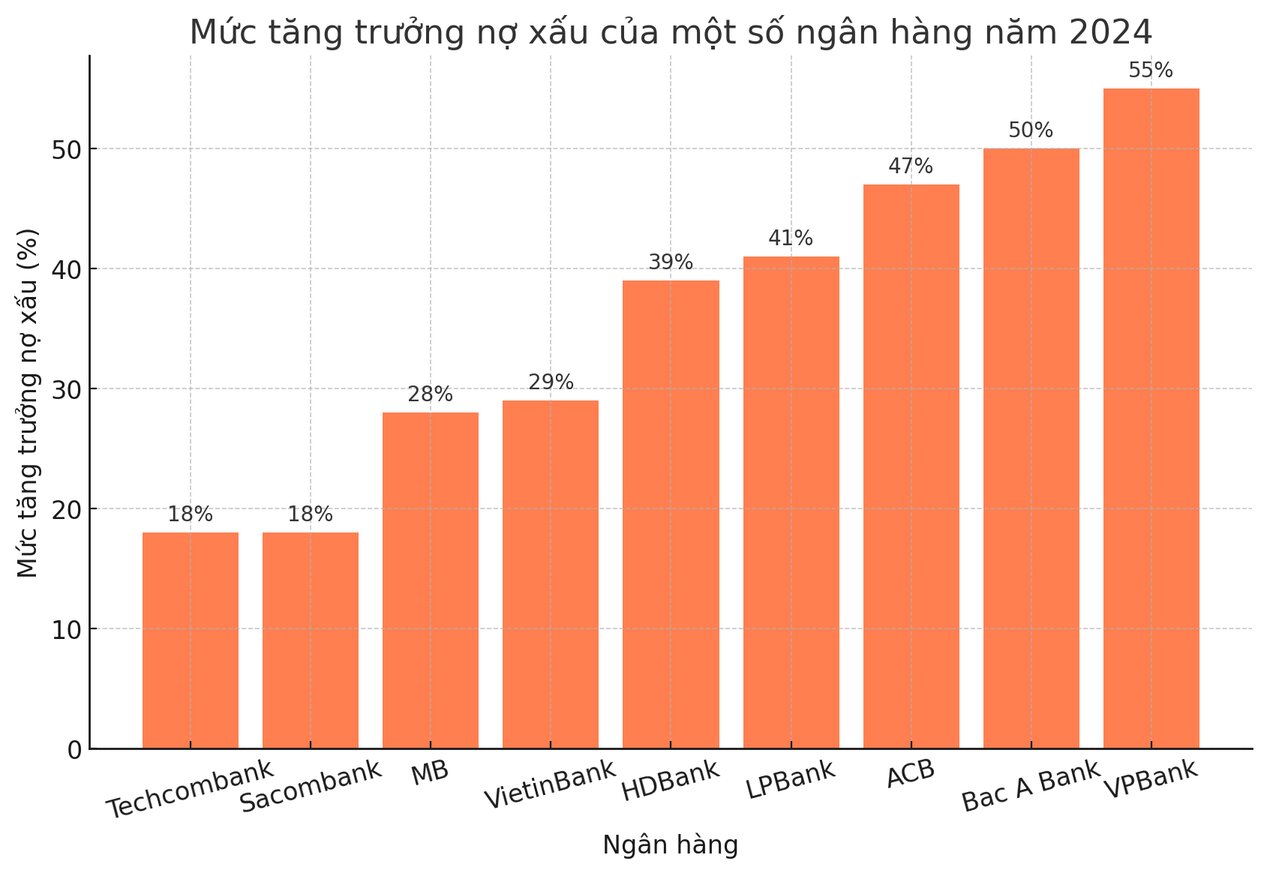

Compared to the beginning of the year, many banks recorded double-digit increases in bad debt, some even increased by more than 40-50%. Which bank has the highest bad debt in 2024?

According to data from financial reports, ACB, HDBank, VietinBank, Techcombank are the names at the top of the list.

Below is the bad debt growth of some banks in 2024:

ACB: Bad debt increased by 47%, from VND 5,887 billion to VND 8,650 billion.

HDBank: Bad debt increased by 39%, from 6,160 billion VND to 8,556 billion VND.

VietinBank: Bad debt increased by 29%, from 16,608 billion VND to 21,473 billion VND.

Techcombank: Bad debt increased by 18%, from VND 5,999 billion to VND 7,101 billion.

Sacombank: Bad debt increased by 18%, from VND 10,984 billion to VND 12,957 billion.

MB: Bad debt increased by 28%, from VND 9,805 billion to VND 12,585 billion.

LPBank: Bad debt increased by 41%, from 3,689 billion VND to 5,199 billion VND.

On the contrary, NCB and TPBank are two banks with bad debt decreasing compared to the beginning of the year, down 16% and 9% respectively.

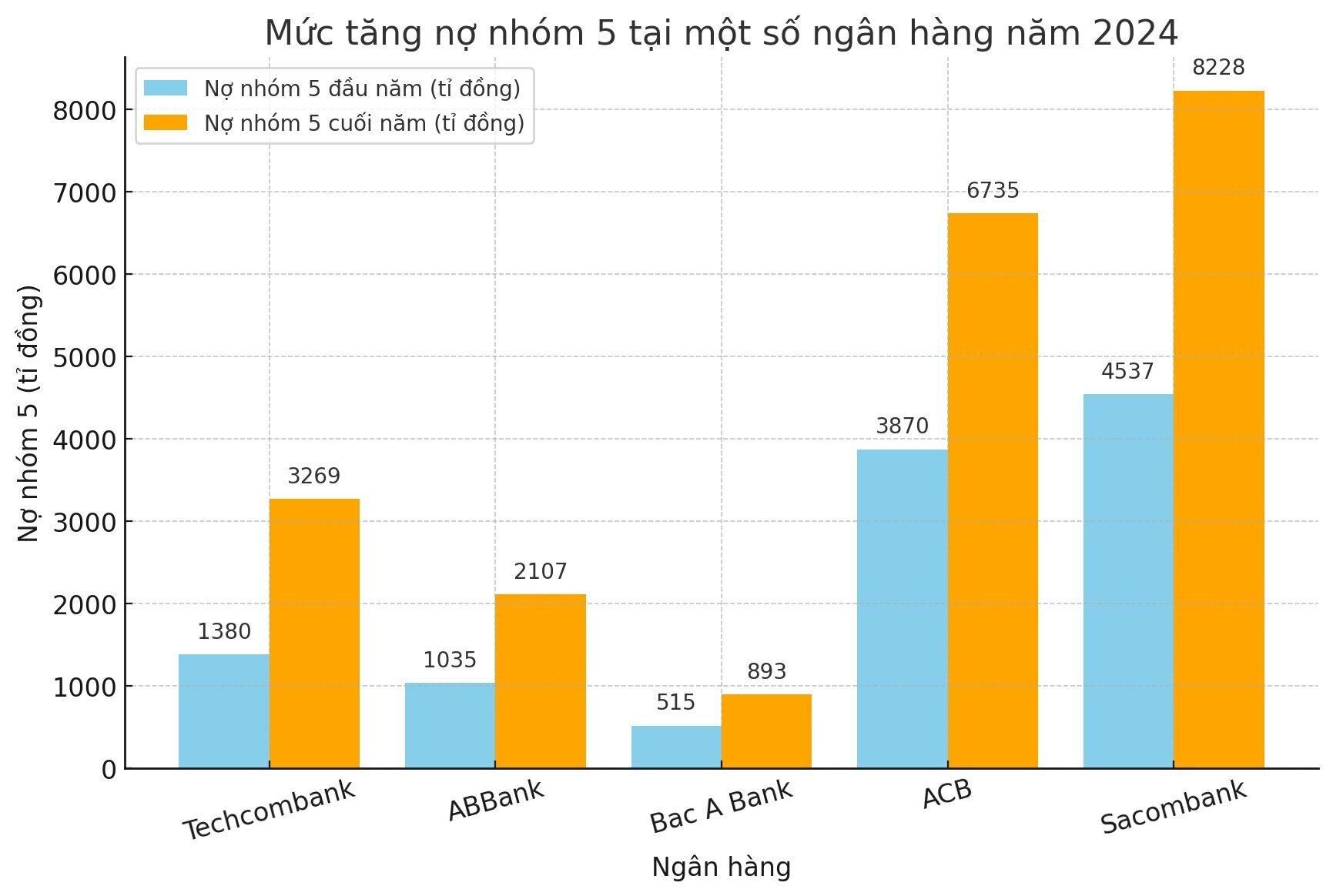

Group 5 debt swells, causing pressure on provisioning

In the bad debt portfolio, group 5 debt is the most worrying factor due to low recovery ability, requiring banks to increase provisions, directly affecting profits.

Some banks recorded a sharp increase in group 5 debt compared to the beginning of the year, typically:

Techcombank: Group 5 debt increased by 136.9%, from VND 1,380 billion to VND 3,269 billion.

ABBank: Group 5 debt increased by 103%, from VND 1,035 billion to VND 2,107 billion.

Bac A Bank: Group 5 debt increased by 73.4%, from 515 billion VND to 893 billion VND.

ACB: Group 5 debt increased by 74%, from VND 3,870 billion to VND 6,735 billion.

Sacombank: Group 5 debt increased by 81.3%, from VND 4,537 billion to VND 8,228 billion.

On the contrary, SHB, NCB and TPBank are the rare banks that recorded a slight decrease in group 5 debt compared to the beginning of the year, showing positive signs in handling bad debt.

The increase in group 5 debt means that banks have to increase provisions, leading to significant erosion of profits.

Risk of bad debt re-emergence

The fact that bad debt in the entire industry showed signs of "cooling down" in the fourth quarter of 2024 is a positive signal, but the sharp increase in group 5 debt at many banks is still a worrying issue.

Entering 2025, experts say bad debt will continue to be clearly differentiated. Banks with high bad debt coverage ratios and good risk management will maintain stability. On the contrary, banks with credit portfolios focused on real estate and corporate bonds but not well-controlled risks may continue to face high provisioning pressure.

A report from Vietcombank Securities (VCBS) shows that although bad debt in the entire banking sector is likely to decrease in the fourth quarter of 2024, the risk cannot be completely eliminated. If the real estate market does not fully recover in 2025, the risk of bad debt re-emerging is still very high.

According to the State Bank, to control risks, banks will have to strengthen credit appraisal, increase provisioning ratios, and apply more effective debt collection measures. This is to ensure that the banking system maintains stability in the face of increasing financial pressure.

Controversy over Circular 02: Should it be extended?

As bad debt continues to rise, the market is questioning the fate of Circular 02 - a policy that allows banks not to transfer debt groups for restructured loans.

According to VnDirect, the continued extension of Circular 02 could bring negative signals by causing the risk of bad debt to persist even though banks have written off debt aggressively. Another risk is that many banks have not fully set aside 100% of provisions for these loans, posing a potential risk when the policy ends abruptly.

Associate Professor Dr. Dinh Trong Thinh shared with Lao Dong Newspaper: "Circular 02 is a way to share difficulties between banks and businesses. However, extending Circular 02 can inflate the bad debt "bubble", creating great risks for the financial system."

If a business is truly resilient, it will be able to repay its debts without having to “hold on” to the policy. Conversely, if a business cannot repay its debts even with a debt extension, then the extension will only prolong the risk.

Legalizing the resolution on handling bad debts of banks At the working session with the State Bank on February 11, 2025, Prime Minister Pham Minh Chinh assigned Deputy Prime Minister Ho Duc Phoc to directly direct the State Bank to prepare documents and submit them to the National Assembly in the upcoming May session to legalize Resolution No. 42 of the National Assembly on piloting the handling of bad debts of credit institutions.