To check bad debts online with CCCD, individuals follow the following steps:

Step 1: Access the CIC website: https://cic.gov.vn

Select “Register” on the right corner of the screen to register an account (if you do not have an account yet).

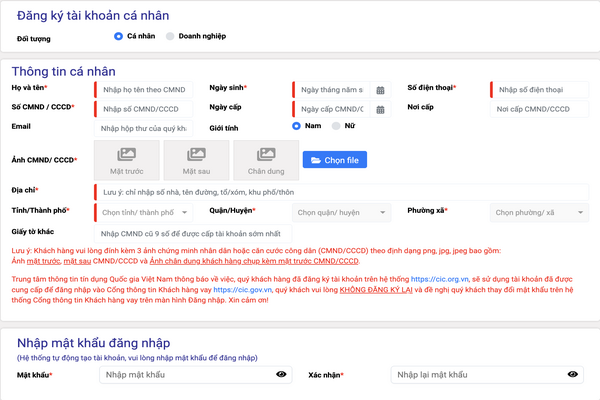

Step 2: Register according to the instructions, fill in the information provided by the system completely and accurately and create a password for the account. Depending on the registration subject, you can choose an individual or a business.

Note: Items marked with (*) must be filled in completely, do not leave blank.

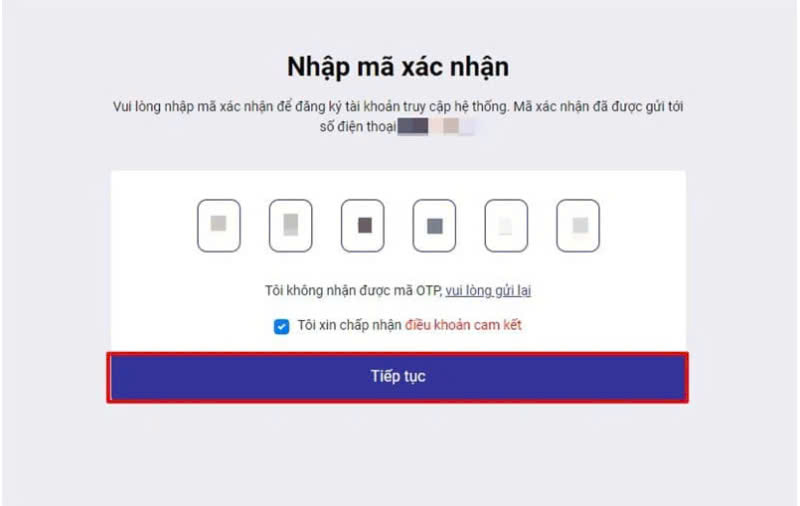

Step 3: Enter the OTP code sent to the registered phone number and click “Continue”.

After completing the above steps, after 01 day the system will call to verify the information.

Step 4: After the information is confirmed, users can access the CIC website to log in and select "Report Mining" to check their CIC bad debt.

In addition, individuals can also download the CIC Credit Connect application on CH Play, App Store to look up bad debt using CCCD.