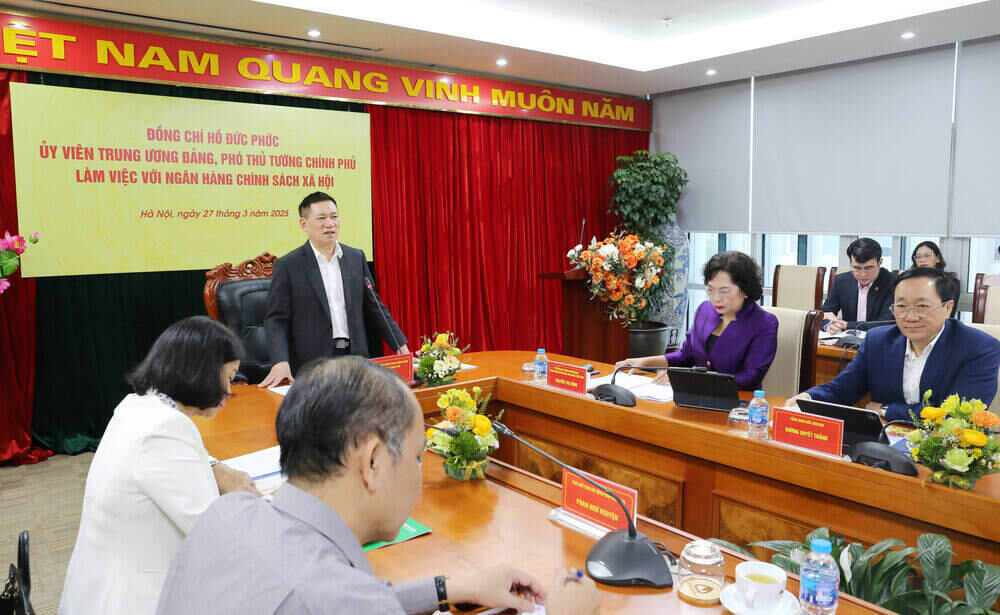

Attending the meeting were Member of the Party Central Committee, Governor of the State Bank of Vietnam and Chairwoman of the Board of Directors of the Vietnam Bank for Social Policies Nguyen Thi Hong; Member of the Party Central Committee, Chairwoman of the Vietnam Women's Union Nguyen Thi Tuyen; Alternate Member of the Party Central Committee, Permanent Vice President of the Vietnam Farmers' Union Phan Nhu Nguyen; members of the Board of Directors of the Vietnam Bank for Social Policies, representatives of relevant ministries and branches.

Reporting at the meeting, Member of the Board of Directors - General Director of the VBSP Duong Quyet Thang said: Up to now, the total social policy credit capital has reached over VND416 trillion, an increase of over VND409 trillion compared to 2002, the average annual growth rate reached 21.4%; of which VND58,783 billion is the capital source entrusted from local budgets. Total outstanding loans of policy credit programs reached over 376 trillion VND. The average annual outstanding growth rate reached 21.1%. Currently, more than 6.8 million poor households, near-poor households and policy beneficiaries still have outstanding loans at the VBSP.

In the past 23 years, nearly 47.9 million poor households and other policy beneficiaries have received preferential loans; thereby contributing to helping more than 7 million households overcome the poverty line; attracting and creating jobs for more than 7.6 million workers; helping more than 4 million students in difficult circumstances to borrow money to study; building nearly 20.4 million clean water and environmental sanitation works in rural areas; building, buying and renting nearly 784 thousand houses for poor households, low-income households and policy beneficiaries...

In recent years, the Government and the Prime Minister have assigned the VBSP to a number of important tasks such as: Credit policies to support people and businesses affected by the COVID-19 pandemic under Resolution 68/NQ-CP of the Government have supported loans for 1,548 businesses/employers affected by the COVID-19 pandemic with an amount of VND 4,829 billion to pay salaries to over 1.2 million workers to help businesses recover production; implement the Socio-economic Recovery and Development Program under Resolution No. 43/2022/QH15 of the National Assembly, Resolution No. 11/NQ-CP of the Government...

At the meeting, representatives of the Ministry of Agriculture and Environment, the Ministry of Finance, the Ministry of Justice, the Ministry of Ethnic Minorities and Religions, the Ministry of Construction, the Government Office, the Ministry of Home Affairs, etc. expressed their high agreement with the report of the State Bank and the VBSP; highly appreciated the results that the VBSP has achieved over the past 23 years, especially in developing and building a modern and reasonable governance model, effectively serving beneficiaries... contributing to maintaining, consolidating and improving the quality of social policy credit. The ratio of overdue and outstanding loans decreased from 13.75%/total outstanding loans (recorded in 2002) to 0.55%/total outstanding loans, of which overdue loans accounted for 0.19%/total outstanding loans (at the time of March 20, 2025). Implement well the goal of preserving and developing capital for the State.

At the same time, representatives of ministries and branches also discussed in depth solutions for the VBSP to continue to develop sustainably in the coming time, especially continuing to promote poverty reduction programs, solve employment, housing for poor households in rural areas, flood areas, housing for low-income people in urban areas, workers in industrial parks, sanitation and rural environment...

At the meeting, Governor of the State Bank of Vietnam Nguyen Thi Hong and Chairwoman of the Board of Directors of the VBSP emphasized: The activities of the VBSP have always been of interest to the Party, the State and the Government leaders; achieved many important results, recognized and highly appreciated by competent authorities and especially the masses. The VBSP is a very typical microfinance provider in Vietnam, internationally recognized for its contribution to helping Vietnam achieve the goals of the 21st century ahead of schedule.

In the coming time, the Board of Directors of the VBSP is determined to lead and direct the implementation of solutions suitable to the characteristics of the service sector to improve the efficiency of governance and operation of the VBSP; promote the application and digital transformation in professional activities, best serve the poor; continue to review and build a reasonable and effective organizational apparatus...

Concluding the meeting, Deputy Prime Minister Ho Duc Phoc stated: the VBSP is one of the "pillars" in the system of poverty reduction policies, ensuring social security in Vietnam, serving the poor and other policy beneficiaries, leaving no one behind. With a creative approach, the organizational apparatus is increasingly complete and professional, effectively serving poor customers and other policy beneficiaries.

Suggesting a development orientation in the coming time, Deputy Prime Minister Ho Duc Phoc emphasized: First, the VBSP must stabilize the arrangement of the apparatus in accordance with the current process of arranging administrative units. In particular, reorganizing the apparatus must maintain the customer network.

Second, the VBSP needs to diversify capital sources, especially "cheap" capital sources to serve poor, near-poor households and policy beneficiaries. In particular, it is necessary to continue to improve efficiency, research and expand the form of receiving entrusted capital not only from localities but also from enterprises, corporations...

Third, the Deputy Prime Minister suggested that the VBSP continue to focus on developing professional and modern human resources, arranging and managing personnel reasonably and effectively.

Fourth, the Deputy Prime Minister suggested that the VBSP continue to research and promote the application of information technology, digital transformation, big data, etc. to improve the operational efficiency of the entire system, best serving the poor and policy beneficiaries.

Fifth, the Deputy Prime Minister suggested that the VBSP continue to strengthen governance and capital management closely and effectively; review, research, and rebuild to optimize the process of reviewing for approval of lending, disbursement, supervision, debt collection, etc. in accordance with the General Secretary's direction of minimizing 30% reduction in administrative procedures.

Sixth, the Deputy Prime Minister requested the State Bank and relevant agencies to study and advise the Government on related contents for young people to borrow to buy houses; for borrowers to buy and rent social housing... in the spirit of innovation, having creative ways of doing things, in line with the development process of society, creating conditions for the disadvantaged to rise up.

The Deputy Prime Minister also gave his opinion on specific recommendations of the VBSP, assigning ministries and branches to handle and advise on handling according to their authority. The Deputy Prime Minister hopes and believes that in the coming time, the VBSP will continue to develop strongly, meeting the development needs of society.