classified as bad debt

Rang Dong Holding Joint Stock Company ( Rang Dong Holding, code: RDP) has just sent an official dispatch to the State Securities Commission and the Ho Chi Minh City Stock Exchange to explain the delay in issuing the Company's Governance Report for 2024 and the Financial Report for the fourth quarter of 2024.

According to the explanation, Rang Dong Holding said that from the second half of 2024 to now, the company has encountered many serious financial difficulties, leading to it being classified as a bad debt group in the national credit system. As a result, both the parent company and its subsidiaries have had to temporarily suspend operations, most of their employees have quit their jobs, including key positions in the Board of Directors and Executive Board.

On February 24, 2025, all 5 members of the Board of Directors, including Chairman of the Board of Directors Ho Duc Lam, simultaneously resigned, causing the Board of Directors to no longer have any members.

The company also encountered difficulties in working with the auditing unit. Nhan Tam Viet Auditing Company Limited - the unit in charge of auditing the previous Financial Statements of Rang Dong Holding - has terminated the contract and refused to continue auditing the 2024 Financial Statements. Finding a new auditing unit is facing many difficulties due to the Company's financial situation not ensuring payment capacity.

The new chief accountant appointed in December 2024 also faces many obstacles in accessing accounting data. Therefore, "the problem of slow disclosure of information and reports according to regulations is really impossible for us," Rang Dong Holding affirmed.

Facing the risk of canceling the listing

Rang Dong Holding is in a serious crisis when it is continuously slow to release financial reports for semi-annual review, reports for the third and fourth quarters and reports on the company's management situation in 2024. In mid-February 2025, the Ho Chi Minh City Stock Exchange (HOSE) issued a warning, requiring businesses to urgently submit reports, if they continue to delay, violations will be handled at a higher level. According to current regulations, the heaviest sanction is the mandatory cancellation of the listing, in the context that RDP stocks have been suspended from trading since November 28, 2024.

Previously, at the end of January 2025, the Ho Chi Minh City People's Court accepted the application to open bankruptcy proceedings against the company. Notably, the request was submitted from Rang Dong Films, a subsidiary of which Rang Dong Holding JSC owns 97.7% of the charter capital. Currently, the Court requires Rang Dong Holding to explain the reasons for the inability to pay, declare assets, bank account balances, list of creditors and debtors.

In mid-December 2024, this Company was fined by the State Securities Commission for disclosing false information. In the fourth quarter financial report of 2023, the company announced after-tax profit of more than 17.3 billion VND, but in fact, the separate financial report after audit recorded a loss of more than 117.6 billion VND. For the consolidated report, the enterprise had announced a profit of more than VND 26 billion, but the audit results showed a loss of more than VND 146.7 billion.

Accumulated loss of VND 267 billion

As of the most recent reporting period released by the company, in the second quarter of 2024, Rang Dong Holding reported a consolidated loss of VND64.5 billion, while in the same period last year, the company made a profit of VND11 billion. Accumulated from the beginning of the year to the end of the second quarter of 2024, the company lost VND65.6 billion, and the same period last year had a profit of more than VND10 billion.

As of June 30, 2024, Rang Dong Holding had accumulated losses of nearly VND 267 billion. Notably, in the previous year (2023), Rang Dong Holding suffered a record loss of VND 146.7 billion, accumulated loss of nearly VND 206 billion.

To overcome the losses, the management board of Rang Dong Holding said it will liquidate financial investments, collect debts from partners, promote sales activities, negotiate with banks to have more credit limits for production and business and negotiate with partners to restructure the debt payment schedule. However, the situation is still not much better, the results in the first 2 months of 2024 have not improved.

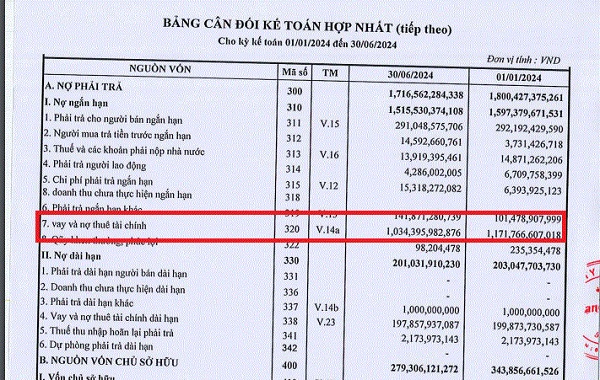

In addition to prolonged losses, Rang Dong Holding (RDP) also faces a significant debt burden. As of June 30, 2024, the company's total payables amounted to VND 1,716 billion, 6.2 times higher than equity, with capital reaching only VND 279.3 billion.

The biggest pressure comes from outstanding loans, when Rang Dong Holding's total outstanding loans reached VND 1,232 billion, accounting for 72% of total payables. Of which, short-term loans account for an overwhelming proportion of VND 1,034 billion, while long-term loans are VND 199 billion.

With large debt scale and low equity, the financial situation of Rang Dong Holding is increasingly tense, especially in the context of businesses having difficulty arranging capital and maintaining business operations.