Increasing investor experience

Ms. Vu Thi Chan Phuong - Chairwoman of the State Securities Commission (SSC) emphasized that the key factor that needs to be improved for market rating organizations to consider upgrading is the practical experience of foreign investors in Vietnam.

When we have completed policy mechanisms and removed bottlenecks, the experience of foreign investors directly investing in the Vietnamese market is a very important factor, because they are the ones who vote for us to be upgraded, Ms. Phuong emphasized.

According to Ms. Phuong, this requires listed companies to improve the quality of governance and information transparency, especially the bilingual release in Vietnamese and English for foreign investors to easily access. At the same time, securities companies that provide direct services to investors also need to improve service quality and customer satisfaction of foreign customers.

The Chairman of the State Securities Commission also highly appreciated the role of domestic investors, especially in maintaining transparency and sustainable market development. "The proportion of individual investors is still very large, making the market vibrant but prone to strong fluctuations. We hope to diversify investors, encourage the participation of institutional investors, professional investors is an inevitable trend" - she said.

The State Securities Commission is also implementing the Investor Restructuring Project, in which the fund management industry is oriented to develop more strongly. According to statistics, the scale of fund management in Vietnam currently accounts for only about 6% of GDP, equivalent to 29 billion USD - there is still much room for expansion. The State Securities Commission will propose preferential policies for developing fund certificates, restructuring long-term investment flows and improving the quality of institutional investors.

CCP - a strategic step in market reform

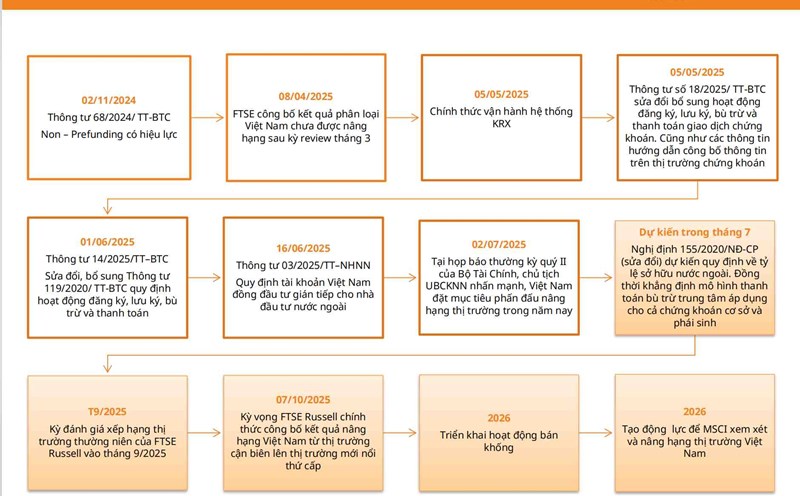

The State Securities Commission is continuing to improve the technical and institutional foundation for the stock market, in which the implementation of the central clearing counterparty (CCP) mechanism is an important step, showing a commitment to long-term reform and improving the experience of foreign investors.

According to the plan, from the third quarter of 2025, the Ministry of Finance will issue accounting instructions for operations related to CCPs. At the same time, the State Securities Commission plans to approve the project to establish Vietnam Securities Depository Company Limited, under the Securities Depository and Depository Corporation (VSD), to act as a CCP organization.

In the first quarter of 2026, the State Securities Commission will issue new guidelines on registration, storage and payment of securities transactions. In parallel, VSD organizes training, system testing with market members and coordinates the preparation of technical infrastructure. The entire process is expected to last throughout 2026 to ensure readiness for official operation from the beginning of 2027.

CCP supplements Non-Prefunding, increases confidence in foreign investors

Ms. Tran Ngoc Thuy Vy - Analyst at Mirae Asset Vietnam Securities Company commented that implementing CCP is a necessary parallel step in addition to the Non-Prefunding (NPF - non-deposit transaction) mechanism allowed under Circular 68/2024/TT-BTC.

Allowing foreign investors to trade without having to pay in full in advance is a great effort of the management agency. However, to truly reduce risks and create trust for the parties, there needs to be CCP as an intermediary to ensure payment, especially in the context of increasingly large and diverse market liquidity, Ms. Vy analyzed.

According to Ms. Vy, it is expected that from 2026, when VSDC's subsidiary is established, the CCP model will help reorganize the payment process between VSDC and market members such as securities companies and deposit banks.