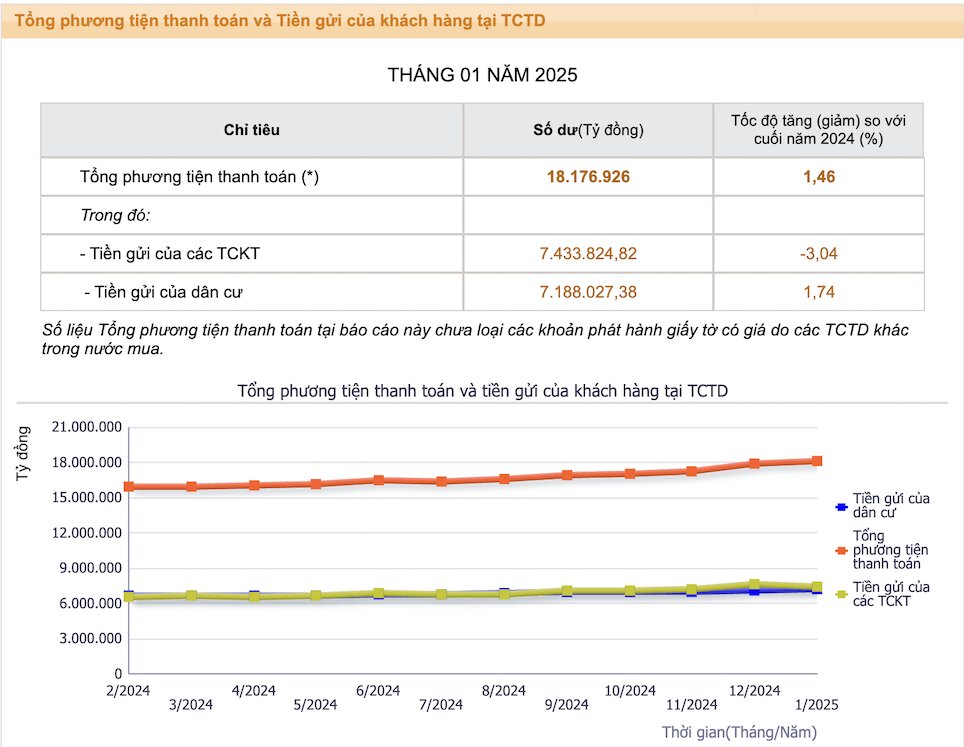

The State Bank of Vietnam (SBV) announced the indices of "Overall payment methods and deposits of customers at credit institutions" in January 2025. In which:

Total payment methods reached VND18,176,926 billion, equivalent to an increase of 1.46% compared to December 2024.

Deposits of credit institutions decreased by 3.04%, to VND 7,433,824.82 billion.

People's deposits increased by 1.74%, to VND 7,188,027.38 billion.

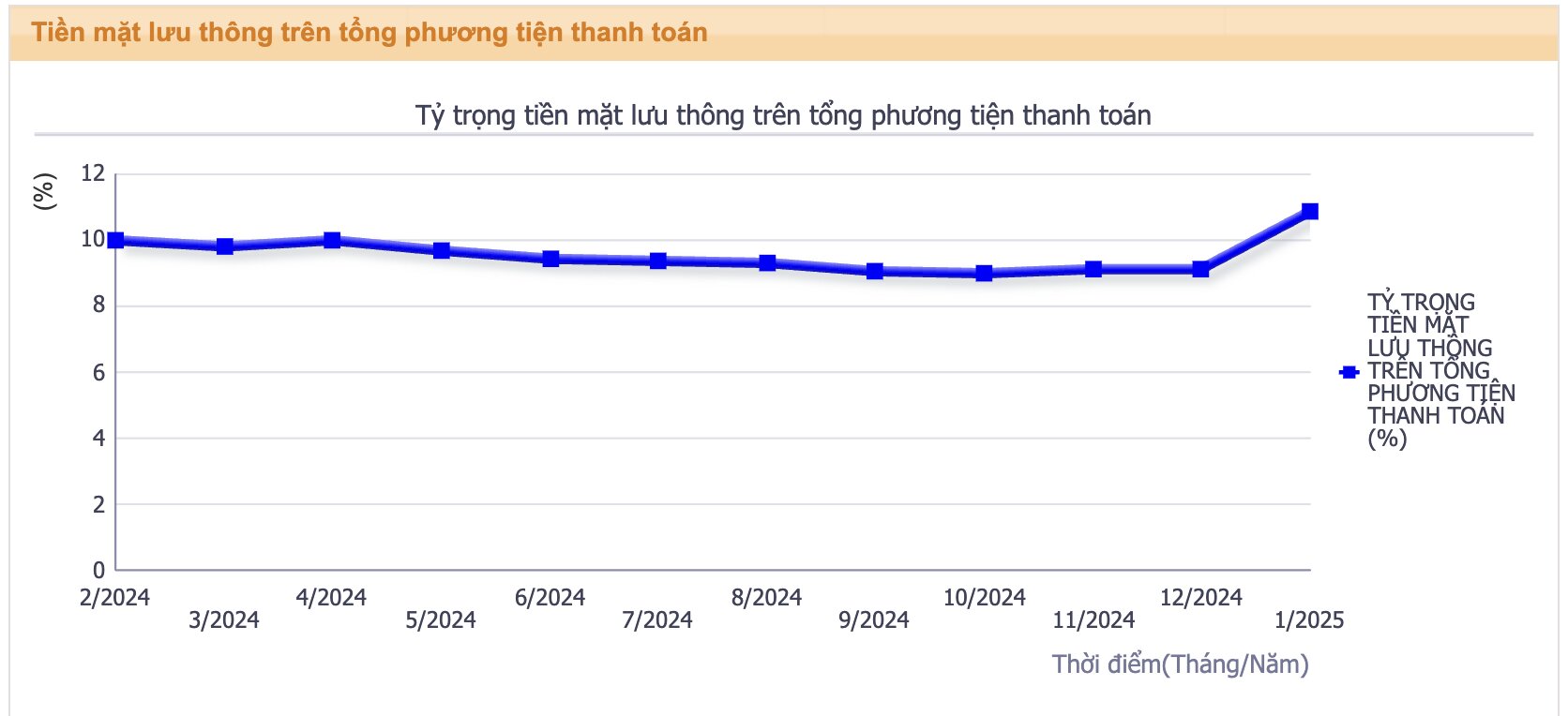

The graph of the proportion of cash in circulation on the total payment method also recorded a notable reversal: after gradually decreasing from 10.0% in February 2024 to a low of 8.9% in October - November 2024, this ratio suddenly increased to 10.8% in January 2025. These figures reflect the fluctuations in the crop season during the Lunar New Year 2025.

January 2025 figures reflect the monetary policy being flexibly managed by the SBV in the direction of loosening to support liquidity and growth, but also show the challenges in withdrawing liquidity in time after Tet and gradually reducing the amount of cash in circulation in the right direction.

Accordingly, the 1.46% increase of M2 in January alone shows that the SBV has pumped additional liquidity into the system to meet peak spending demand during Tet. In fact, the SBV net infused about VND 67,500 billion into the market in January 2025, more than 5 times higher than the previous month.

This occurs in the context of decreasing exchange rate pressure and increased demand for Tet spending, causing the liquidity of the banking system to be under great pressure. The proactive pumping of money through open markets (OMO) with large volumes shows a flexible monetary policy orientation, prioritizing liquidity and stabilizing the short-term currency market.

However, the strong pumping of money also posed a challenge for the SBV in controlling the total annual payment means and inflation. In 2025, the SBV aims to grow credit about 16% to support the economic growth target of about 8%. This orientation of monetary policy towards moderate loosening, encouraging credit expansion from the beginning of the year. However, the SBV must balance the growth support and control inflation, avoiding the long -lasting liquidity after Tet.

In fact, right after the peak of Tet, the SBV started to attract money through the open market channel in the first week of February 2025 to stabilize the money that had been pumped out before.

However, there is another challenge to note: reducing the proportion of cash in circulation according to the Government's target.

Accordingly, at the end of 2016, the Government issued Decision No. 2545/QD-TTg approving the project of non-cash payment development development in Vietnam in the period of 2016-2020 (Decision 2545/QD-TTg). In particular, the most important target is by the end of 2020, the proportion of cash on the total payment is lower than 10% and by the end of 2025 to withdraw to 8%.

Expenditures of data announced by the State Bank are as follows: