According to the General Department of Taxation, this result was achieved thanks to the tax sector synchronously implementing many revenue management measures, including strengthening propaganda and guiding taxpayers to fulfill their tax obligations.

At the same time, the tax sector also promotes the collection of revenue from individuals with multiple sources of income, especially from digital business activities, e-commerce, affiliate marketing, online business individuals and live video sales (livestream).

In addition, increased revenue from business activities and real estate transfers is also an important factor contributing to this growth.

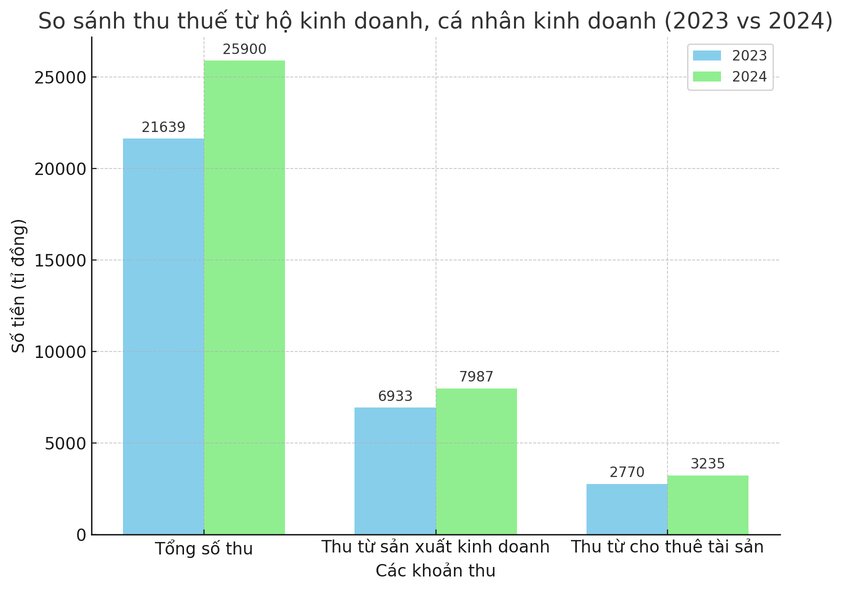

Regarding tax collection from business households and individuals, the total revenue in 2024 will reach VND 25,900 billion, an increase of 20% compared to 2023 (VND 21,639 billion). Of which, income tax revenue from individual production and business activities will reach VND 7,987 billion, an increase of 15% compared to 2023 (VND 6,933 billion); tax revenue from individual property leasing activities will reach VND 3,235 billion, an increase of 17% compared to 2023 (VND 2,770 billion).

In general, the total budget revenue managed by the tax sector in 2024 is estimated at 1.73 million billion VND, exceeding the estimate by 16.5%, equivalent to exceeding 245,588 billion VND and increasing by 13.7% compared to 2023.

Director General of the General Department of Taxation Mai Xuan Thanh said that in 2025, the tax sector will continue to implement synchronous solutions to prevent revenue loss, recover tax debts and complete the state budget collection task assigned by the National Assembly, with the target of reaching over 1.71 million billion VND.

In general, over the past year, the tax sector has made strong changes in revenue management, with measures such as increasing propaganda and guidance for taxpayers. This helps raise people's awareness in fulfilling tax obligations, especially in the context of strong digital economic development.

The tax sector has also focused on collecting revenue from individuals with multiple sources of income, especially those involved in digital business activities, e-commerce and real estate transfers.