On December 10, 2025, the National Assembly passed the Law on Personal Income Tax 2025 (replacing the Law on Personal Income Tax 2007). The law takes effect from July 1, 2026.

The notable content of the 2025 Law on Personal Income Tax is the adjustment of the progressive personal income tax rate table from 07 levels to 05 levels.

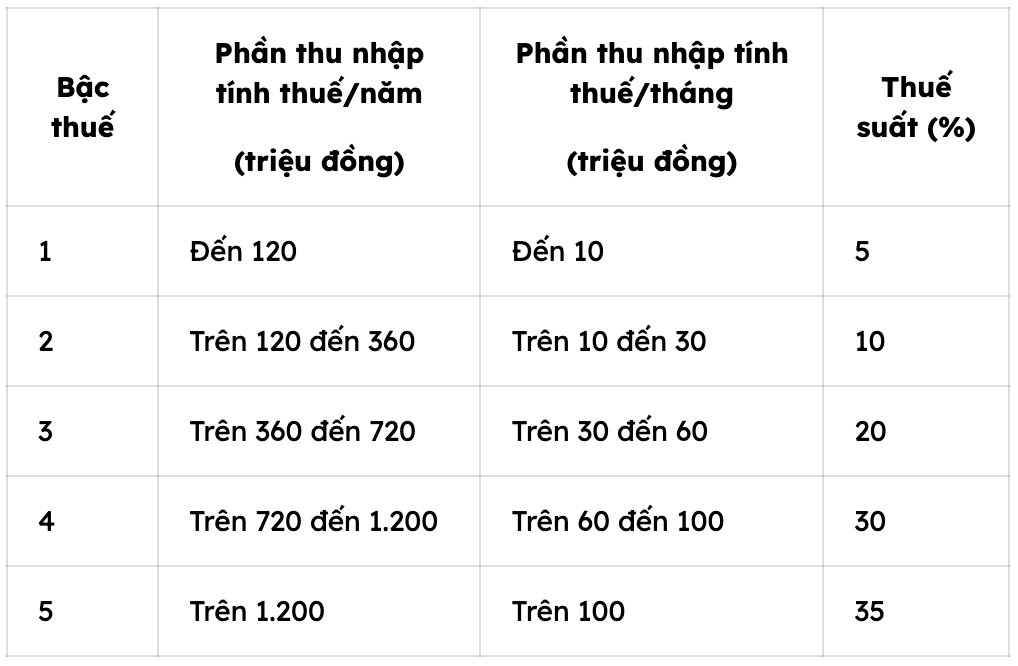

Below is the 5-level progressive personal income tax table of the 2025 Personal Income Tax Law:

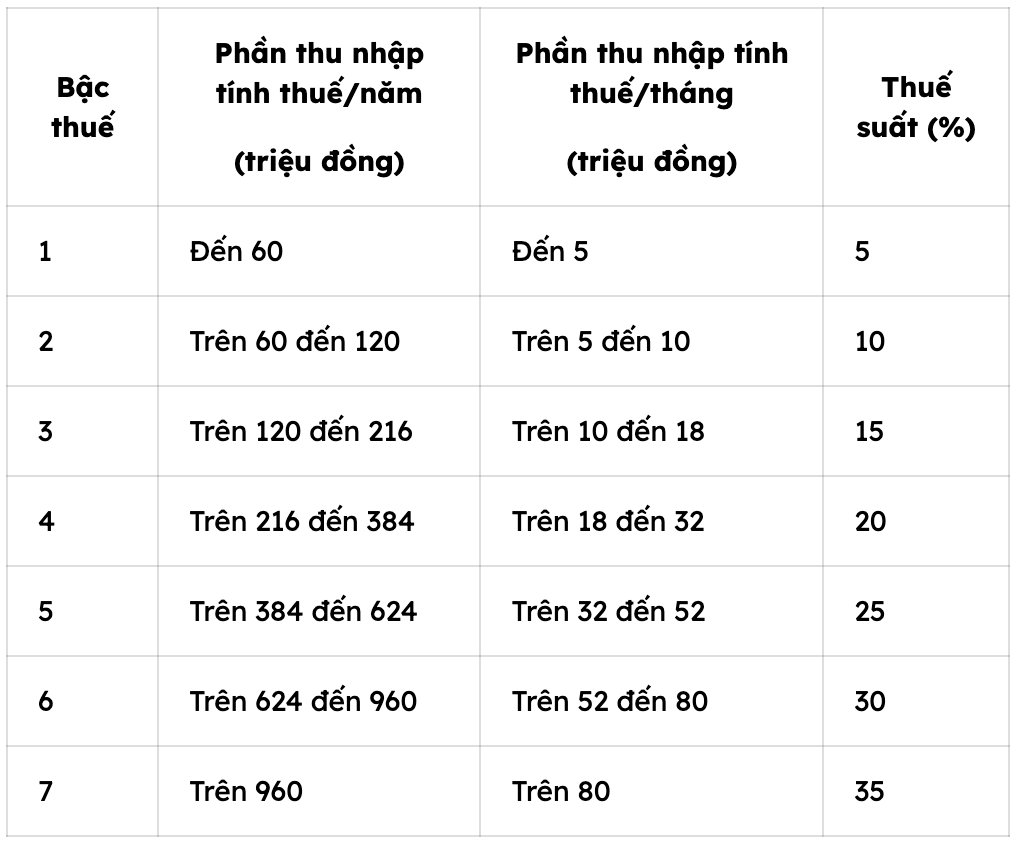

The 7-level progressive personal income tax rate according to the previous regulations:

Thus, in addition to reducing tax rates, the new tax rate according to the 2025 Law on Personal Income Tax has reduced tax rates at some levels compared to current regulations, the tax rate of 15% at level 2 to 10% and the tax rate of 25% at level 3 to 20%.

At the same time, adjust the income subject to personal income tax at each level to match the tax rates payable. For example, the starting rate for calculating personal income tax at the current 5% is up to 5 million VND/month (ie up to 60 million VND/year), while the latest personal income tax rate applied from July 1, 2026 is up to 10 million VND/month (ie up to 120 million VND/year).

Income of 17 million VND/month not yet subject to tax

Regarding the family deduction level, the National Assembly assigned the Government to base on price and income fluctuations to adjust the family deduction level.

According to the resolution of the National Assembly Standing Committee approved on October 17, the deduction for taxpayers themselves is up to 15.5 million a month for dependents to 6.2 million, applied from the tax calculation period in 2026.

With this deduction, individuals who pay taxes (without dependents) earn 17 million VND/month, from the tax calculation period in 2026, they do not have to pay taxes, after deducting insurance and family deductions for themselves.

Individuals with an income of 17 million VND/month, the social insurance contribution level is equal to income. The insurance amount of 10.5% (cial insurance 8%, health insurance 1.5% and unemployment 1%) is 1.785 million VND. The total deductible amounts to VND 17.285 million (after adding a deduction of VND 15.5 million for themselves), which is larger than their income, so they do not have to pay taxes.

In case there is 1 dependent or individual earning 24 million/month, they will not have to pay taxes after deducting insurance. Similarly, individuals with an income of VND 31 million per month and 2 dependents have not yet had to pay taxes when applying according to the progressive tax rate table.