On the morning of December 10, the National Assembly voted to pass the amended Law on personal income tax. With 438/443 delegates participating in the vote, accounting for 92.54%, the National Assembly officially passed the Law on personal income tax.

Accordingly, the family deduction is the amount deducted from taxable income before calculating tax on income from salary and wages of taxpayers who are residential individuals. Household deductions include:

The deduction for taxpayers is 15.5 million VND/month (186 million VND/year);

The deduction for each dependent is 6.2 million VND/month.

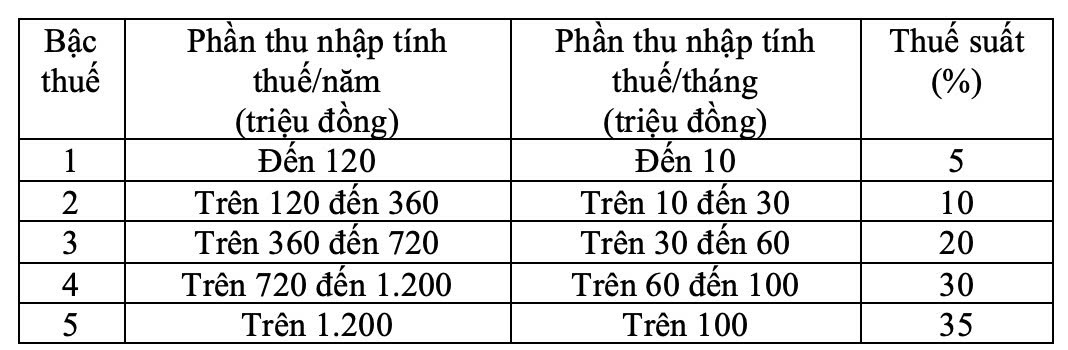

The tax rate has 5 levels with the gap between gradually increasing levels of 10, 20, 30, 40 million VND and tax rates of 5%, 10%, 20%, 30%, 35%. The final tax rate is 35% applied to taxable income over VND 100 million/month.

The partial excise tax rate is regulated as follows:

Previously, Minister of Finance Nguyen Van Thang reported on the reception, explanation, revision and completion of the draft Law on Personal Income Tax (amended).

Regarding taxes for business households and individuals, taking into account the opinions of the Committee's opinions and the opinions of the Standing Committee of the National Assembly, the Government has reviewed and adjusted the regulations on taxes for business households and individuals as follows:

First, adjust the non-taxable revenue of households and individuals doing business from VND 200 million/year to VND 500 million/year and deduct this rate before calculating tax according to the ratio on revenue. At the same time, the revenue not subject to VAT was adjusted to 500 million VND.

Second, supplement the method of calculating tax on income (revenue - cost) for households and individuals with a revenue of over VND500 million/year to VND3 billion and apply a tax rate of 15% (similar to the corporate income tax rate for enterprises with a revenue of less than VND3 billion/year). At the same time, it is stipulated that these individuals are allowed to choose the method of calculating tax based on the ratio on revenue.

Regarding the family deduction level, the Minister said that, taking into account the opinions of the Delegates and the opinions of the Standing Committee of the National Assembly, the Government has introduced the family deduction level prescribed in Resolution No. 110/2025/UBTVQH15 of the Standing Committee of the National Assembly (the deduction for taxpayers is 15.5 million VND/month, for each dependent is 6.2 million VND/month) prescribed in the draft Law and assigned the Government to submit to the Standing Committee of the National Assembly to adjust this family deduction level based on fluctuations in prices and income to suit the socio-economic situation in each period.

Regarding the partial progressive tax rate table, the tax table has been revised in the direction of reducing the tax rate by 15% (at level 2) to 10% and the tax rate by 25% (at level 3) to 20% to avoid sudden increases between levels, ensuring the reasonableness of the Tax rate.