Reducing tax rates by 15%, 25% in the tax table

The draft Law on Personal Income Tax (amended) has been submitted by the Government to the National Assembly in Submissions No. 844/TTr-CP dated September 29, 2025 and Submission No. 985/TTr-CP dated October 24, 2025.

The Ministry of Finance said that, based on the reviewed opinions of the National Assembly's Economic and Financial Committee, the opinions of the National Assembly deputies discussed in the afternoon session of November 5, 2025 and at the Hall on the afternoon of November 19, 2025, the drafting agency has organized research, received, revised and submitted to the Government a report on the plan to complete the draft Law with many notable contents, including the progressive tax table.

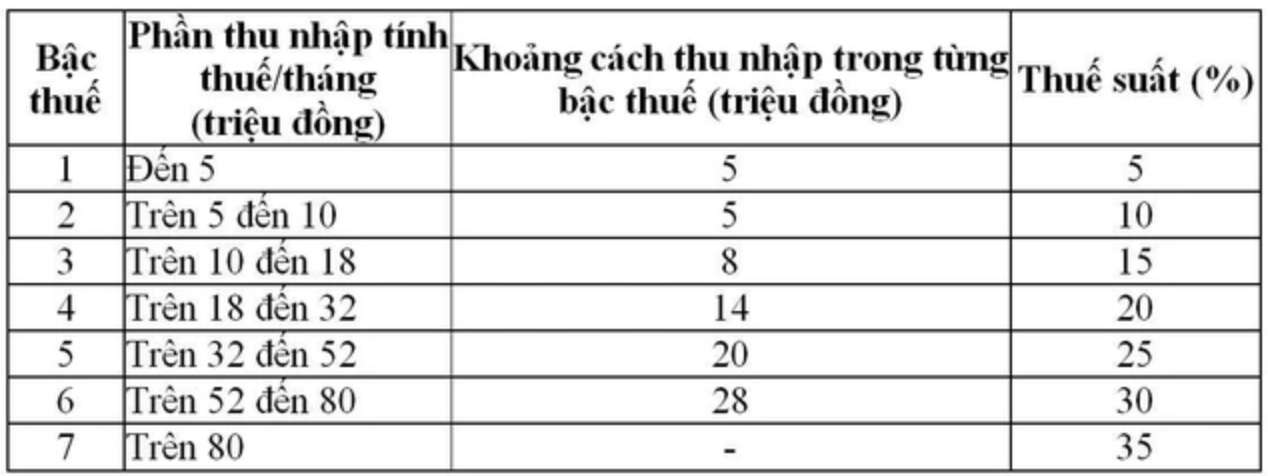

The partial progressive tax rate applies to individuals with income from salaries and wages according to current regulations as follows:

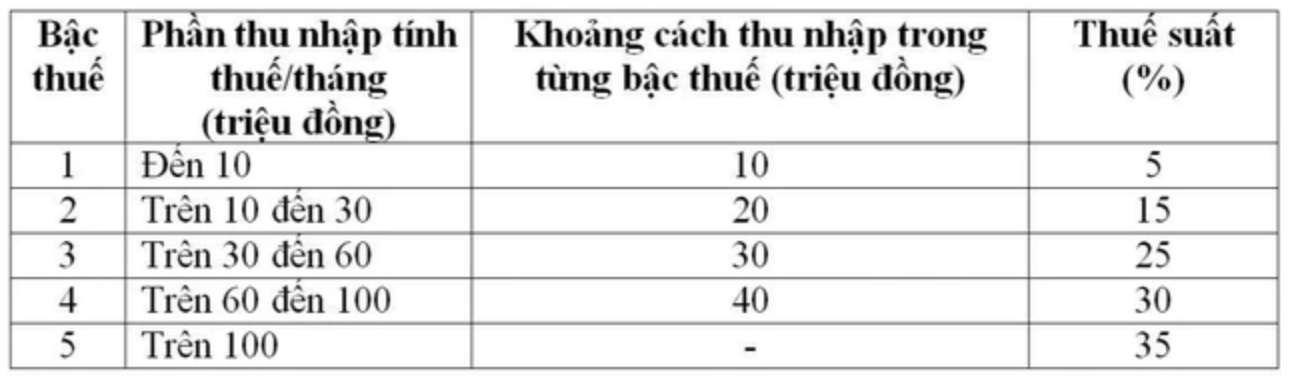

According to the plan proposed by the Government, the National Assembly reported in the draft Law on adjusting the progressive tax system in part to apply to residential individuals with income from salaries and wages in the direction of reducing the number of tax levels from 7 to 5 levels and expanding the gap between levels.

Based on the opinions of National Assembly deputies, the drafting agency plans to report to the Government to complete the partial acceptance of the progressive tax rate in the direction of being able to study and consider the option of adjusting the tax rate down by 15%, 25% to 10%, 20% to unify the tax rates of the tax rate.

"With this new tax rate, all individuals who are paying taxes with income at the current levels will have their tax obligations reduced compared to the current tax rate. In addition, the new tax table has also overcome the sudden increase of some levels (level 2, level 3) as proposed in the previous draft Law, ensuring the more reasonableness of the tax table", the Ministry of Finance commented.

Previously, when the Ministry of Finance announced to collect opinions on the draft Law on Personal Income Tax (amended), many experts assessed that both tax declaration options proposed by the Ministry of Finance (including the plan that the Government reported to the National Assembly above) were unreasonable.

Many experts propose reducing tax rates, expanding the tax grade gap

According to Associate Professor, Dr. Nguyen Van Hieu (University of Economics, Vietnam National University, Hanoi), over the past 20 years, the personal income tax policy has mainly focused on adjusting the family deduction level without significant adjustments to the tax rate table, including the starting tax rate for one-time income. This leads to a situation where a part of those working for salary can "jump the tax rate" even though their actual income does not increase.

Associate Professor, Dr. Nguyen Van Hieu has calculated above the same adjusted income level as the price drop, applying a family deduction of 15.5 million VND/month and a 5-level tax rate according to option 2. The results show that although the tax burden has decreased compared to the actual level in 2025, it is still much higher than the original design in 2007.

Accordingly, the average tax rate in the income group of 150 million VND/year and 250 million VND/year increased by about 20% and 25% respectively compared to the beginning. Only the group with an income of 70 million VND/year recorded a slight decrease due to the household deduction increasing faster than the price drop rate.

He said that the tax burden under the new draft is still about 3050% higher than in 2007, due to the tax table being almost unchanged or not adjusted significantly. Thus, the average tax rate on income is still high, showing that tax pressure on employees has not been relieved.

Associate Professor, Dr. Phan Huu Nghi - Deputy Director of the Institute of Banking and Finance (National Economics University) said that streamlining the tax table to 5 levels is reasonable, in line with international practices. However, the current proposal structure is not reasonable when eliminating two levels of 10% and 20% but still maintaining the highest rate of 35%.

According to him, this creates a huge tax slope between medium and high tax levels, not ensuring the principle of progress and reducing labor motivation.

He proposed to pay the tax as follows: level 1: 010 million VND/month - 5%; level 2: 1030 million VND/month - 10%; level 3: 3070 million VND/month - 15%; level 4: 70150 million VND/month - 20%; level 5: Over 150 million VND/month - 25%.

According to Mr. Nghi's analysis, average income is increasing rapidly, causing many people to fall into a higher tax rate even though real income does not accurately reflect their standard of living. "Income increases by 30%, but if the range is not extended and the tax rate is adjusted accordingly, workers will suffer the loss. In the long term, this affects the mentality of dedication and transparency in tax declaration, he warned.

Associate Professor, Dr. Le Xuan Truong - Head of the Faculty of Taxation and Customs ( Academy of Finance) commented that the number of current tax rates is too high (7 levels) and too dense in the middle-income group or higher, causing the regulatory rate to increase rapidly, unreasonable to the goal of social justice.

Both options of the draft reduce the tax rate to 5, keeping the same at 5% and 35%. Option 2 raises the taxable income threshold at the highest tax rate from VND 960 million/year to VND 1.2 billion/year.

However, according to Associate Professor, Dr. Le Xuan Truong, it is necessary to continue to adjust the gap between levels, while raising the highest taxable income threshold to 1.5 billion VND/year to ensure reasonable progress and create motivation to attract high-quality human resources.

He also proposed reducing the highest tax rate from 35% to 30%, with the goal of both ensuring income regulation and increasing competitiveness, attracting experts to work in Vietnam.