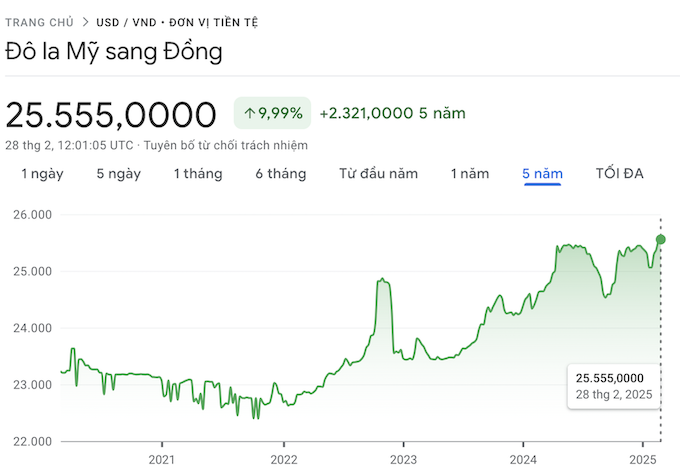

USD/VND exchange rate hits 5-year peak

At 7:00 p.m. on February 28, according to data from Google Finance, the USD/VND exchange rate reached VND 25,555/USD, the highest in the past 5 years. Increased by nearly 10% after 5 years.

On February 28, 2025, the State Bank of Vietnam announced the central exchange rate at 24,726 VND/USD, up 712 VND compared to 24,014 VND/USD on the same day in 2024, equivalent to VND depreciated by about 2.97% compared to USD in the past year.

In the banking market, the USD/VND exchange rate also recorded a significant increase.

Vietcombank listed the buying - selling exchange rate at 25,350 - 25,740 VND/USD on February 28, 2025, compared to 24,430 - 24,800 VND/USD on the same day last year, showing that VND has depreciated by about 3.5% compared to USD.

In the world market, the USD Index, which measures the strength of the greenback against a basket of major currencies, increased by 0.8% on Thursday, currently standing at 107.34.

Sharing with Reuters, Mr. Sim Moh Siong, currency strategist at the Bank of Singapore, predicted that the USD could strengthen if tariff risks continue to escalate in April, despite declining confidence in the superior strength of the US economy.

Why is the USD/VND exchange rate increasing sharply?

The USD interest rate announced by the US Federal Reserve (Fed) is currently maintained at 4.25% - 4.50% after the adjustment in December 2024. Meanwhile, US inflation will increase to 3% in January 2025, which could delay the Fed's interest rate cut plan this year.

The Fed's policy of tightening currencies has caused the USD Index - an index measuring the strength of the USD against the basket of international currencies - to increase sharply, putting pressure on the exchange rates of countries, including Vietnam.

In Vietnam, the SBV is currently pursuing a loose monetary policy to support the economy. Since the beginning of 2023, the SBV has reduced its operating interest rate 4 times, bringing the refinancing interest rate to 4.5%, much lower than the USD interest rate in the US. This interest rate difference has caused capital flows to tend to shift to USD to enjoy higher yields, pushing the USD/VND exchange rate up sharply. Last year, the SBV operated a flexible monetary policy to reduce pressure on the exchange rate. However, there are many other factors that cause the USD/VND exchange rate to increase.

For example, domestic USD demand has increased. According to statistics from the General Department of Customs, import turnover in January 2025 will reach 31 billion USD, an increase of more than 15% compared to the average in 2024. The growth of production and import of raw materials and petroleum increased, increasing demand for USD.

In addition, there is the mentality of investors and businesses wanting to hold USD when USD increases. Or the shift of profits to parent companies of the FDI sector often takes place strongly at the end of the year, but can partly extend to the first quarter, creating pressure on foreign currency supply and demand.

The high price of USD has allowed foreign investors to sell net in the stock market to preserve their asset value against exchange rate risks. The proof is that from the beginning of 2025 to the end of the session on February 17, foreign investors have net sold approximately VND13,600 billion, equivalent to a value of more than half a billion USD. And if we calculate the net selling value of foreign investors on the Vietnamese stock market from the beginning of 2023 to present, it has exceeded VND 130,600 billion, equivalent to about 5.1 billion USD of foreign capital withdrawn from the Vietnamese stock exchange.

The SBV affirmed that it will closely monitor the exchange rate's developments. Credit and interest rate policies will also be adjusted appropriately to ensure macroeconomic stability and support growth.

At the Government Standing Committee Conference on February 27, 2025, Mr. Dao Minh Tu - Deputy Governor of the SBV, said: In 2024, the exchange rate management will only fluctuate around 5%. With available potential, foreign exchange reserves and operations of the SBV, we will continue to ensure a stable exchange rate in 2025. This will bring security to businesses, especially large businesses related to import and export.

The State Bank of Vietnam is committed to ensuring foreign currency supply and demand, including import and export. With strong foreign exchange reserves, we are capable of stabilizing the exchange rate, said Deputy Governor Dao Minh Tu.