Central exchange rate sets new record, USD continues to rise

This morning (February 12), the State Bank of Vietnam announced the central exchange rate at 24,550 VND/USD, up 28 VND compared to yesterday. This is the highest level ever, reflecting the strong increase of USD in the global market.

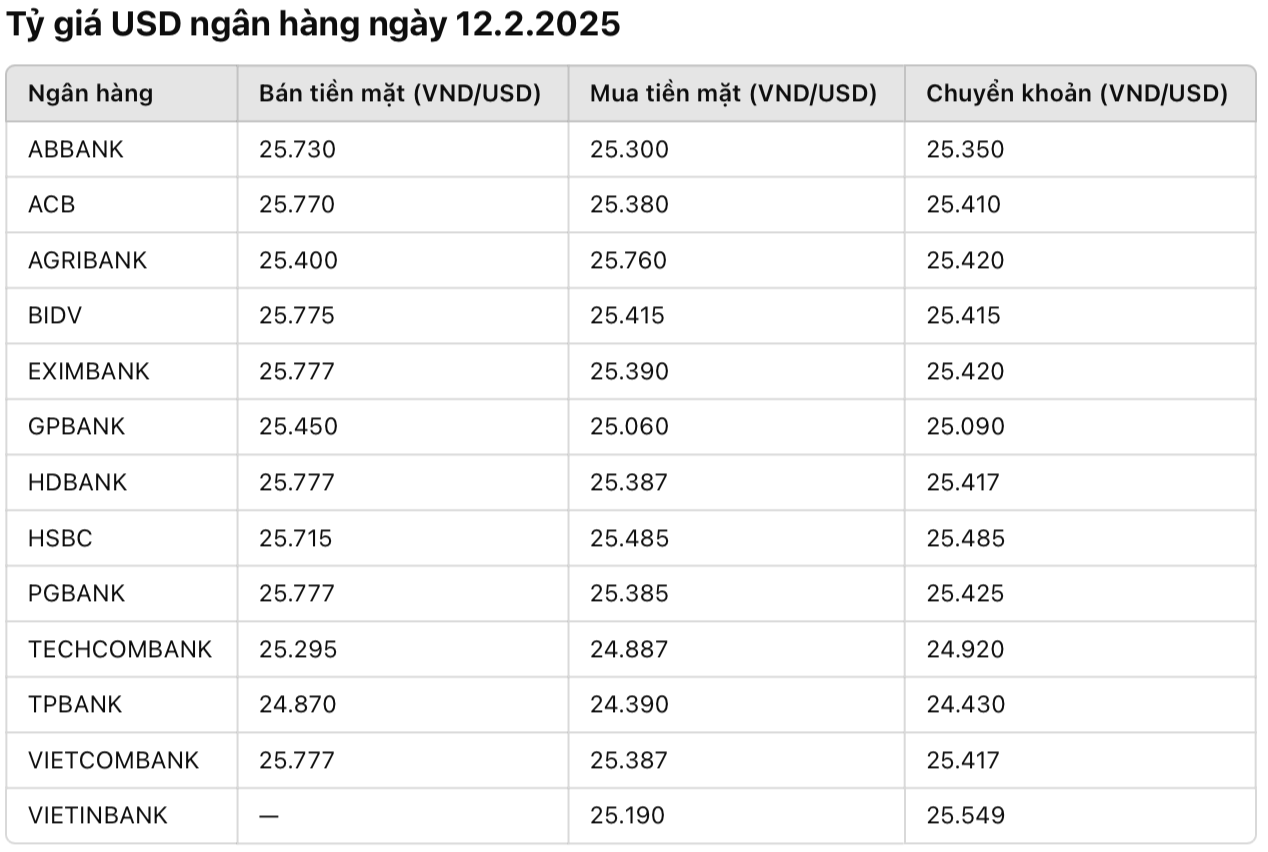

With a margin of plus/minus 5%, commercial banks today are allowed to trade USD in the range of 23,373 - 25,727 VND/USD.

At the State Bank of Vietnam, the reference exchange rate today also increased sharply:

Buy: 23,373 VND/USD

Selling: 25,727 VND/USD (up 29 VND)

USD banks, black market increase sharply

At commercial banks, the USD price continued to increase sharply today. The black market USD price continued to increase, approaching 25,800 VND/USD.

Banks with the highest USD selling price: Eximbank, HDBank, PGBank, Vietcombank (selling at 25,777 VND/USD).

Bank with the highest USD buying price: HSBC (25,485 VND/USD).

The difference between buying and selling prices at banks ranges from 300 - 500 VND/USD.

Thus, the USD exchange rate today is still maintained at a record high, with the common selling price above 25,700 VND/USD.

Why does the USD continue to rise strongly?

The rapid increase in domestic USD prices is mainly due to the impact of developments in the international market. Currently, the greenback continues to maintain a strong upward momentum compared to other major currencies, pushing the USD/VND exchange rate to its highest level in many months.

According to data recorded at 10:24 on February 12, the US Dollar Index - a measure of the strength of the USD against a basket of major currencies - reached 108 points, up 3.68% after 1 year.

One of the main reasons for the USD’s strength is the escalating trade tensions between the US and China. After US President Donald Trump announced a 25% tariff on all imported steel and aluminum, China immediately responded by announcing a list of US goods subject to new tariffs. This move raised concerns about a prolonged trade war, making the USD a safe haven, attracting investment flows.

In addition, the risk of inflation in the US is also increasing as import tariffs may cause prices of goods to rise. In this situation, the US Federal Reserve (Fed) is likely to maintain a high interest rate policy to control inflation. This policy makes the USD more attractive to investors, pushing the USD exchange rate to its highest level in many months.

With the above factors, USD is maintaining a strong upward trend and shows no signs of cooling down.