Bloomberg reported that on April 7, the State Administration of Foreign Affairs of China released data showing that China has increased its gold reserves for the fifth consecutive month.

As of the end of March 2025, the People's Bank of China's gold reserves reached 73.7 million ounces, up 90,000 ounces compared to 73.61 million ounces at the end of February - equivalent to an increase of 0.15%.

Along with that, China's foreign exchange reserves also recorded impressive growth, reaching 3,240.7 billion USD, up 13.4 billion USD (0.42%) compared to the previous month. This is the 16th consecutive month that China's foreign exchange reserves have remained stable at over $3,000 billion.

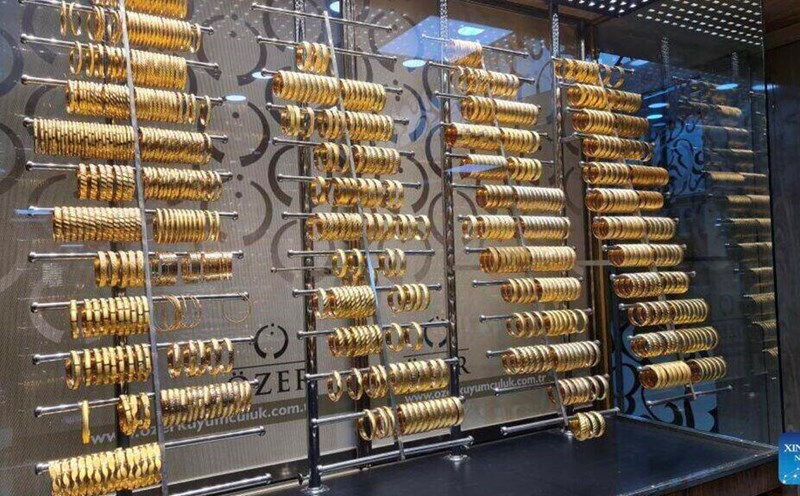

With spot gold prices currently fluctuating around $3,047.76/ounce - after peaking above $3,100 last month and increasing by 19% in the first quarter of 2025, gold is becoming a safe destination for global central banks.

The shaky financial market due to a series of tariff policies of US President Donald Trump has caused investors to massively sell off most assets, including gold. However, this sell-off cannot overshadow the long-term trend: gold is still expected to play the role of a "safe destination" in times of turmoil.

Wallstreetcn said that according to Haitong Securities' assessment, from 2022 to now, the gold buying activities of central banks have become a factor that significantly affects global gold prices.

Golds safe haven status is becoming increasingly prominent in the uncertain policy environment, the report said. In an optimistic scenario, gold prices could surpass $3,800/ounce.

The State Administration of Foreign Affairs of China said that in March, developments in macro indicators, fiscal and monetary policies and expectations from major economies caused the USD index to decline, causing the value of many types of global financial assets to decline. However, it was exchange rate changes and asset price adjustments that contributed to China's increased foreign exchange reserves in the past month.

The agency also stressed that China's economy remains stable and is making positive progress, with the effectiveness of a series of short-term and long-term support policies starting to take effect. This is a key factor in helping to maintain the solidity of national foreign exchange reserves in the context of a volatile global market.