While the world gold price increased to a record high, surpassing the 4,200 USD/ounce mark on October 15, Italy - a country that has been steadfast in "holding gold" for decades - is reaping a great reward.

The reserve of 2,452 tons of gold of the Central Bank of Italy (Bank of Italy) is currently valued at about 300 billion USD, equivalent to 13% of GDP.

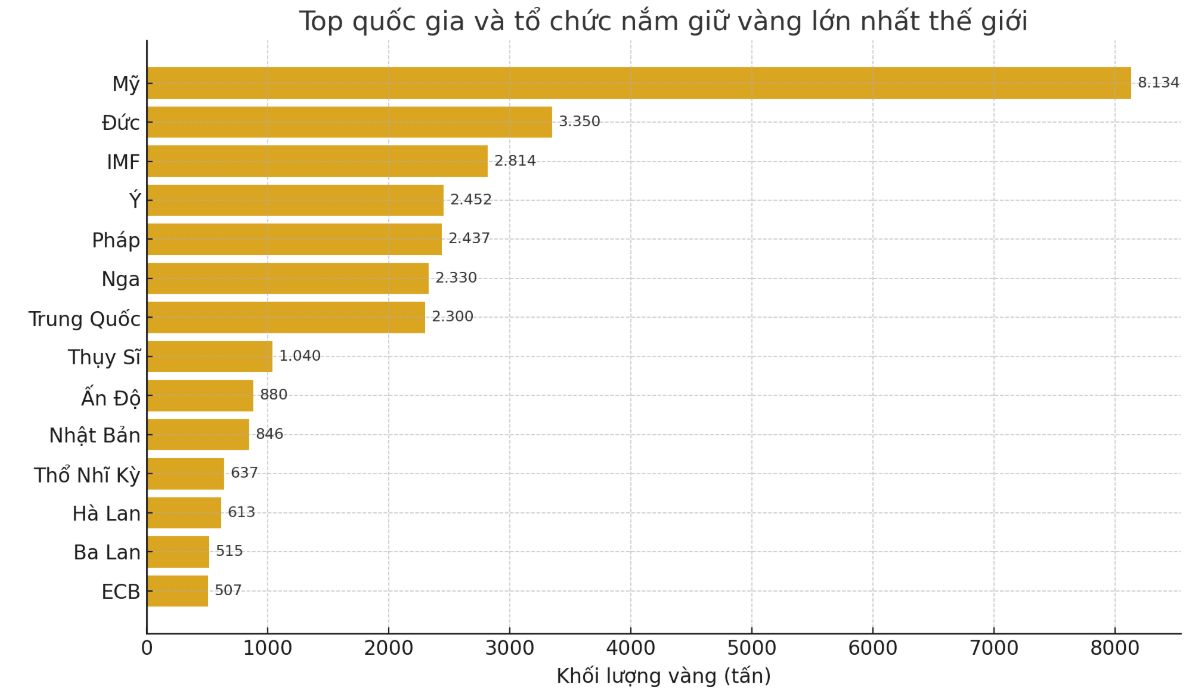

While many European countries have sold less gold to cover their budgets, Italy is determined to preserve gold reserves. The Bank of Italy currently holds the world's third largest gold reserves, after the US and Germany.

This huge amount of gold is the result of decades of steadfast protection of national assets, especially after Italy restored its reserves that were looted by German Nazis during World War II. After the war, only about 20 tons of gold were retained, but by 1960, the figure had skyrocketed to 1,400 tons, of which 3/4 was gold recovered in 2008.

Italy's history of attachment to gold can be traced back thousands of years. Since the Etruscan period - an ancient civilization before the Grecian army, the Italian people have known how to make sophisticated gold. Under the Julius Caesar era, the gold aureus became the main currency of the Roman empire. In the Middle Ages, the famous famous famous famous currency of Florence was as influential as the current USD.

Entering the 20th century, gold continues to play a strategic role. When the oil crisis of the 1970s caused an economic downturn, Italy mortgaged more than 41,000 gold bars to borrow 2 billion USD from the German Central Bank, thereby stabilizing the national budget. However, unlike England or Spain, Rome has never sold gold to overcome the crisis, even during the 2008 financial crisis.

Today, as the global financial order is reshaping and central banks are increasing their gold reserves, Italy's conservative choice has suddenly become a pioneer.

That historic decision by the Bank of Italy is now extremely modern, because the world is returning to gold as a last resort, said Professor Stefano Caselli, Principal of Bocconi School for SDA Management in Milan.

Currently, 75% of Italy's official foreign exchange reserves are gold, significantly higher than the Eurozone average of 66.5%. About 1,100 tons were stored in the Bank of Italy's tunnel, the rest were sent to the US, UK and Switzerland.

The Bank of Italy currently holds about 871,713 VND in gold, weighing about 4.1 tons, in its reserves.

With gold prices at a record level, many opinions say that Italy should sell less gold to reduce public debt beyond 3,000 billion euros (equivalent to 137% of GDP). However, experts say that selling gold does not solve the debt problem.

Even if it sells half of its gold, Italy cannot solve the problem of public debt, said Giacomo Chiorino, chief market analyst at Banca Patrimoni Sella & C.

In contrast, policy makers in Rome still maintain the viewpoint of "keeping gold is holding national trust".

In a volatile world, where digital assets such as stablecoin or cryptocurrency are emerging, central banks are still holding the hottest asset - gold. And they were right not to sell it, Professor Caselli concluded.