According to the China Stock Exchange (SAFE), as of the end of June 2025, China's total foreign exchange reserves increased for the 6th consecutive month, reaching 3,320 billion USD - the highest level since December 2015.

Compared to last month, reserves increased by 32.2 billion USD, equivalent to 0.98%, exceeding the 3,300 billion USD mark for the first time since September last year.

SAFE said that this increase comes from the weakening of the USD index and the increase in global financial markets, in the context of the Chinese economy maintaining a stable recovery.

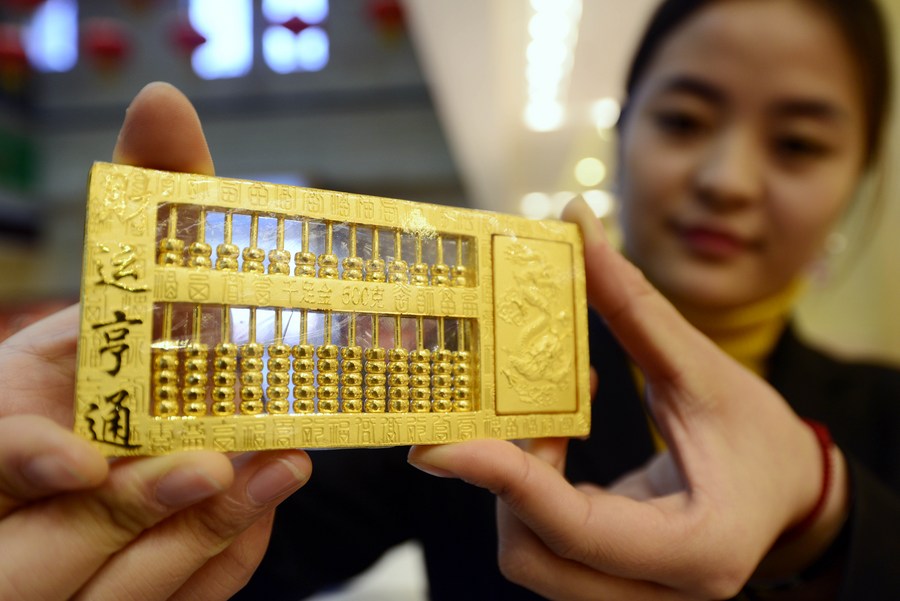

Meanwhile, China's official gold reserves also increased for the 8th consecutive month, to 73.9 million ounces, compared to 73.83 million ounces in May.

At the end of the trading session of the week, the world spot gold price was listed at 3,354.8 USD/ounce, up 18.9 USD/ounce compared to the closing price of the previous trading session. US gold futures closed up 1.4%, to $3,371.20/ounce.

The main reason comes from President Donald Trump's announcement of a series of new tariffs: imposing a 35% tax on imports from Canada and preparing to impose a 15-20% tax on most of the remaining trading partners. The US has also just announced a 50% tax rate on copper and goods from Brazil.

Intability has returned to the market and gold is benefiting from its safe-haven asset role, said global gold strategist Aakash doshi from State Street Global Advisors. He predicted that gold prices in the third quarter will range from 3,100 to 3,500 USD/ounce.

Not only gold, spot silver increased by 3.9% to 38.46 USD/ounce - the highest level since September 2011. platinum rose 2.8% to $1,399.13 and palladium surged 6.5% to $1,216.12 an ounce.

Investors believe that the strong increase in palladium is related to the possibility of the US announcing new sanctions against Russia next week, which could affect the supply of this precious metal.

In China - the world's largest gold consumer market, the gap between domestic gold prices still maintains 10-25 USD/ounce compared to world gold prices.

In Hong Kong (China), gold is sold at the world price level or 1.5 USD higher; Singapore ranges from the price level to the highest level of 2.2 USD; while in Japan, the difference is not significant.