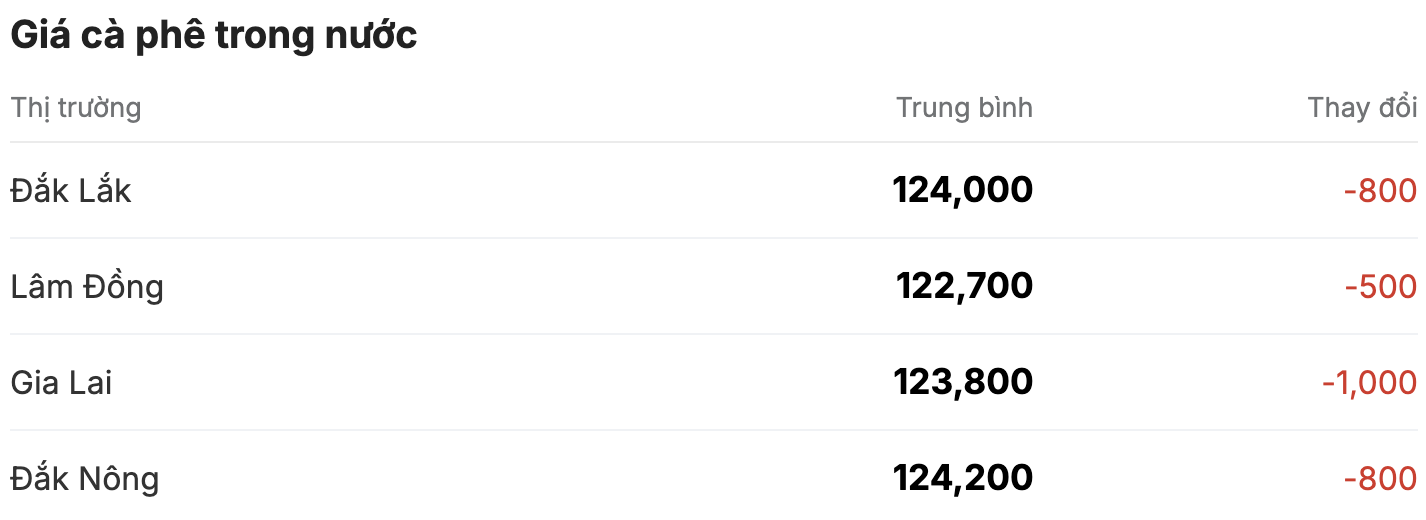

As of 11:30 a.m. today (December 18), the domestic coffee market has reversed to decrease in price, averaging a decrease of VND900/kg per session, currently fluctuating between VND122,700 - VND124,200/kg. The average coffee purchase price in the Central Highlands provinces today is VND124,000/kg.

Lam Dong is still the province with the lowest coffee purchasing price in the Central Highlands, with a difference of about VND1,300/kg compared to the average price. Compared to the closing price at the end of last week, coffee prices in this region have decreased by at least VND500/kg, currently hovering at VND122,700/kg.

Gia Lai province today announced that the coffee purchase price fluctuates around 123,800 VND/kg, a sharp decrease of up to 1,000 VND/kg compared to the same time yesterday (December 17).

In the same direction, coffee prices in Dak Lak province today ranked second on the chart, simultaneously changing direction to decrease by 800 VND/kg, to 124,000 VND/kg.

Notably, Dak Nong has always maintained a stable performance, firmly holding the leading position in the province and city with the highest coffee purchasing price in the country, setting the price at 124,200 VND/kg.

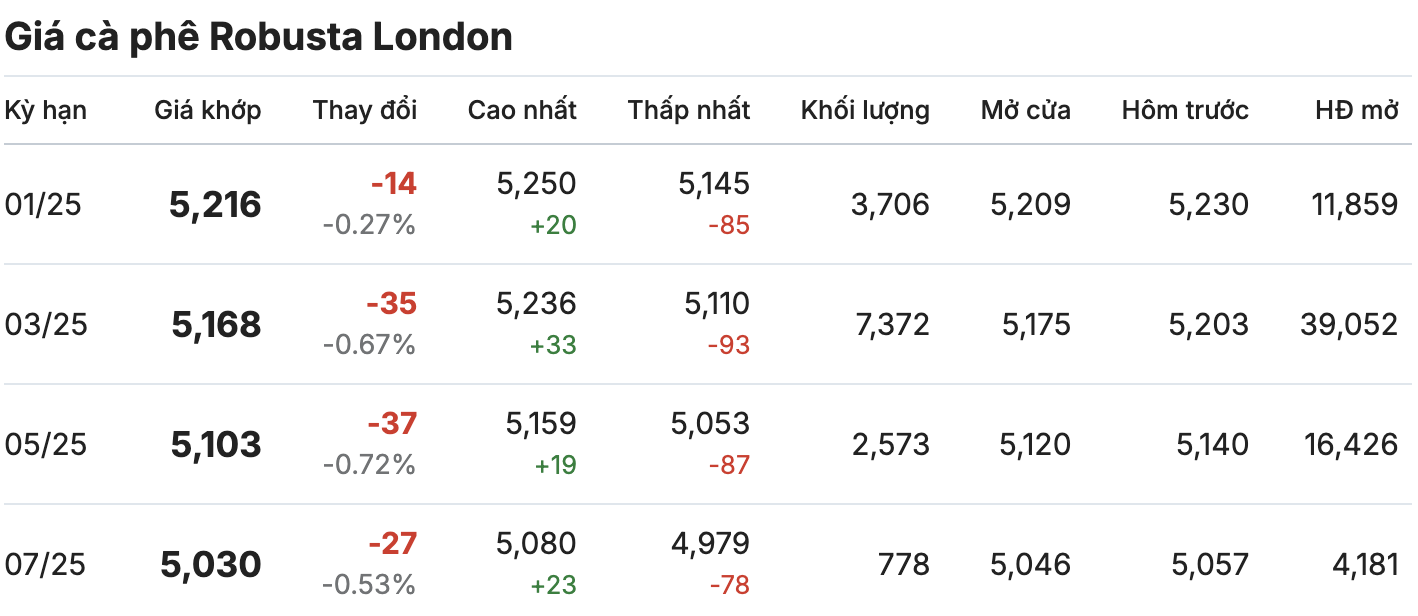

On the London and New York exchanges, the coffee market moved in a slight downward trend across all terms. The January 2025 contract decreased by 0.27% (equivalent to 14 USD/ton), standing at 5,216 USD/ton. The March 2025 contract also slid by 0.67% (equivalent to 35 USD/ton), trading at 5,168 USD/ton.

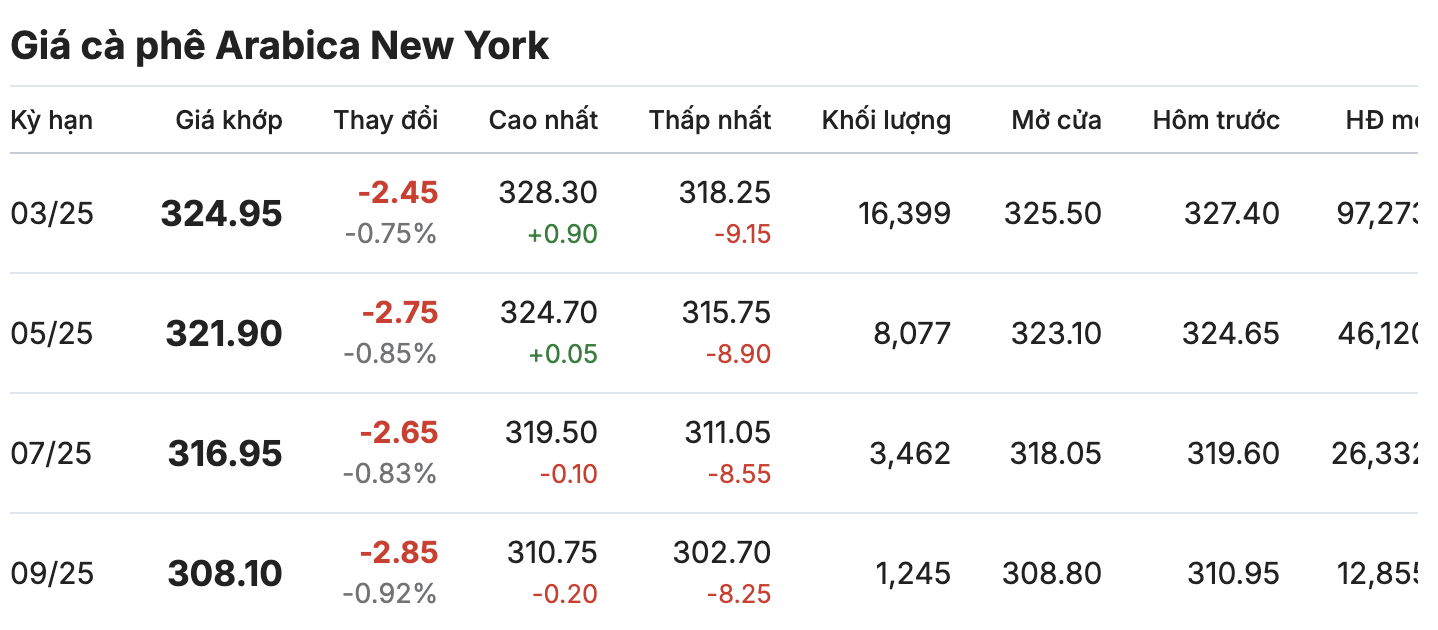

Notably, the New York Arabica coffee market reversed course after a sudden surge. The March 2025 and May 2025 delivery periods settled at 324.95 cents/lb and 321.90 cents/lb, respectively, down nearly 1%.

Global coffee prices are currently under pressure from a supply shortage caused by lower-than-average rainfall in Brazil. Rainfall in Brazil’s largest Arabica coffee growing region is expected to be just 65% of the historical average, according to a report from Somar Meteorologia, raising concerns that the 2025-2026 crop will be significantly reduced.

As of December 11, Brazilian producers had sold 79% of their 2024-25 crop, up 9% from the previous month. However, recent price spikes and expectations of a possible production cut have left producers cautious in their decisions.

Slow domestic exports have tightened the global coffee market. The Vietnam Coffee and Cocoa Association (Vicofa) forecasts that coffee output in the 2024-2025 crop year could fall by 5% to around 1.6 million tonnes. If this happens, it will be the second consecutive year that Vietnam has seen a decline in coffee output. However, shifting consumption in emerging markets such as China and Southeast Asian countries will create long-term growth opportunities for the Vietnamese coffee industry.