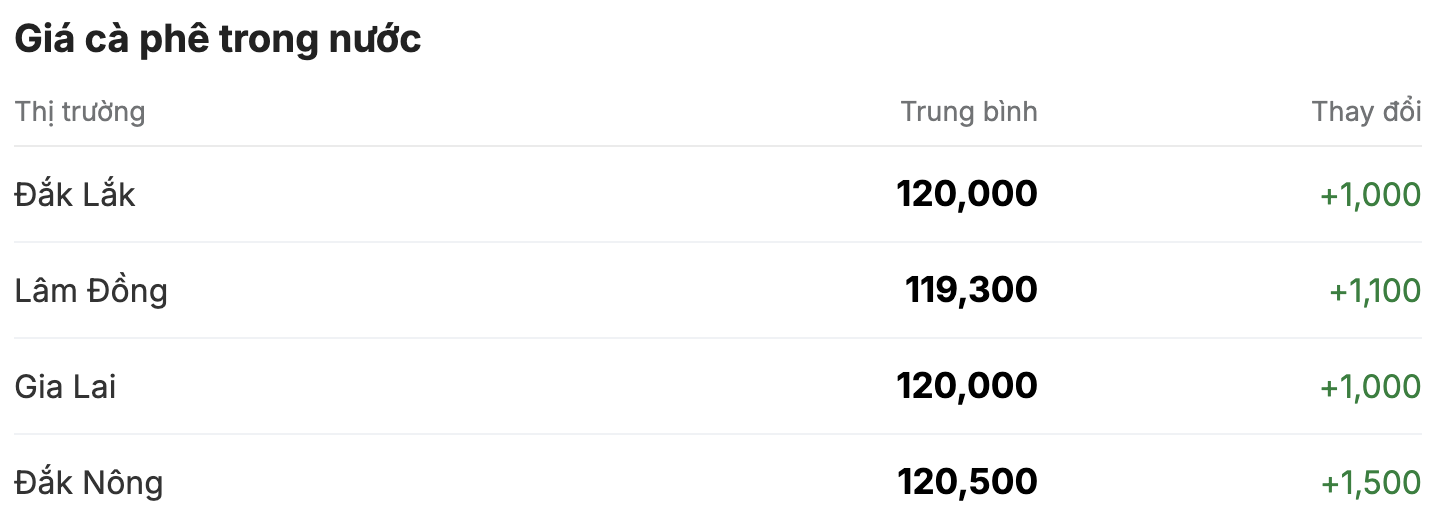

As of 11:30 a.m. today (January 21), the domestic coffee market has reversed sharply, increasing by an average of VND1,200/kg in the first session of the week. Currently, the purchase price fluctuates between VND119,300 - VND119,000/kg. The average coffee purchase price in the Central Highlands provinces today is VND120,200/kg.

Lam Dong is still the province with the lowest coffee purchasing price in the Central Highlands, about 900 VND/kg higher than the average price. Compared to the sharp decrease yesterday (January 20), coffee prices in this region continue to increase, currently hovering at 119,300 VND/kg.

Purchasing price is higher than Lam Dong, Gia Lai and Dak Lak provinces, all increased by 1,000 VND/kg, reaching 120,000 VND/kg.

Notably, Dak Nong is still the leading province among the provinces and cities with the highest coffee purchasing price in the country, listed at 120,500 VND/kg, the strongest increase of 1,500 VND/kg.

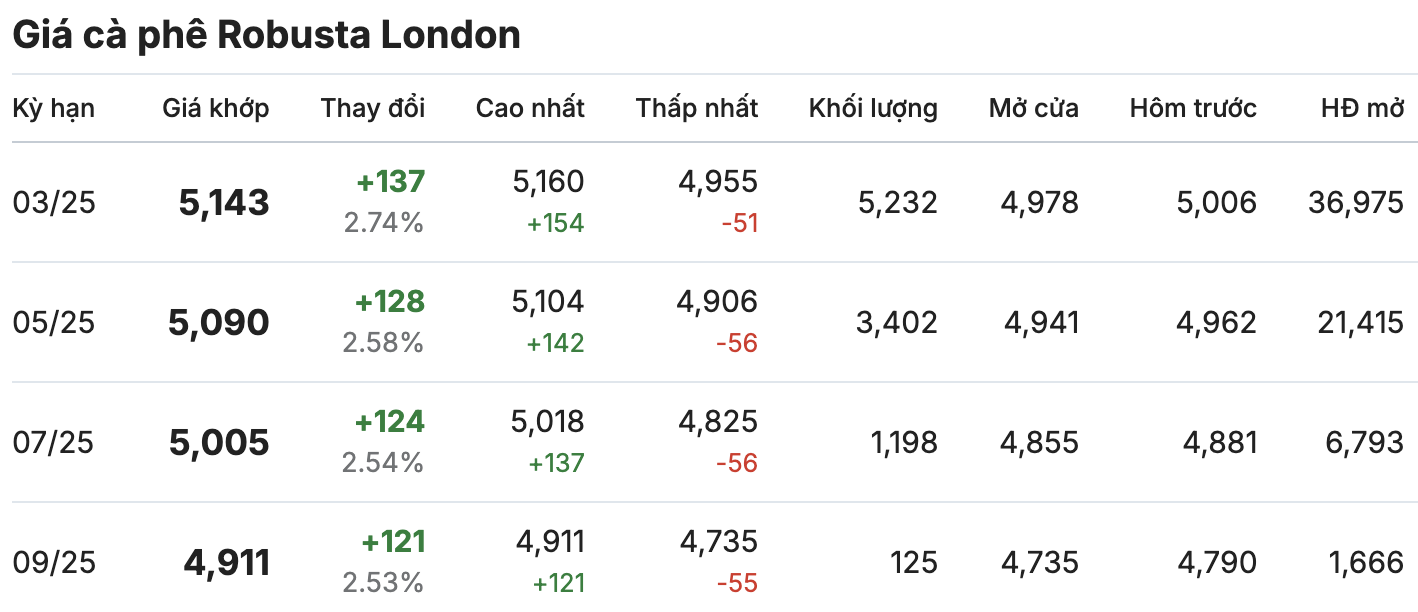

On the London and New York exchanges, the coffee market was covered in green in all terms. On the London Robusta coffee exchange, coffee prices increased, reaching a peak of 5,000 USD/ton. The contract for delivery in March 2025 increased by 2.74% (equivalent to 137 USD/ton), reaching 5,143 USD/ton. In the same direction, the contract for delivery in May 2025 increased by nearly 3% (equivalent to 128 USD/ton), anchoring at 5,090 USD/ton.

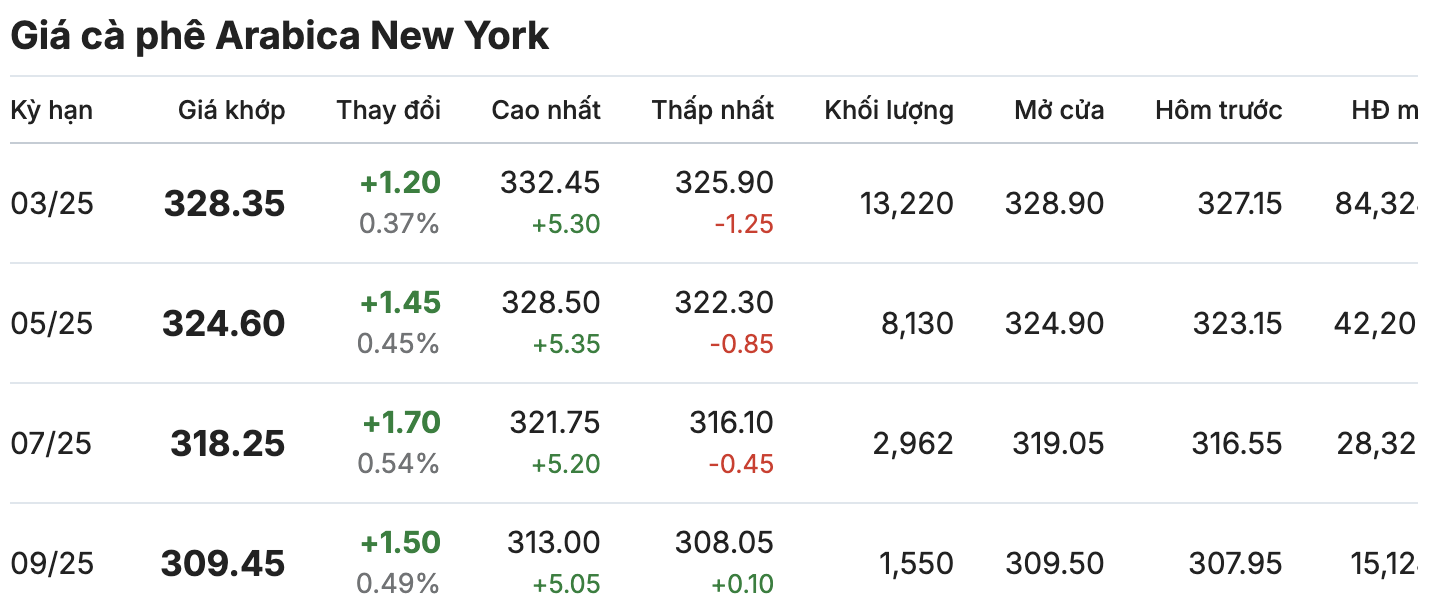

Similarly, the New York Arabica coffee market continued its strong increase. The March 2025 and May 2025 delivery periods both maintained their increase of nearly 1%, reaching the market at 328.35 cents/lb and 324.60 cents/lb.

Coffee exports from top producer Brazil could slow this year, a lean year in the country’s biennial crop cycle, while dry weather last year could reduce the 2025-2026 crop, traders said.

In the domestic market, during the 15 days when Vietnam celebrates the Lunar New Year, Robusta coffee cannot be produced much. The reason for this is that in the first three months of the crop year, the export volume decreased by 50% compared to the same period, exporters could not buy much, including FDI, due to high raw material prices while the credit situation during Tet was quite difficult.