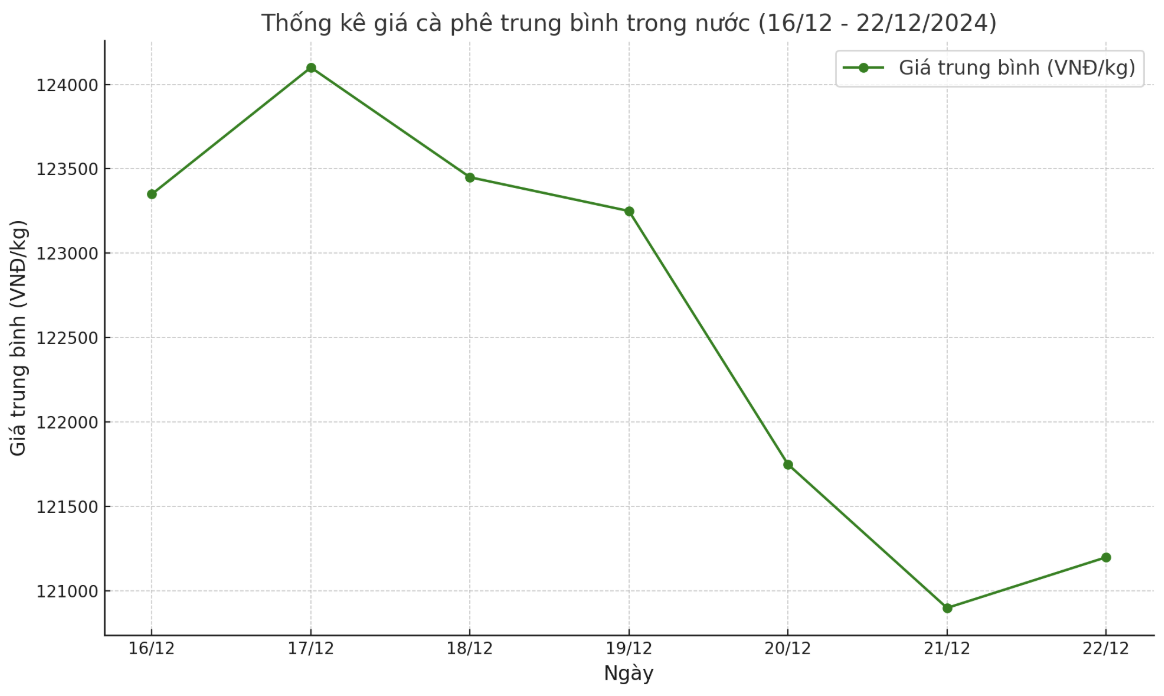

As of 11:30 a.m. today (December 22), the domestic coffee market continued to decline, with an average decrease of VND800/kg per session, currently fluctuating between VND120,500 - VND121,300/kg. The average coffee purchase price in the Central Highlands provinces at the end of the week fell to VND121,100/kg.

At the end of the week, domestic coffee prices fell sharply by VND3,100/kg compared to the peak of the week at VND124,200/kg. Although domestic coffee prices were at times close to VND125,000/kg and increased and decreased alternately, overall this was a week of sharp decline after a week of "galloping" increases.

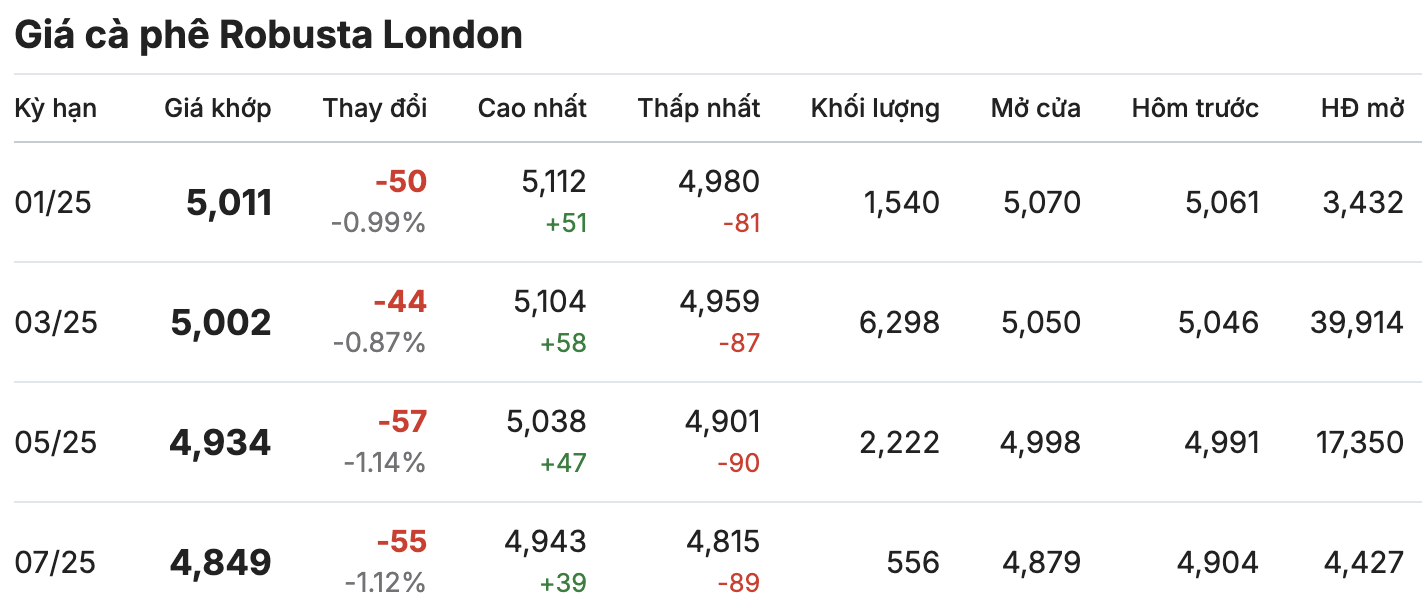

On the London and New York exchanges, the coffee market moved in opposite directions across all terms. On the London Robusta Coffee Exchange, coffee prices were covered in red, approaching the $5,000/ton mark. The January 2025 contract fell nearly 1% (equivalent to $50/ton), standing at $5,011/ton. The March 2025 contract fell in the same direction, down 0.87% (equivalent to $44/ton), trading at $5,002/ton.

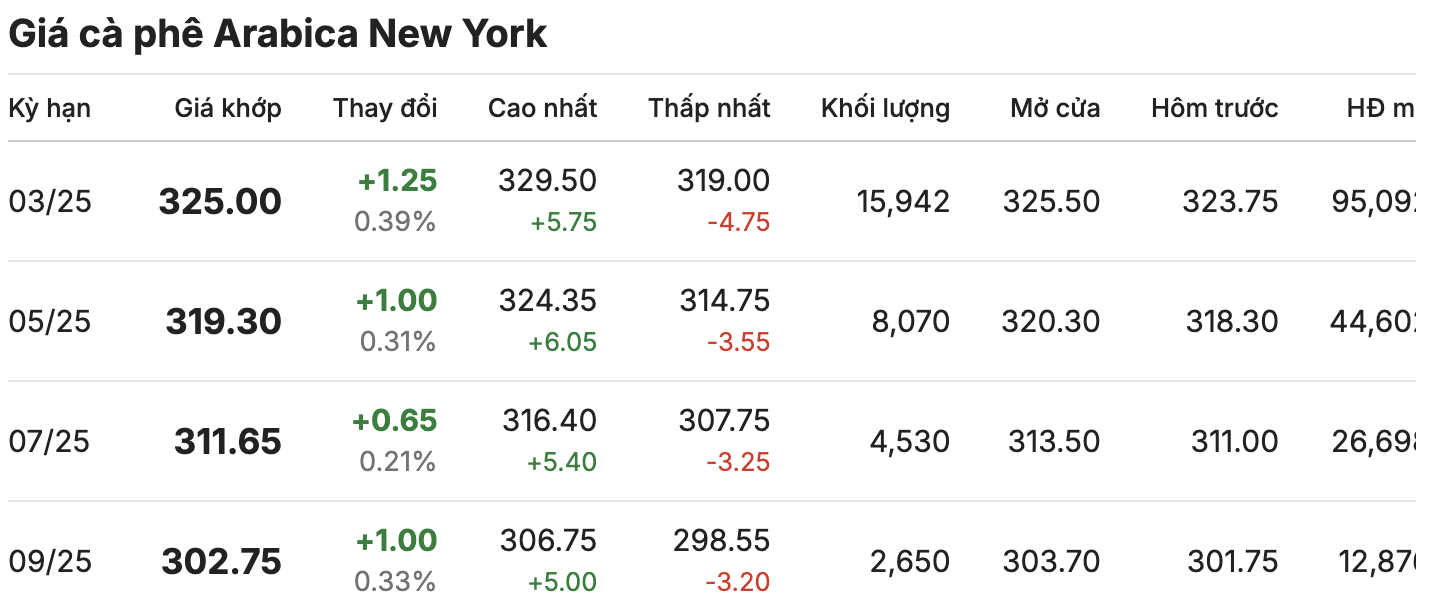

Similarly, the New York Arabica coffee market saw a simultaneous increase after a sharp decline. The March 2025 and May 2025 delivery periods were at 325.00 cents/lb and 319.30 cents/lb, up 0.39% and 0.31%, respectively.

The recovery of the Brazilian Real on December 20 after falling to a record low against the US dollar has severely affected the price of Arabica coffee. This makes Brazilian coffee more expensive in the international market. The increase in price also reduces the incentive for Brazilian coffee producers to export, negatively affecting the supply of Brazilian coffee on the international market. As a result, exporters may hold on to coffee domestically instead of exporting at a lower price.

However, the upward momentum of Arabica coffee prices will still be limited due to the increase in inventories monitored by ICE. Notably, on December 19, Arabica coffee inventories reached a 2.5-year high of 981,565 bags. The data shows that the abundant supply of Arabica coffee in the market has prevented coffee prices from increasing sharply despite supportive factors.

According to experts, the European Union (EU)'s official one-year postponement of the implementation of the EU Deforestation and Forest Degradation Regulation (EUDR) will help stabilize the market and benefit Vietnamese coffee exporters. When applied, the EUDR requires coffee exporting countries to prove that their products are not related to deforestation or human rights violations. The postponement of the EUDR will give exporters more time to adjust and prepare for the new requirements, minimizing negative impacts.