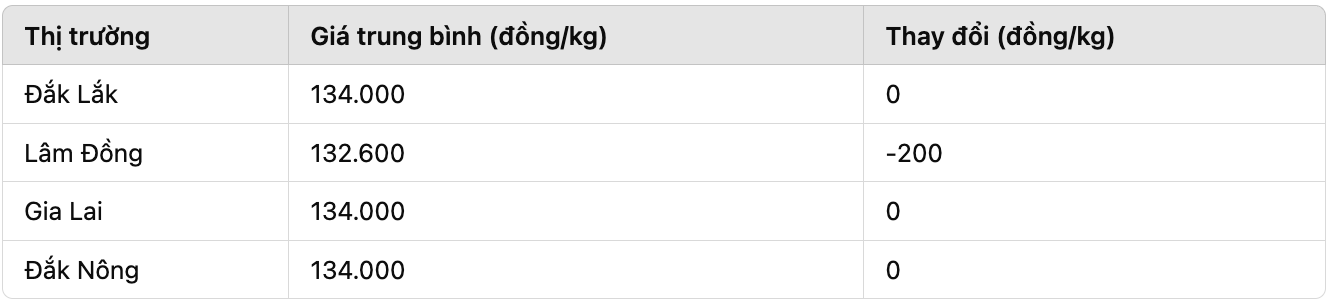

Domestic coffee prices stagnate, Lam Dong decreases slightly

In the domestic market, coffee prices today did not fluctuate much after increasing sharply in previous sessions. Coffee prices in the Central Highlands provinces continue to remain high, Lam Dong alone decreased by 200 VND/kg.

The fact that domestic coffee prices remain stable in the context of rising world prices shows that exporting enterprises are still monitoring market developments before making major transaction decisions. According to many experts, the supply of coffee in Vietnam is no longer abundant, while farmers still expect prices to increase higher, so they are not in a hurry to sell.

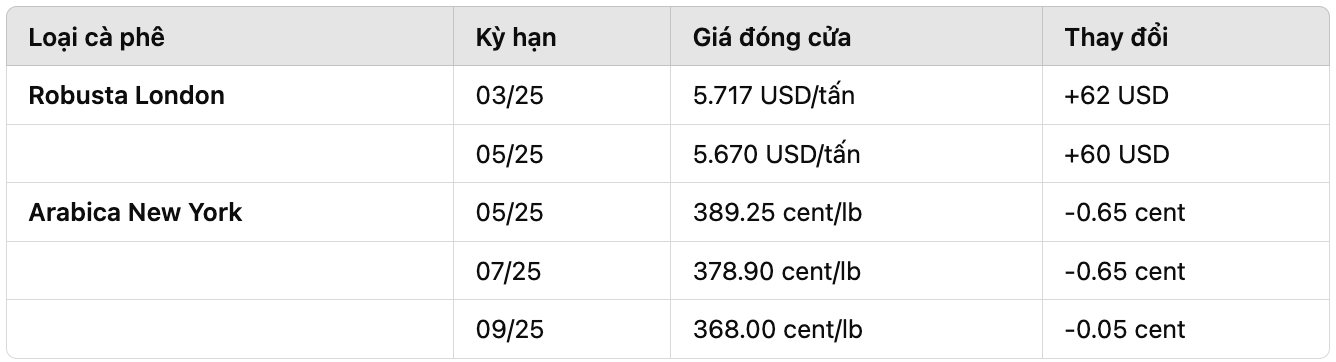

World coffee prices: Robusta continues to increase, Arabica in opposite directions

In the world market, Robusta coffee prices on the London exchange continue to maintain a strong increase. Meanwhile, Arabica coffee prices on the New York exchange have differentiated between terms, some terms have decreased slightly.

The increase in Robusta prices is supported by scarce supply, especially in Vietnam - the world's largest Robusta producer. Meanwhile, Arabica is still under pressure to adjust as investment funds reduce their buying position, although supply in Brazil is still in a downward trend.

Assessment and forecast: Will coffee prices continue to remain high?

According to a report from agricultural consulting firm Safras & Mercado, Brazilian farmers have sold 88% of their 2024/25 coffee output, up from 79% in the same period last year. However, the sales volume of the 2025/26 crop is significantly slower, reaching only 13% of the expected output (while the average for 4 years is 22.2%). This reflects expectations of continued price increases from coffee growers.

At the same time, Cecafe reported that Brazil's green coffee exports in January 2025 decreased by 1.6% compared to the same period last year. This, combined with Conab's forecast that Brazil's 2025/26 coffee crop will fall 4.4% to 51.81 million bags, adding momentum for prices to remain high.

In Vietnam, according to customs data, from October 2024 (the beginning of the harvest) to now, the amount of coffee exported is estimated at 480,000 tons, mainly green coffee beans. Although the first half of February coincided with the Tet holiday, exports still recorded a strong increase compared to the previous month. However, total exports are still lower than the same period in 2024.

Coffee prices typically peak in late April, before Brazil starts harvesting for the new crop. This opens up opportunities for Vietnamese coffee to reach the best price in the coming time.

In addition, another important factor is that the European Union (EUDR) anti-deforestation law will officially take effect at the end of 2025. This could give Vietnamese coffee an advantage, as Vietnam is the best producer to meet EUDR requirements, creating favorable conditions for the export of deep-processed coffee such as Instant and roasted coffee.

In short, domestic coffee prices are tending to stagnate while world prices continue to increase, especially Robusta. With forecasts of falling output in Brazil and tight supply, the market can maintain its upward momentum in the coming time. This is an opportunity for exporting businesses to take advantage of good price times, while farmers can also consider appropriate sales strategies to maximize profits.