At the 9th Session of the 15th National Assembly held on the morning of June 14, the National Assembly pressed the button to pass the Law on Special Consumption Tax (amended).

Clause 1, Article 2 of the draft Law on Special Consumption Tax stipulates the subjects subject to tax on goods as follows:

Cigarettes according to the provisions of the Law on Prevention and Control of Tobacco Harm; Alcohol according to the provisions of the Law on Prevention and Control of Alcohol and Beer Harm; Beer according to the provisions of the Law on Prevention and Control of Alcohol and Beer Harm;

Vehicles with engines under 24 seats, including: passenger cars; four-wheeled motorized passenger vehicles; passenger pick-up cars; double-cabin cargo pick-up cars; VAN trucks with two or more rows of seats, with a fixed divider design between the passenger compartment and the cargo compartment;

Two-wheeled motorbikes, three-wheeled motorbikes with a cylinder capacity of over 125 cm3; Airplanes, helicopters, tourists and yachts; Gasoline of all kinds;

Coordinate the temperature with a capacity of over 24,000 BTU to 90,000 BTU except for the type according to the manufacturer's design only for installation on means of transport including cars, railway cars, airplanes, helicopters, ships, boats.

In case the organization or individual producing and selling or the organization or individual importing separately each part is a hot or cold unit, the goods sold or imported (hot or cold unit) are still subject to special consumption tax as for the finished product (complete air conditioner);

Courtys; Gold bars, codes, excluding codes for children's toys, teaching aids;

soft drinks according to Vietnam Standards (TCVN) have a sugar content of over 5g/100ml.

The goods specified in this clause are complete products, excluding components for assembling these goods.

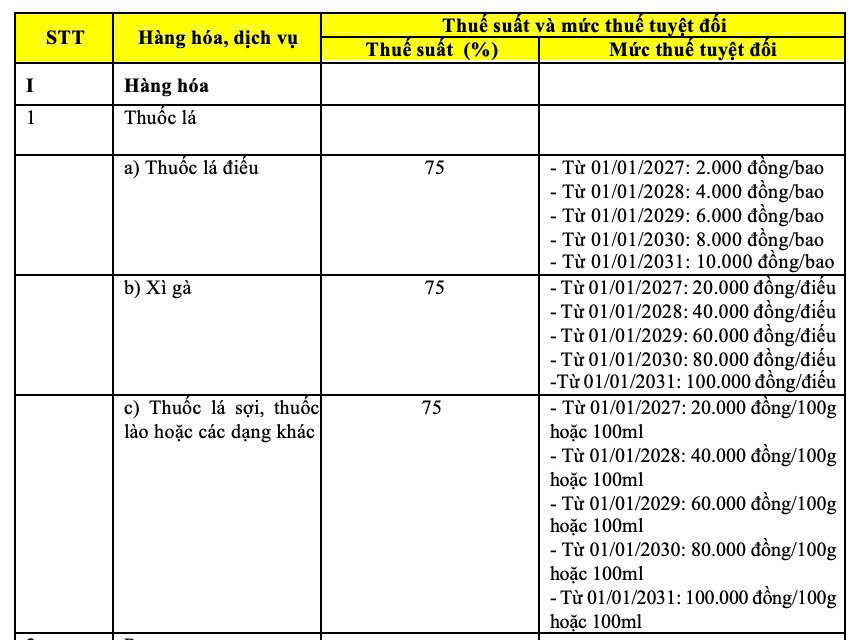

Article 8 of the draft stipulates the tax rate and absolute tax rate of special consumption tax on goods and services. In which, the special consumption tax rate on cigarettes is calculated according to the roadmap, in which the absolute tax rate on cigarettes from January 1, 2021 is 10,000 VND/pack.

Special consumption tax rates for cigarettes are as follows: