Why is it necessary to compare both traditional banking and online savings apps?

You need to compare both traditional banking and online savings apps because each form has different advantages: online savings are often charged higher interest rates, operate quickly, flexibly and easily manage accounts anytime, anywhere, while traditional banking brings safety, direct support and suitability to people with no technology.

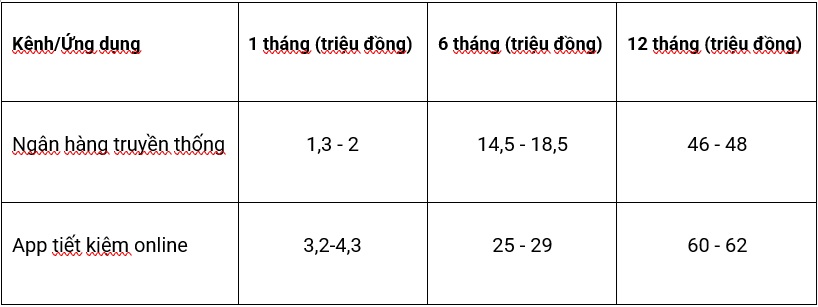

A specific example is as follows for a deposit of VND1 billion or more: Calculating actual profits when depositing VND1 billion in options

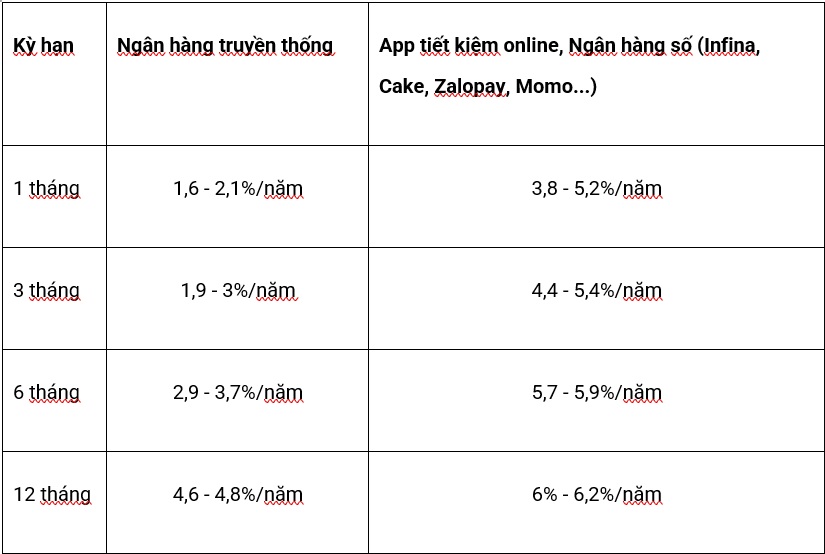

* Traditional bank interest rates (7/2025):

- 1-month term: 1.6-2.4%/year.

- 6-month term: 2.93.7%/year.

- 12-month term: 4.64.8%/year.

* Profit from online savings apps, e-wallets, digital banking:

- Infina: 5.2%/year (1 month), 5.9%/year (6 months), 6.2%/year (12 months).

- Cake by VPBank, ZaloPay, Momo: 4.96%/year(12 months), flexible deposit, quick operation.

Compare 1 - 3 - 6 - 12 month terms: Which term is reasonable?

If you prioritize profit maximization and flexibility in money management, online savings applications such as Infina will be an attractive choice. However, for those who value absolute safety, traditional banking is still a suitable channel.

Which savings channel should a 30-year-old choose?

* Young people often prioritize flexibility, digital experience, expect higher profits and like to manage finances on the phone. Savings apps for young people such as Infina, Cake, ZaloPay, MoMo, Viettel Money all meet this need well.

* The 50:30:20 rule should be applied (50% of essential expenses, 30% individuals, 20% savings/investment), dividing savings into smaller amounts: partly as a bank deposit (safe), partly as a reputable savings app deposit (high profit, flexible), partly as an investment ( fund certificate, bonds...).

Proposal for channel to optimize idle cash flow

* Traditional banking: Legal safety, deposit insurance, clear procedures.

* fintech App: Intermediate fintech App (Infina, Zalopay, Momo, Viettel Money...) need to carefully consider the fund management partner, transparency level and reliability. If it is a digital banking app (Cake, Timo, ...), it is as safe as a bank.