Domestic silver price

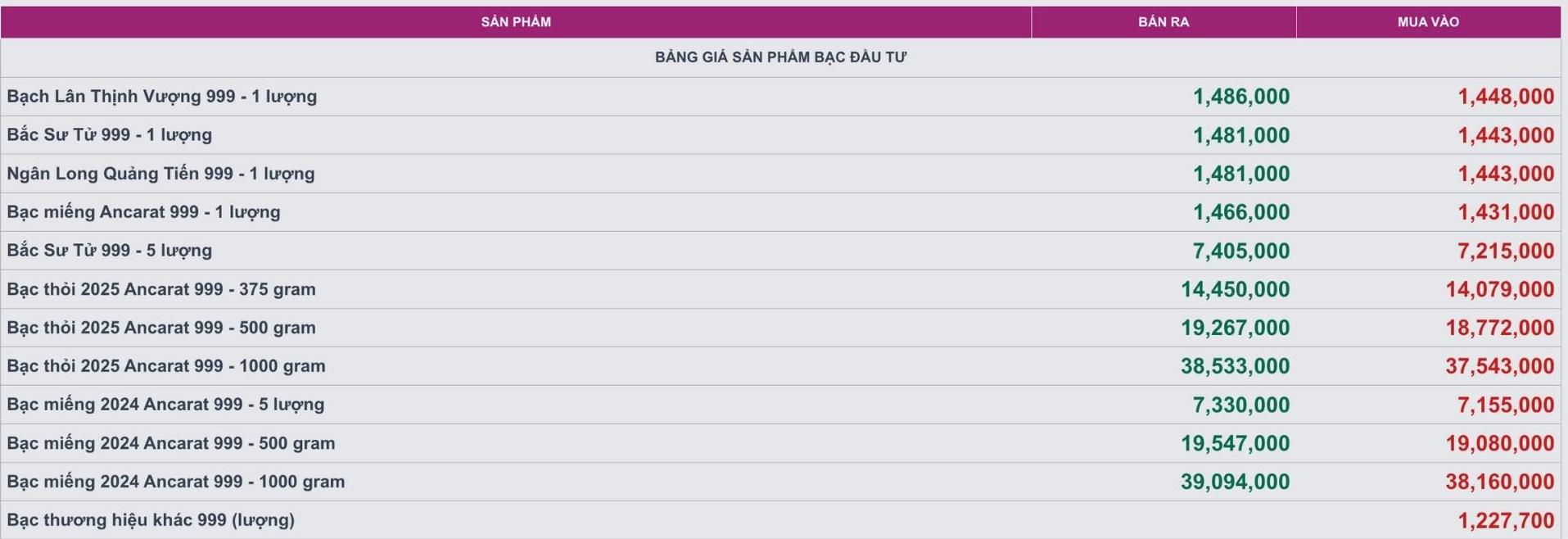

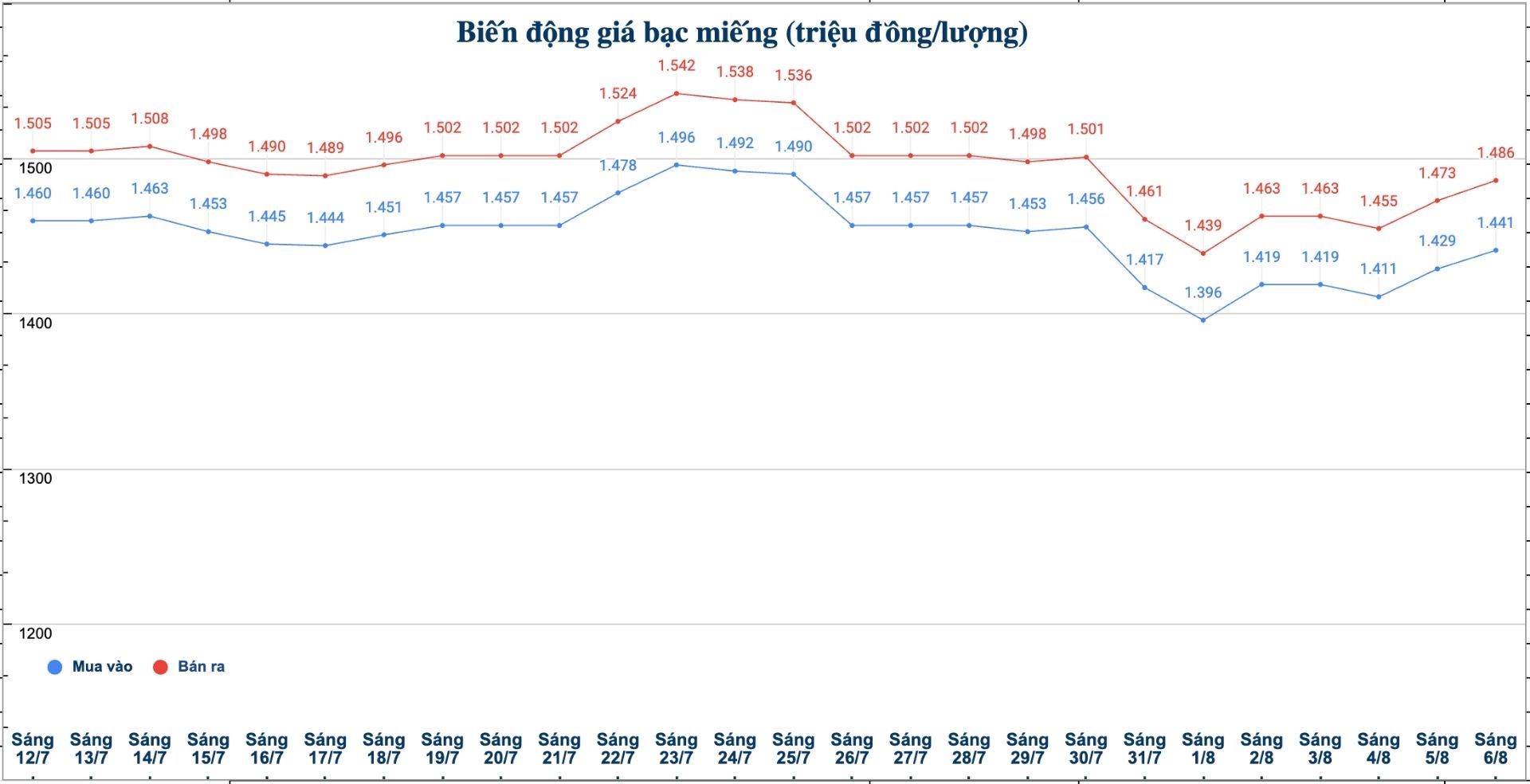

As of 9:50 a.m. on August 6, the price of 999 silver bars at Ancarat Golden variety Company was listed at 1.431 - 1.466 million VND/tael (buy - sell); an increase of 13,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of Ancarat silver Company was listed at 37.543 - 38.533 million VND/kg (buy - sell); an increase of 323,000 VND/kg in both buying and selling directions compared to yesterday morning.

At the same time, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.441 - 1.486 million VND/tael (buy - sell); an increase of 12,000 VND/tael for buying and an increase of 13,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.441 - 1.486 million VND/tael (buy - sell); an increase of 12,000 VND/tael for buying and an increase of 13,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38,426 - 39,626 million VND/kg (buy - sell); an increase of 320,000 VND/kg for buying and an increase of 347,000 VND/kg for selling compared to yesterday morning.

World silver price

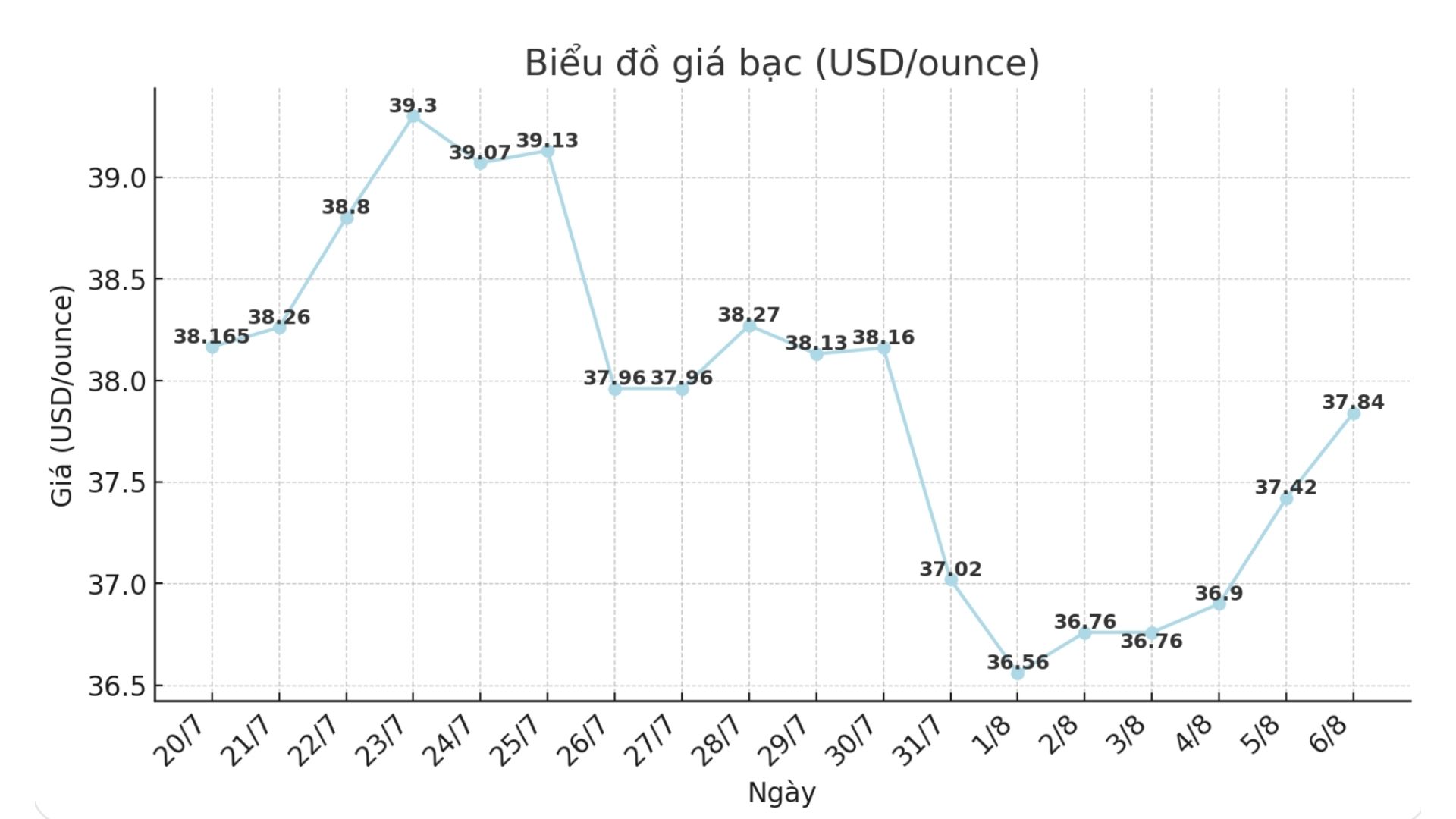

On the world market, as of 9:50 a.m. on August 6 (Vietnam time), the world silver price was listed at 37.84 USD/ounce; up 0.42 USD compared to yesterday morning.

Causes and predictions

Silver prices rebounded after the Services PMI released by the Institute for Supply Management (ISM) was lower than expected, showing the slowing growth momentum of the US economy.

This unpstidy data has led the market to expect the Federal Reserve to soon switch to an easing policy, which would support silver a non-yielding asset, said market analyst James Hyerczyk.

He added that the report also showed that the labor market in the service sector continued to weaken, as the employment index fell to 46.4 - the fourth decline in 5 months. The number of new orders also decreased to 50.3, while business activities fell from 54.2 to 52.6, showing that services are growing slowly.

"If upcoming reports continue to show a weak economy, the possibility of the Fed loosening policy will increase, helping silver break out above 37.87 USD/ounce and towards the 39.53 USD/ounce zone.

However, if inflation remains persistent due to tariffs and high input costs, expectations of a rate cut could be held back," said James Hyerczyk.

Currently, James Hyerczyk believes that silver will continue to increase in the short term, supported by weak economic signals and stable price levels.

See more news related to silver prices HERE...