Domestic silver price

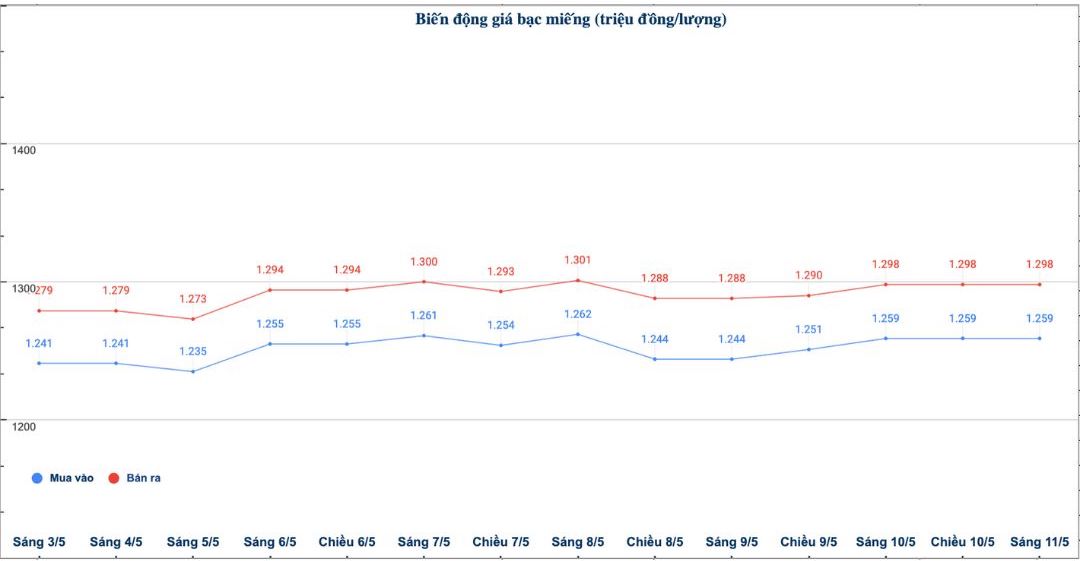

As of 10:10 on May 11, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.259 - 1.298 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.259 - 1.298 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

At the same time, the price of 999 (1kilo) taels at Phu Quy Jewelry Group was listed at 33.573 - 34.613 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to early this morning.

In the trading session last week (morning of May 4, 2025), the price of 999 gold bars (1kilo) at Phu Quy Jewelry Group was listed at 33.093 - 34.106 million VND/kg (buy - sell).

Thus, if buying 999 silver bars at Phu Quy Jewelry Group in the session of 4.5 and selling in this morning's session (11.), buyers will lose 533,000 VND/kg.

World silver price

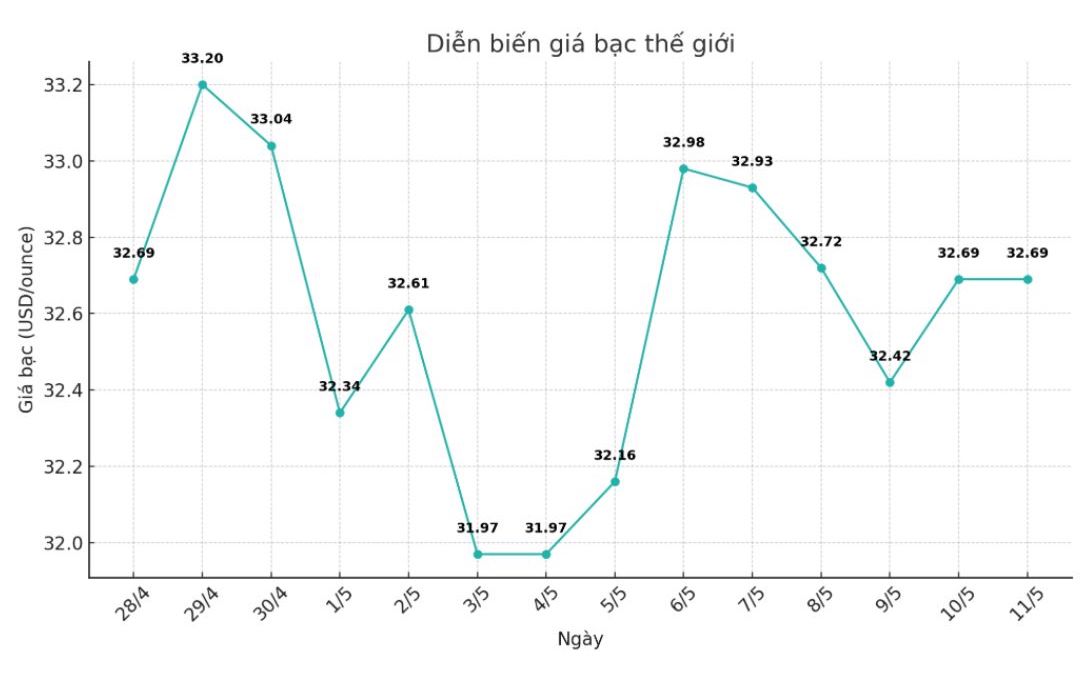

On the world market, as of 10:15 on May 11 (Vietnam time), the world silver price listed on Goldprice.org was at 32.69 USD/ounce.

Causes and predictions

According to Kitco, investor risk sentiment is increasing this week, as cash flow shifts to higher-yielding assets. This trend puts pressure on precious metals such as gold and silver - which often act as a safe haven when the market fluctuates.

For silver, analyst Vladimir Zernov at FX Empire assessed that this precious metal still benefits as traders focus on the strong performance of the gold market.

"Currently, silver is trying to stabilize above the resistance level at 33 - 33.20 USD/ounce. If it maintains this mark, the precious metal could continue to increase to the next resistance zone around 34.40 - 34.60 USD/ounce," he said.

Meanwhile, analyst James Hyerczyk at FX Empire said that broader fundamentals could support silver.

"The US-China trade talks in Switzerland are being closely monitored. Any tariff easing for Chinese imports could boost industrial demand for silver.

Of which, more than 50% of consumption is associated with industrial applications, especially electronics and solar energy. This could help slow down the decline of silver and stabilize prices again," said James Hyerczyk.

See more news related to silver prices HERE...