Domestic silver price

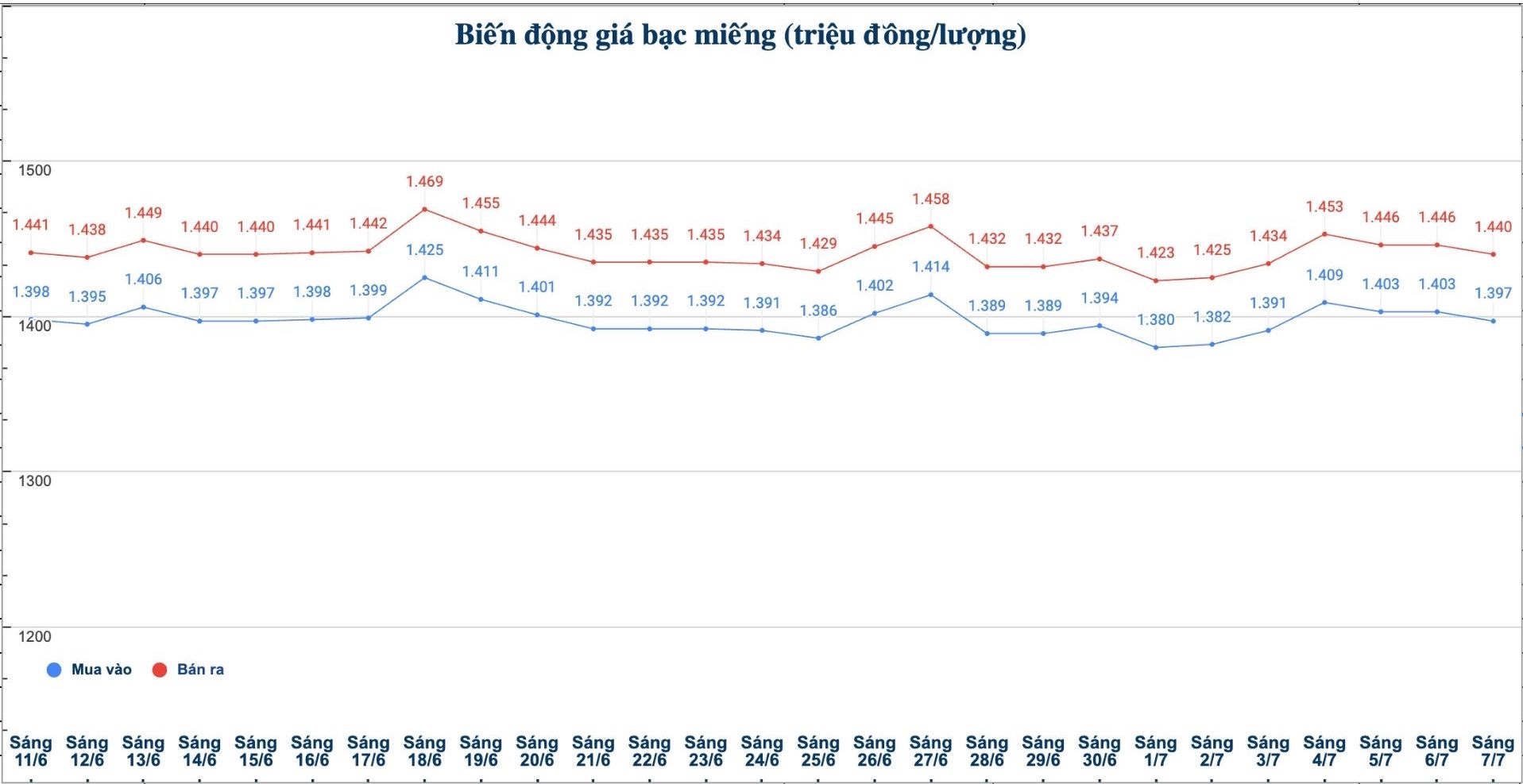

As of 9:50 a.m. on July 7, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.397 - 1.440 million/tael (buy - sell); down VND6,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.397 - 1.440 million VND/tael (buy - sell); down 6,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.253 - 38.399 million VND/kg (buy - sell); down 160,000 VND/kg in both buying and selling directions compared to early this morning.

World silver price

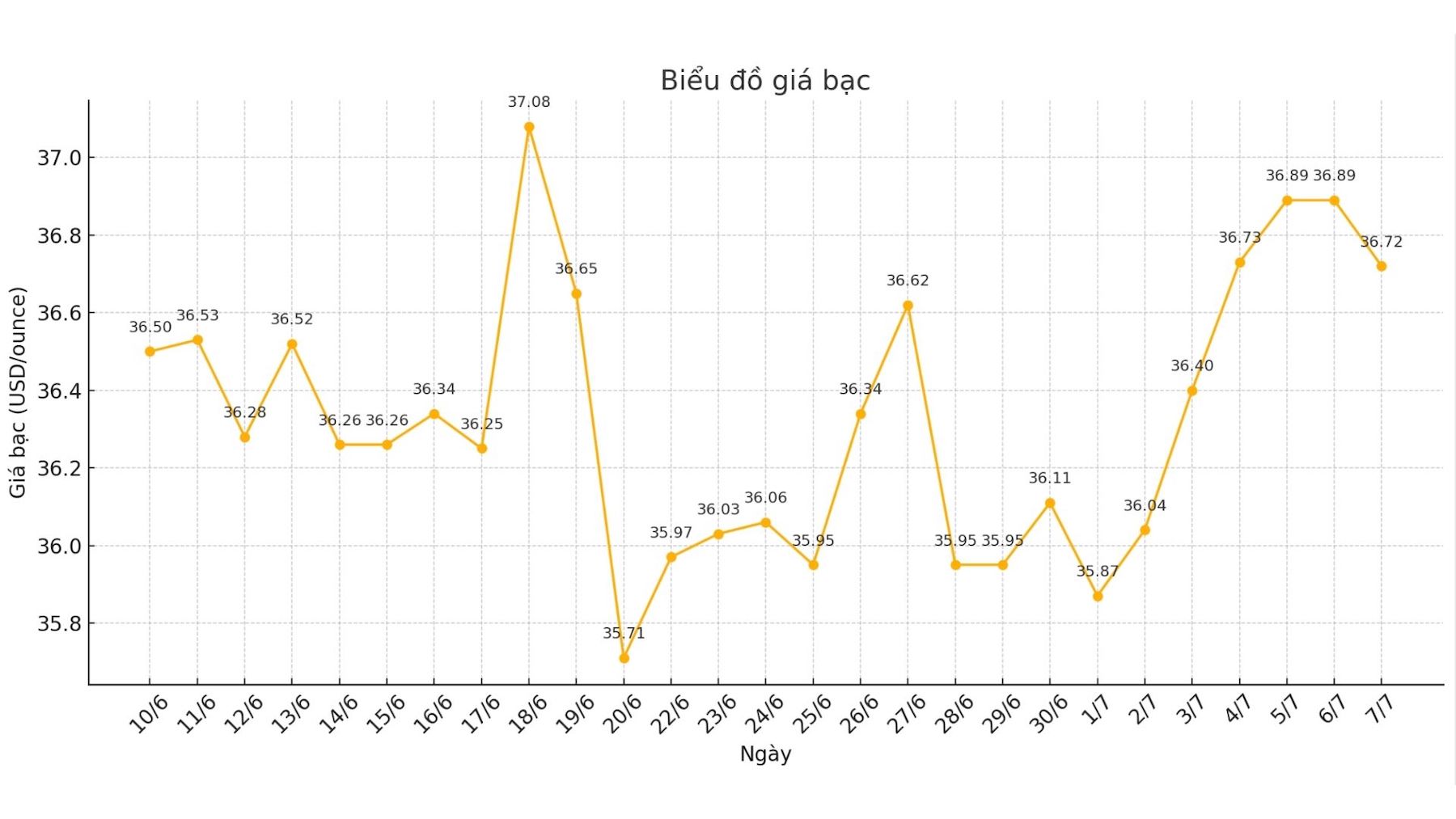

On the world market, as of 9:52 a.m. on July 7 (Vietnam time), the world silver price was listed at 36.72 USD/ounce; down 0.17 USD compared to yesterday morning.

Causes and predictions

Silver prices turned down slightly, but there was still much room to rebound. In a recent interview, Mr. Ryan McIntyre - Senior Executive partner at Sprott said that although he is still optimistic about gold, he is currently paying more attention to silver in the short term.

Mr. McIntyre's positive view was given when the gold/esilience ratio fell below 92, much lower than the multi-year peak of over 100 in April.

The calm worry about the global economic downturn and reduced trade tensions are supporting the cyclical industrial demand of silver. Mr. McIntyre predicts that both silver and gold will tend to increase in price as individual investors seek assets to protect asset value and purchasing power.

He said he has a slightly optimistic view on silver in the short term, as the metal still needs to catch up with gold's rally. Although silver is not held by central banks as a reserve asset, it is still a metal with important monetary value for individual investors.

Gold is still considered the top currency globally. But at this time, silver is an attractive valuable investment opportunity. For me, gold has always held a long-term position in the portfolio. Silver is added flexibly, based on valuation factors, he said.

Although many investors focus on industrial consumption demand - accounting for 60% of the silver market and continuing to create a large deficit, Mr. McIntyre emphasized the role of silver as a tangible asset.

Meanwhile, according to the latest commentary report on precious metals, Bernard Dahdah - Precious metals analyst at Natixis - said that he still maintains a positive view on silver and predicts that this metal will continue to outperform gold in the second half of this year.

He predicts that silver prices will reach about $38/ounce by the end of the year.

Looking ahead, Dahdah expects industrial demand to continue to be the main driver of silver prices. He said industrial demand now accounts for 59% of total global silver consumption, up from 51.5% in 2019.

Most of this increase comes from the increasing demand for renewable energy. For example, the proportion of silver demand from the solar energy sector has increased from 6% of total demand in 2015 to 16% in 2023 and is approaching 20% in 2024 - he commented.

See more news related to silver prices HERE...