Domestic silver prices

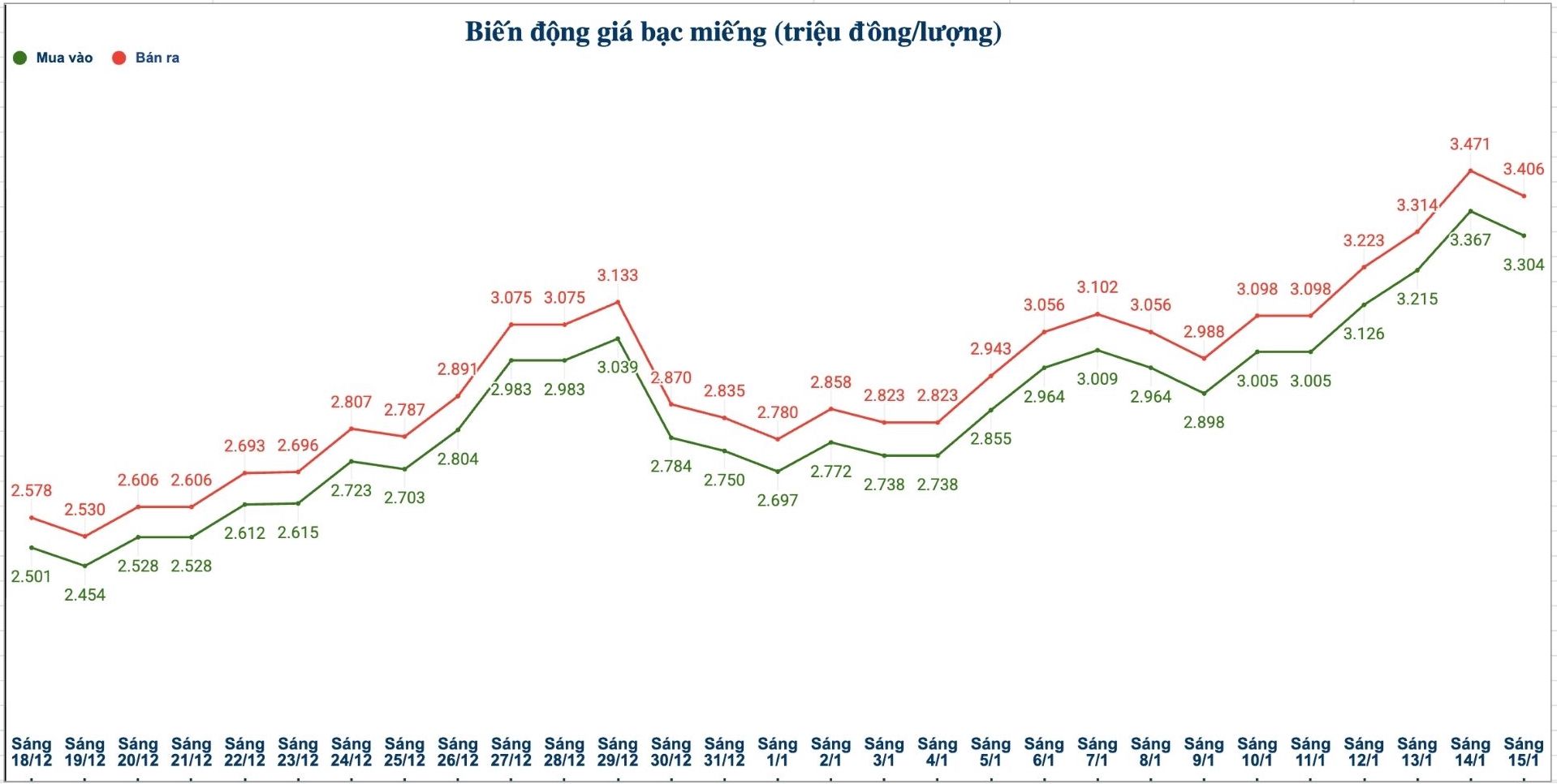

As of 10:40 am on January 15, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 3,300 - 3,381 million VND/tael (buying - selling); down 69,000 VND/tael on the buying side and down 71,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 87.020 - 89.660 million VND/kg (buying - selling); down 1.834 million VND/kg on the buying side and down 1.894 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) is listed at the threshold of 3.378 - 3.465 million VND/tael (buying - selling); down 12,000 VND/tael on the buying side and down 9,000 VND/tael on the selling side compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.304 - 3.406 million VND/tael (buying - selling); down 63,000 VND/tael on the buying side and down 65,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 88.106 - 90.826 million VND/kg (buying - selling); down 1.080 million VND/kg on the buying side and down 1.733 million VND/kg on the selling side compared to yesterday morning.

World silver prices

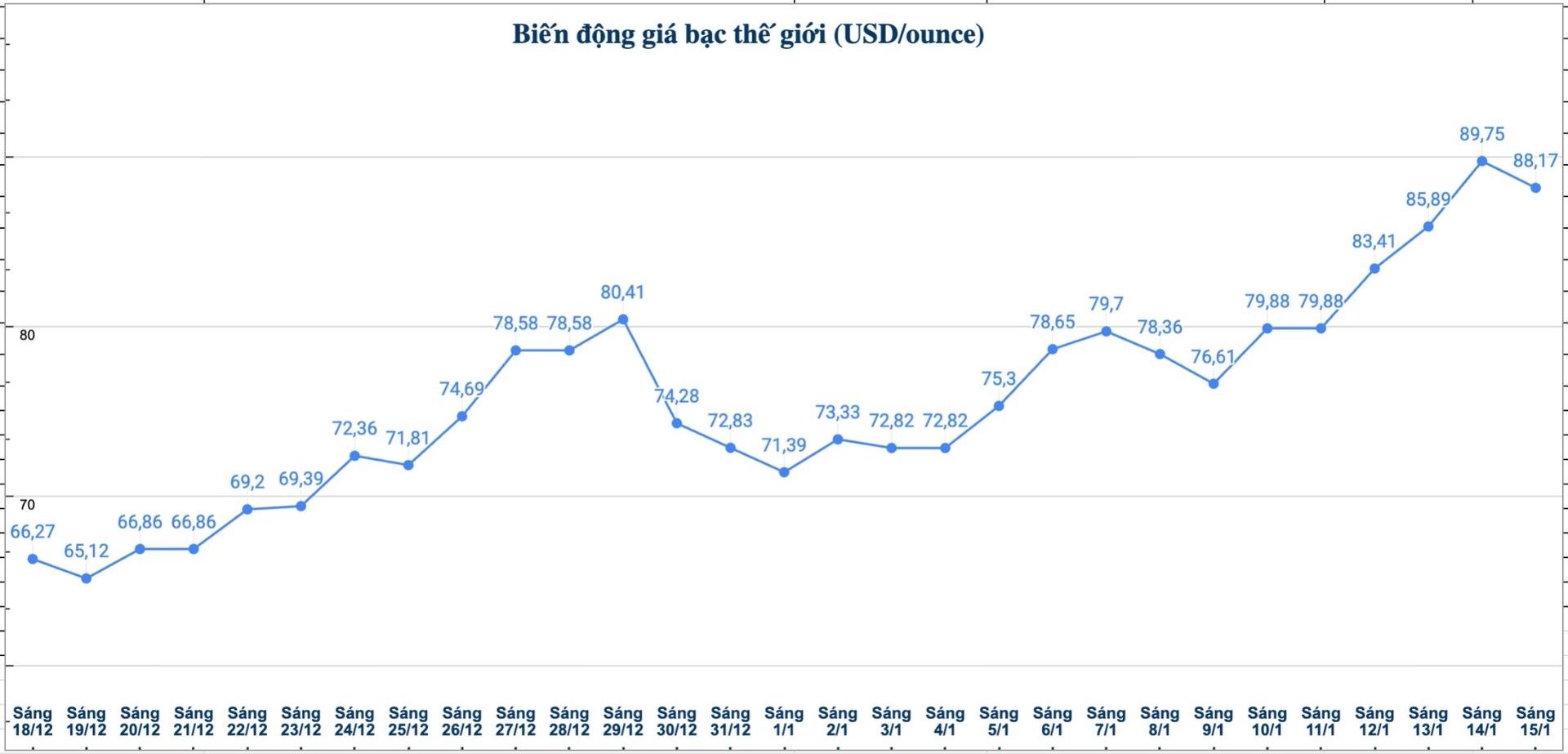

On the world market, as of 10:40 am on January 15 (Vietnam time), the world silver price was listed at 88.17 USD/ounce; down 1.58 USD compared to yesterday morning.

It's a bit of a bit of a bit of a bit of a bit of a bit.

Causes and forecasts

The world silver market recorded strong gains in recent sessions. According to precious metals analyst Christopher Lewis at FX Empire, these developments show that the market situation may change very quickly.

Currently, short-term downward corrections are considered opportunities for investors to participate in the market, at least until the 80 USD/ounce zone - a region that was once an important resistance level" - he said.

Christopher Lewis also warned that the higher the price, the greater the risk - which is true for any financial market.

However, according to the assessment of precious metals analyst Christopher Lewis, with the existing dynamics, silver prices still have plenty of room to continue to rise and are fully capable of approaching the 100 USD/ounce mark in the near future. He believes that the current upward momentum of the silver market is not only short-term but also supported by fundamental factors.

Specifically, the silver market is being affected by a supply shortage that has lasted for at least the past 5 years, thereby creating an important support for the current upward trend. Besides the supply factor, in the medium and long term, Christopher Lewis believes that demand for silver is forecast to continue to increase thanks to a series of new drivers.

Among them, the rapid development of data centers, the trend of China promoting silver accumulation, as well as the US considering silver as a strategic asset. According to him, these factors are contributing to forming a solid foundation, supporting silver prices in the medium and long term.

See more news related to silver prices HERE...