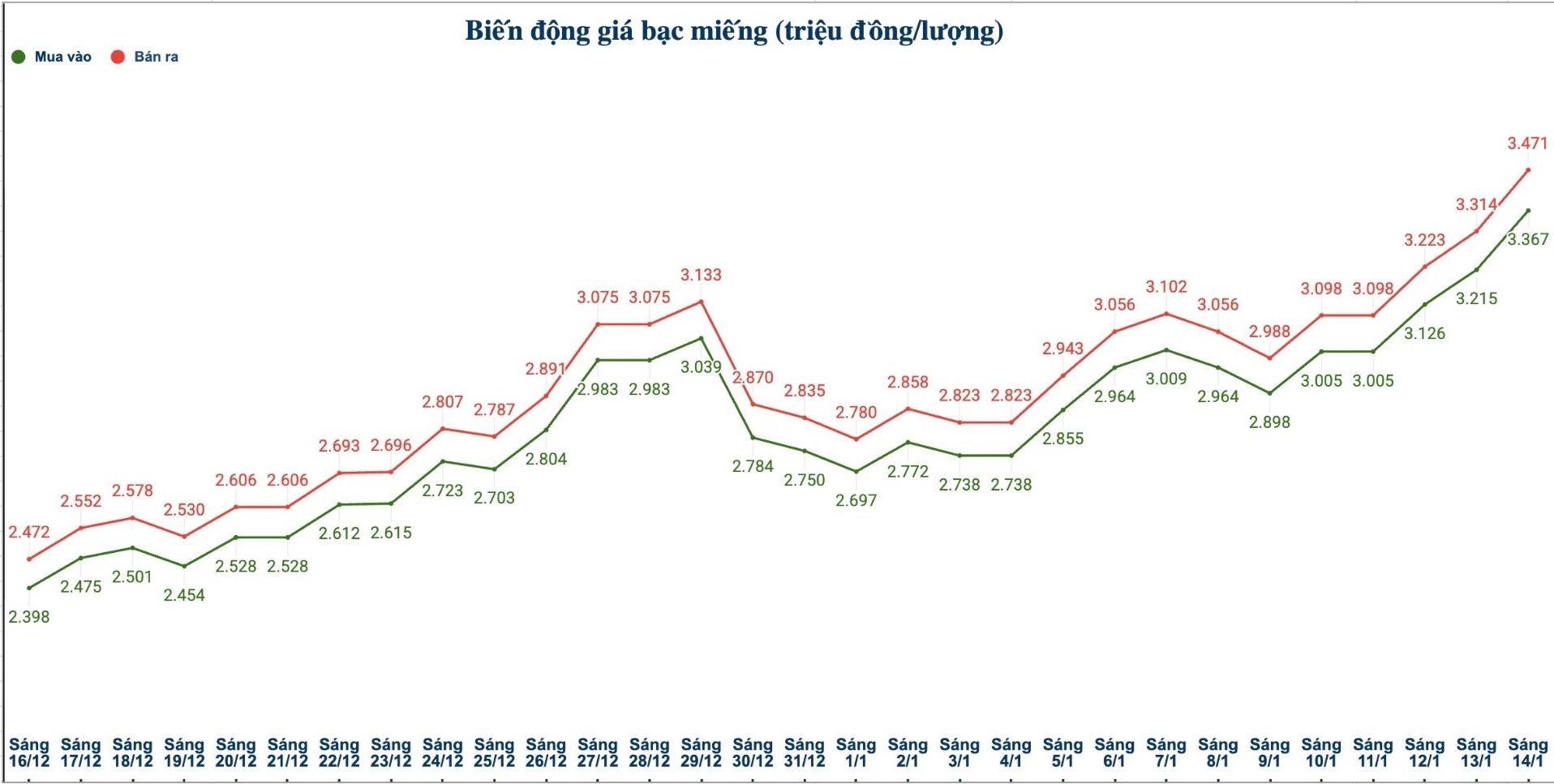

Domestic silver prices

As of 9:15 am on January 14, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) was listed at the threshold of 3.390 - 3.474 million VND/tael (buying - selling); an increase of 165,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.367 - 3.471 million VND/tael (buying - selling); an increase of 152,000 VND/tael on the buying side and an increase of 157,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 89.786 - 92.559 million VND/kg (buying - selling); an increase of 4.053 million VND/kg on the buying side and an increase of 4.186 million VND/kg on the selling side compared to yesterday morning.

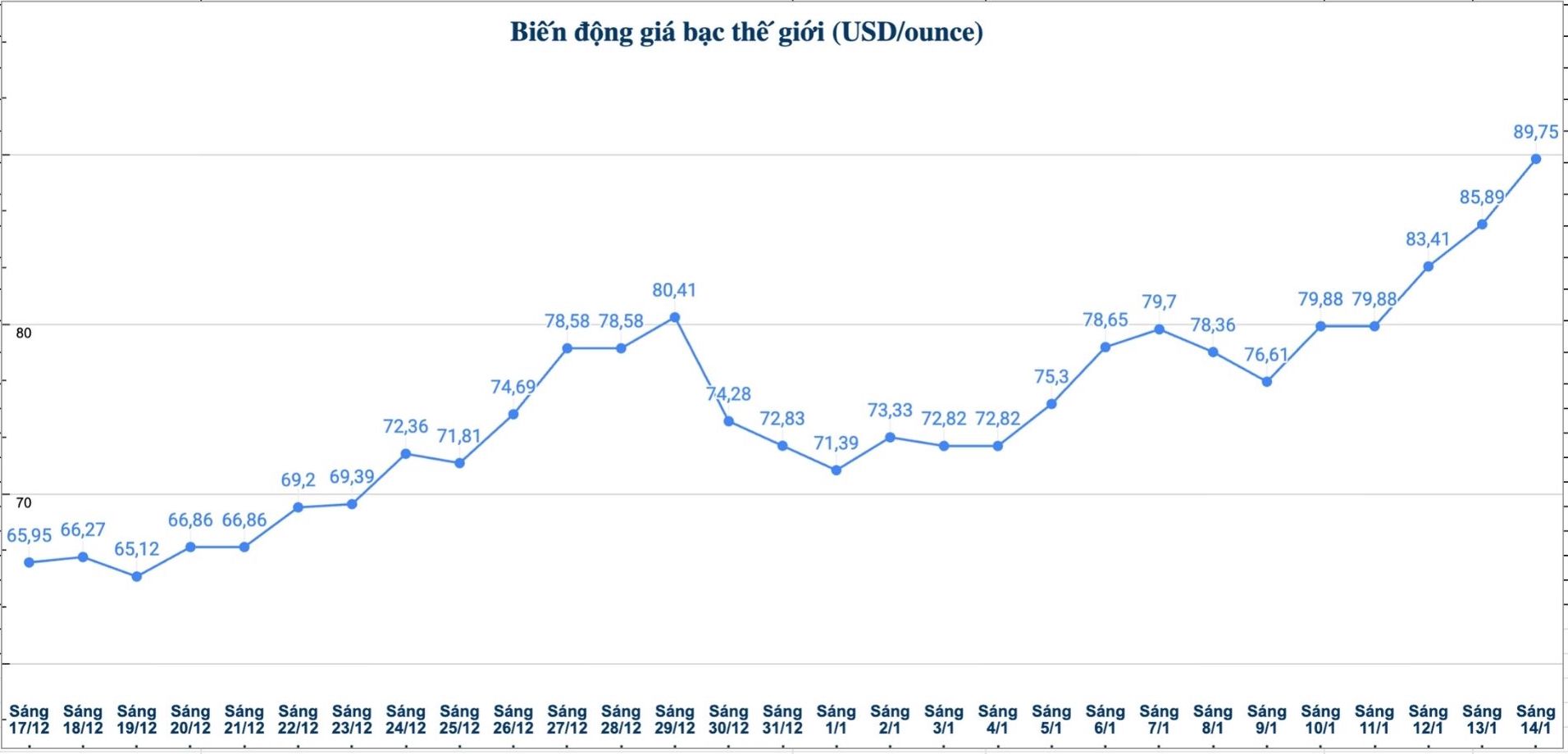

World silver prices

On the world market, as of 9:20 am on January 14 (Vietnam time), the world silver price was listed at 89.75 USD/ounce; up 3.86 USD compared to yesterday morning.

Causes and forecasts

The silver market continued to increase sharply in the mid-week trading session. Gold metal analyst James Hyerczyk at FX Empire said that investors are specifically monitoring the Producer Price Index (PPI) expected to be released on Thursday, to assess the monetary policy outlook of the US Federal Reserve (Fed).

In that context, Mr. James Hyerczyk said that precious metal traders, including silver and gold, should still maintain positive prospects, unless actual inflation increases significantly higher than current forecasts.

Referring to the silver price outlook in the coming time, in a report released on Monday, Mr. Nick Cawley - market analyst at Solomon Global - said that gold and silver prices are on track to conquer important psychological milestones in the first half of 2026. According to him, silver prices are completely likely to reach 100 USD/ounce.

Mr. Cawley said that the driving force for price increases this week mainly comes from the re-emergence of geopolitical chaos in the Middle East.

In a volatile context, as investors leave the USD, demand for safe-haven assets continues to increase" - Mr. Cawley said in a report on Monday.

According to him, the fact that gold and silver reach new price targets is only a matter of time, and any market correction should be seen as an opportunity to buy.

Meanwhile, as silver prices have surpassed the historical peak set last month, he believes there are almost no significant barriers to a 100 USD/ounce increase. However, he also warned investors to be cautious.

Anyone who trades silver must be aware that price fluctuations will become increasingly intense, with sessions fluctuating above 10% per day. The higher the silver price, the greater the level of fluctuation" - he warned.

See more news related to silver prices HERE...