Silver prices continued to increase after the US Federal Reserve (Fed) cut interest rates, in the context of high demand for this precious metal from the technology industry.

According to Mr. Yeow Hwee Chua (Nanyang University of Technology), when interest rates decrease, depositing money in banks or buying short-term bonds becomes less attractive. At that time, investors tend to shift cash flow to assets such as silver to preserve value.

"This makes the need to shift to assets considered a place to store value, including silver" - Mr. Hwee Chua commented.

The trend of searching for "safe hiding" assets is also the main reason why gold prices have continuously hit new peaks in recent times, surpassing the 4,000 USD/ounce mark for the first time.

Mr. Christopher Wong - an analyst at OCBC - said that the increase in silver is partly a spillover effect from gold, as investors seek lower-priced but still risk-off options.

"Since the beginning of the year, gold prices have increased by more than 50%, in the context of central banks stepping up buying. Other precious metals such as platinum and palladium also recorded significant increases," he said.

In addition to investment, Christopher Wong emphasized that silver prices are also strongly supported by real demand from the technology sector. "The demand for silver is currently far exceeding supply, thereby pushing the price of this metal to more than double this year, surpassing many other precious metals, including gold" - Christopher Wong emphasized.

Sharing the same view, Kosmas Marinakis from the University of Management Singapore said that silver is not only an investment asset but also an essential material for production.

"With outstanding electrical conductivity, silver is widely used in the production of electric vehicles and solar panels.

The sharp increase in electric vehicle sales in the coming time is expected to continue to increase demand for silver, while advanced batteries for cars increasingly need more of this metal," he said.

Kosmas Marinakis added that silver supply is unlikely to increase as quickly. Most of the global silver output is a by-product of lead, copper or gold mines, making the expansion of supply limited.

Kosmas Marinakis said that silver prices are also affected by concerns that the US may impose import tariffs on this commodity within the framework of President Donald Trump's trade policy. These concerns have fueled silver hoarding in the US, adding to shortages in many other regions.

"Gold prices are likely to remain high in the coming months, as industrial demand continues to increase in the context of un signs of improvement in supply" - Kosmas Marinakis commented.

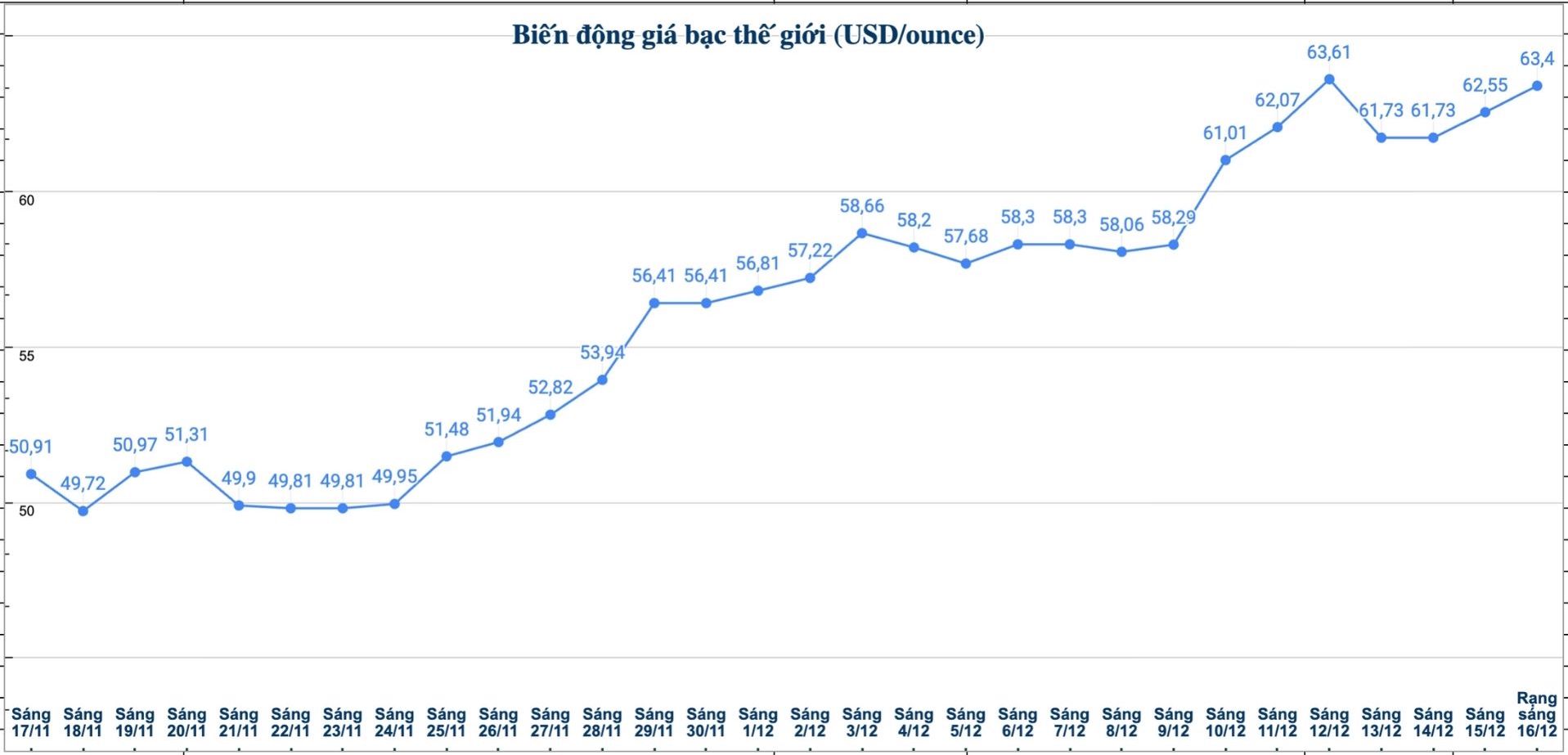

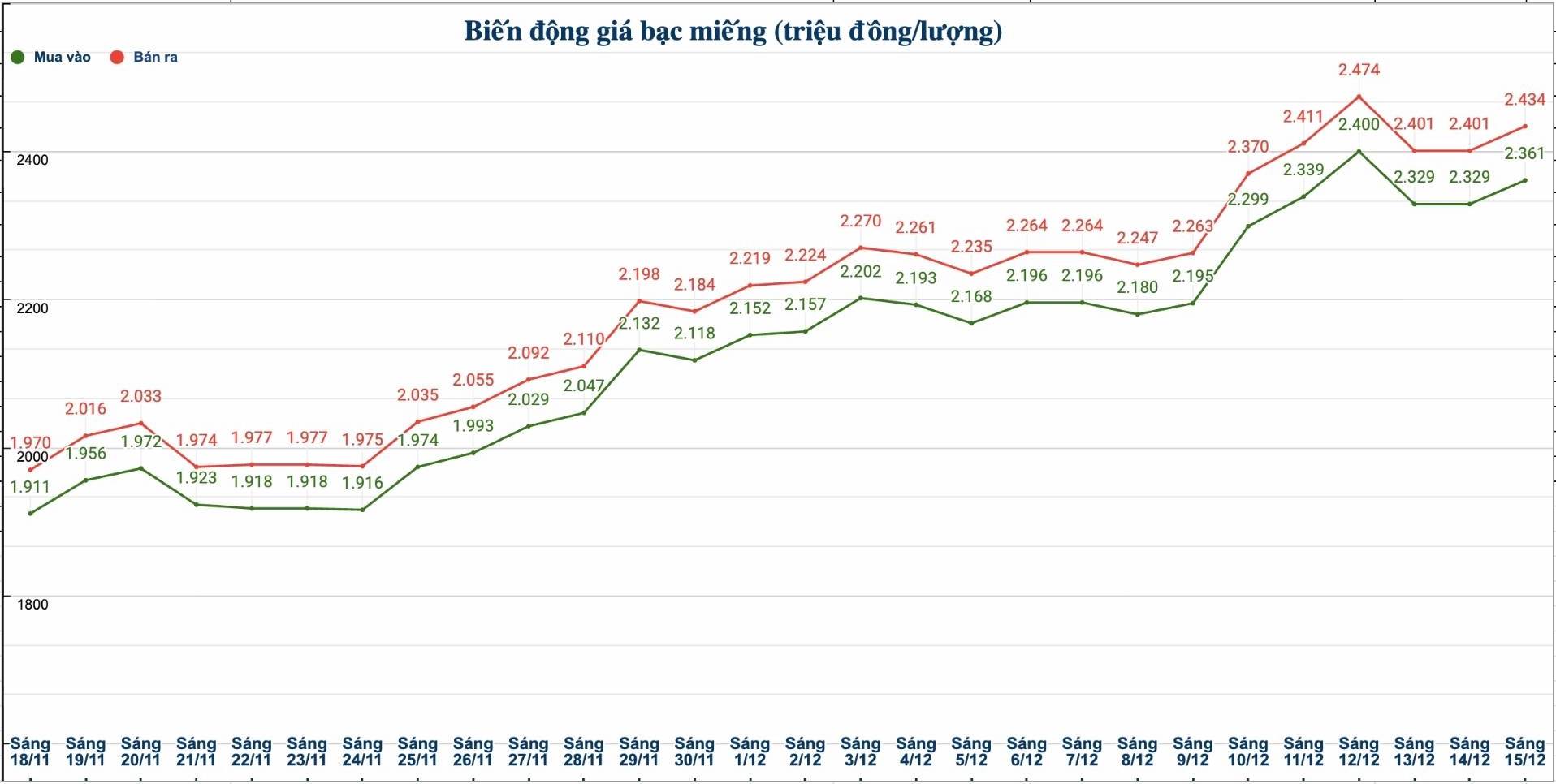

Updated silver price

As of 6:00 a.m. on December 16, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2,400 - 2.459 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 63.154 - 65.074 million VND/kg (buy - sell).

The price of 999 gold bars of the Golden Rooster Bank of Vietnam (Sacombank-SBJ) is listed at VND 2.382 - 2.439 million/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.398 - 2.472 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 63.946 - 65.919 million VND/kg (buy - sell).

See more news related to silver prices HERE...