Domestic silver price

As of 9:00 a.m. on April 20, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.247 - 1.286 million/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1.247 - 1.286 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

The price of 999 (1kilo) gold bars at Phu Quy Jewelry Group was listed at 33.253 - 34.293 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to early this morning.

In the trading session last week (morning of April 13, 2025), the price of 999 gold bars (1kilo) at Phu Quy Jewelry Group was listed at 32.853 - 33.866 million VND/kg (buy - sell).

Thus, if buying 999 silver bars at Phu Quy Jewelry Group on April 13 and selling them this morning (September 20), buyers will lose VND613,000/kg.

World silver price

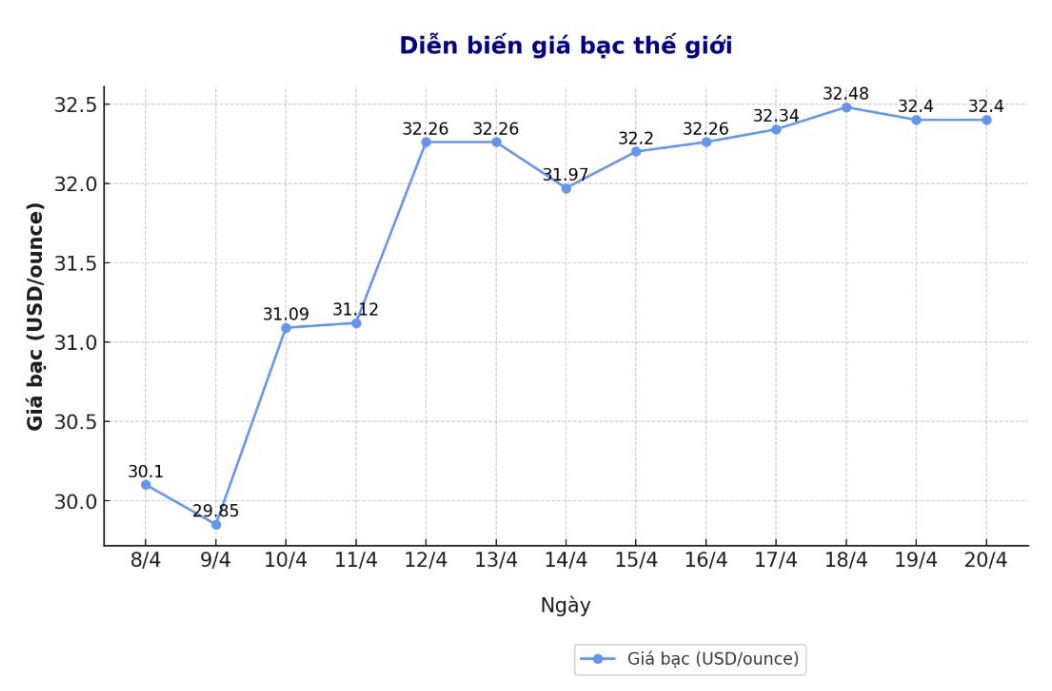

On the world market, as of 9:05 a.m. on April 20 (Vietnam time), the world silver price listed on Goldprice.org was at 32.4 USD/ounce.

Causes and predictions

According to James Hyerczyk - Market Analyst at FX Empire, silver is attracting attention as macro risks increase. Escalating US-China trade tensions and the growing discord between Donald Trump and Fed Chairman Jerome Powell are shaking confidence in both fiscal and monetary policy.

For traders, this creates a big opportunity for silver - an asset that tends to operate well in stressful conditions but is often overlooked against gold.

The gold- silver ratio remains high, trading much higher than the historical average of 70:1 to 85:1.

"This imbalance shows that silver could be more profitable than gold if normalization occurs. Traders who want to rebalance may find silver attractive at current levels, especially as confidence in central banks and inflation expectations are important issues," said James Hyerczyk.

According to him, the slowdown related to tariffs could affect industrial silver demand, especially in the electronics and solar energy sectors.

"However, the main offset measures, including tax exemptions for silver, are helping to protect the continuity of supply. For investment demand, as macro risks increase, the interest of organizations and individuals in silver also increases" - he assessed.

Economic data to watch next week:

Wednesday: Preliminary manufacturing and services PMI, new home sales in the US.

Thursday: Long-term goods orders, weekly jobless claims, US existing home sales.

See more news related to silver prices HERE...