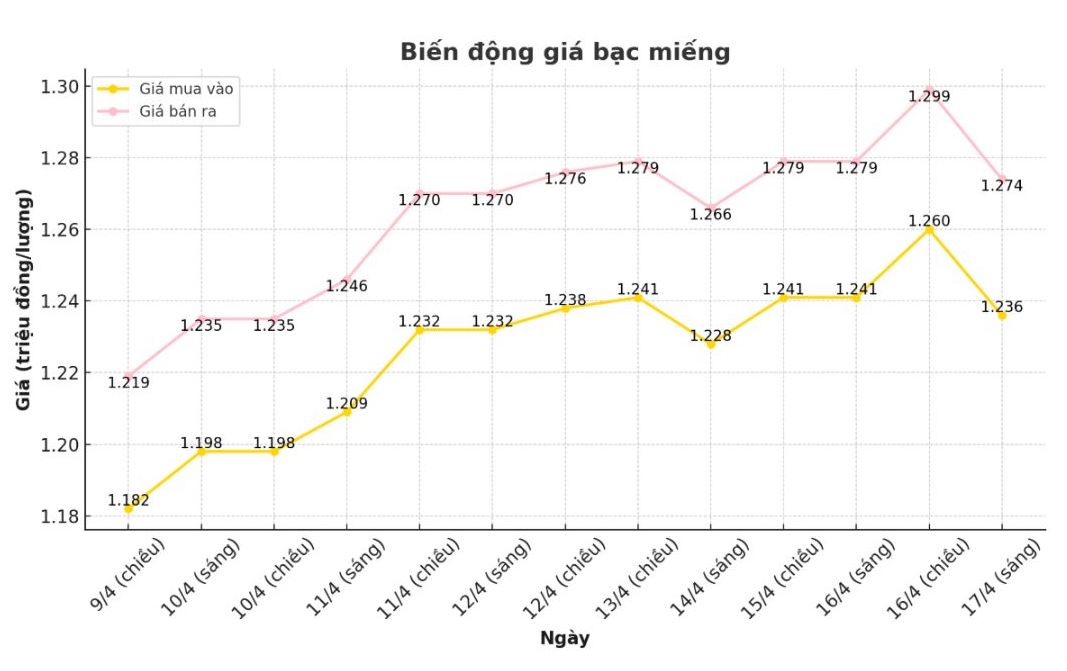

Domestic silver price

As of 9:15 a.m. on April 17, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.236 - 1.274 million VND/tael (buy - sell); down 5,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1.236 - 1.274 million VND/tael (buy - sell); down 5,000 VND/tael for both buying and selling compared to early this morning.

The price of 999 (1kilo) gold bars at Phu Quy Jewelry Group was listed at 32.959 - 33.973 million VND/kg (buy - sell); down 134,000 VND/kg for buying and down 133,000 VND/kg for selling compared to early this morning.

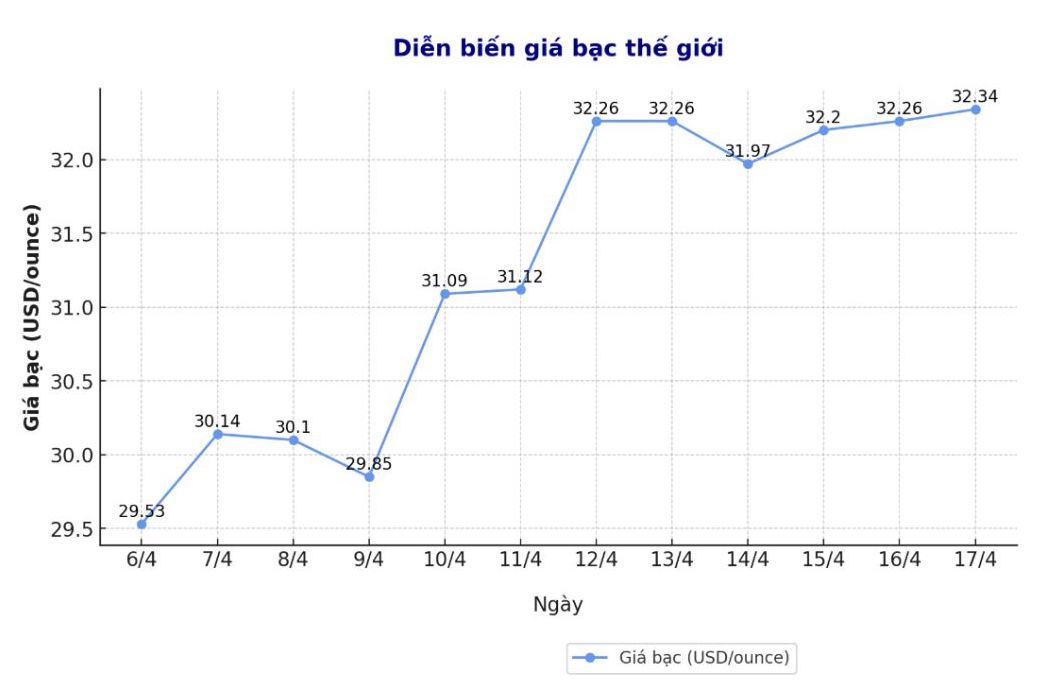

World silver price

On the world market, as of 9:20 a.m. on April 17 (Vietnam time), the world silver price listed on Goldprice.org was at 32.34 USD/ounce.

Causes and predictions

According to Kitco, despite economic and financial instability causing many investors to seek safe-haven assets, silver has not kept up with the increase in gold. However, silver will continue to have good prospects thanks to strong industrial demand surpassing the declining supply.

A report by Metals Focus on Wednesday showed that industrial demand for silver is expected to remain stable at around 677.4 million ounces this year. In particular, demand for electricity and electronics is expected to grow slightly by 1% this year as demand for use in the automobile industry, investment in the grid and consumer electronics overcomes the decline in the solar energy industry.

The report was released in the context of silver prices witnessing great fluctuations in the market and being less effective than gold due to concerns about the increasing global economy. The gold- silver ratio is fluctuating near its highest level in the past 5 years, over 100 points.

Silver has struggled in recent weeks as investors worry that industrial demand could be affected if the global economy falls into recession.

However, in an interview with Kitco News, Philip Newman - CEO at Metals Focus - said that despite the market having gone through 5 consecutive years of supply shortages, supply and demand have not yet reached a balanced state.

We believe that the shortage will last for a few more years and this will be beneficial for silver prices, although there will be many fluctuations in the short term, he said.

Newman also said that the global trend towards electrification will continue to boost demand for silver.

"Cryber's strength is that there are many applications. Even when the economy is in recession, I do not think demand will decrease sharply. Of course, there are always risks, but the silver market is still highly flexible, he said.

Although silver increased more slowly than gold due to dependence on industry, Newman did not consider this a major barrier for investors. After two years of stagnation, Metals Focus forecasts that silver investment flows will increase by 70 tons this year, equivalent to an increase of 14% compared to last year.

He added: When the economy is unstable, the need for safe havens will return, silver is an option in the precious metals market.

See more news related to silver prices HERE...