Positive outlook for silver prices

According to Kitco, despite economic and financial instability causing many investors to seek safe-haven assets, silver has not kept up with the increase in gold. However, silver will continue to have good prospects thanks to strong industrial demand surpassing the declining supply.

The Silver Institute published the 2025 Silver Survey on April 16, a survey predicted that the precious metal would record its fifth consecutive year of deficit, although the shortage was at its lowest level in four years.

Meanwhile, according to a report by Metals Focus, silver is expected to be short of 117 million ounces due to slightly reduced demand to 1.148 billion ounces; although total supply increased by 1.5% due to increased mining output.

In addition, industrial demand for silver is forecast to remain stable at around 677.4 million ounces in 2025.

The report was released in the context of silver witnessing strong fluctuations in the market and being less effective than gold due to concerns about the increasing global economy. Currently, the gold- silver ratio is fluctuating near its highest level in 5 years, above 100 points.

Silver has struggled in recent weeks as investors worry that industrial demand could be affected if the global economy falls into recession.

However, Mr. Philip Newman - CEO at Metals Focus - said that despite 5 years of supply deficits, the silver market has not yet come close to a state of balance between supply and demand.

We still believe that the deficit will continue in the next few years. This will benefit the silver price. Although there may be fluctuations in the short term, the long-term trend is still positive, he said.

Newman said that the main factor to change the imbalance between silver supply and demand is price. Although there is still a large amount of inventory in the world, the price needs to go well beyond the threshold of 35 USD/ounce, investors will think about bringing this amount of silver to the market.

In fact, the silver market has the advantage of diversity in demand. Even when the economy is in recession, I do not think that consumption will decrease sharply. Although there are still risks, silver is still a market with certain resilience" - Philip Newman commented.

Along with that, the increasingly strong electrification of the global economy also creates a positive push for silver prices. He added that economic uncertainty could fuel a wave of investment in silver as a safe-haven asset, like gold.

Although silver will face some challenges in 2025, the analysis team at Metals Focus still expects prices to be well supported.

We believe that silver prices are still likely to increase in the coming time. In a few months, silver prices could reach a new high, surpassing the highest level in 2024 and reach levels unprecedented in many years.

There will be times when silver catches up with the increase of gold - as investors turn to looking for new opportunities - after a long period of this metal being left behind" - the analysis team of Metals Focus assessed.

According to Metals Focus, the gold price may not reach a new peak in 2025, as current cash inventories are still sufficient and demand for shelter is still leaning towards gold - pushing gold prices to unprecedented areas.

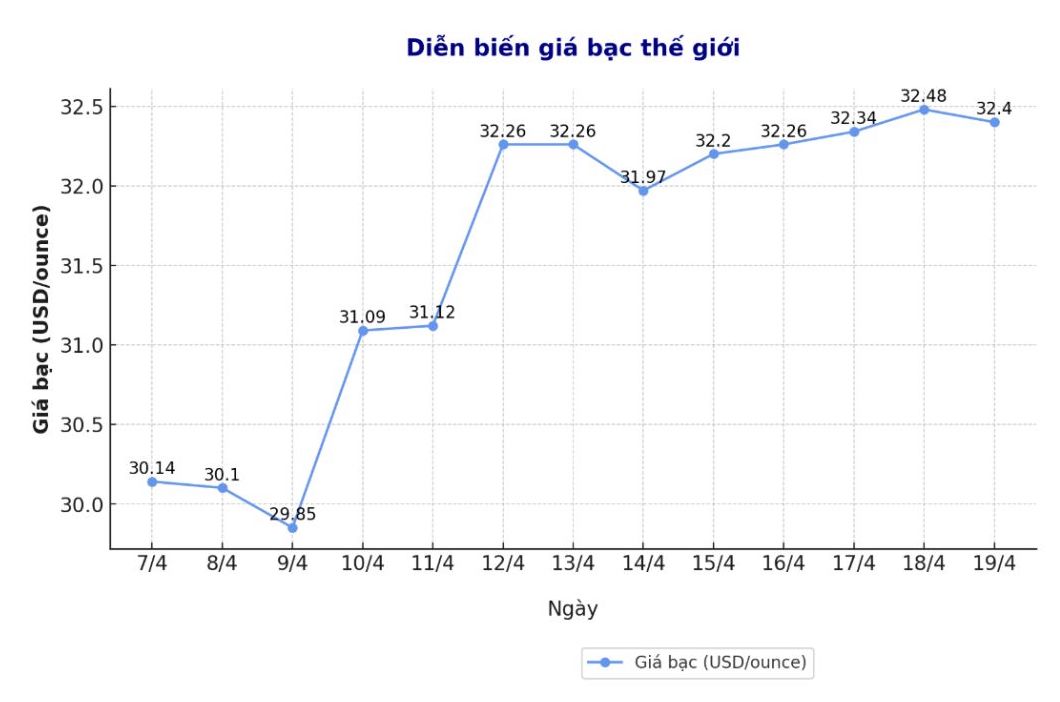

Updated silver price

As of 11:55 a.m. on April 19, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.247 - 1.286 million/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1.247 - 1.286 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

On the world market, as of 11:56 a.m. on April 19 (Vietnam time), the world silver price listed on Goldprice.org was at 32.4 USD/ounce.