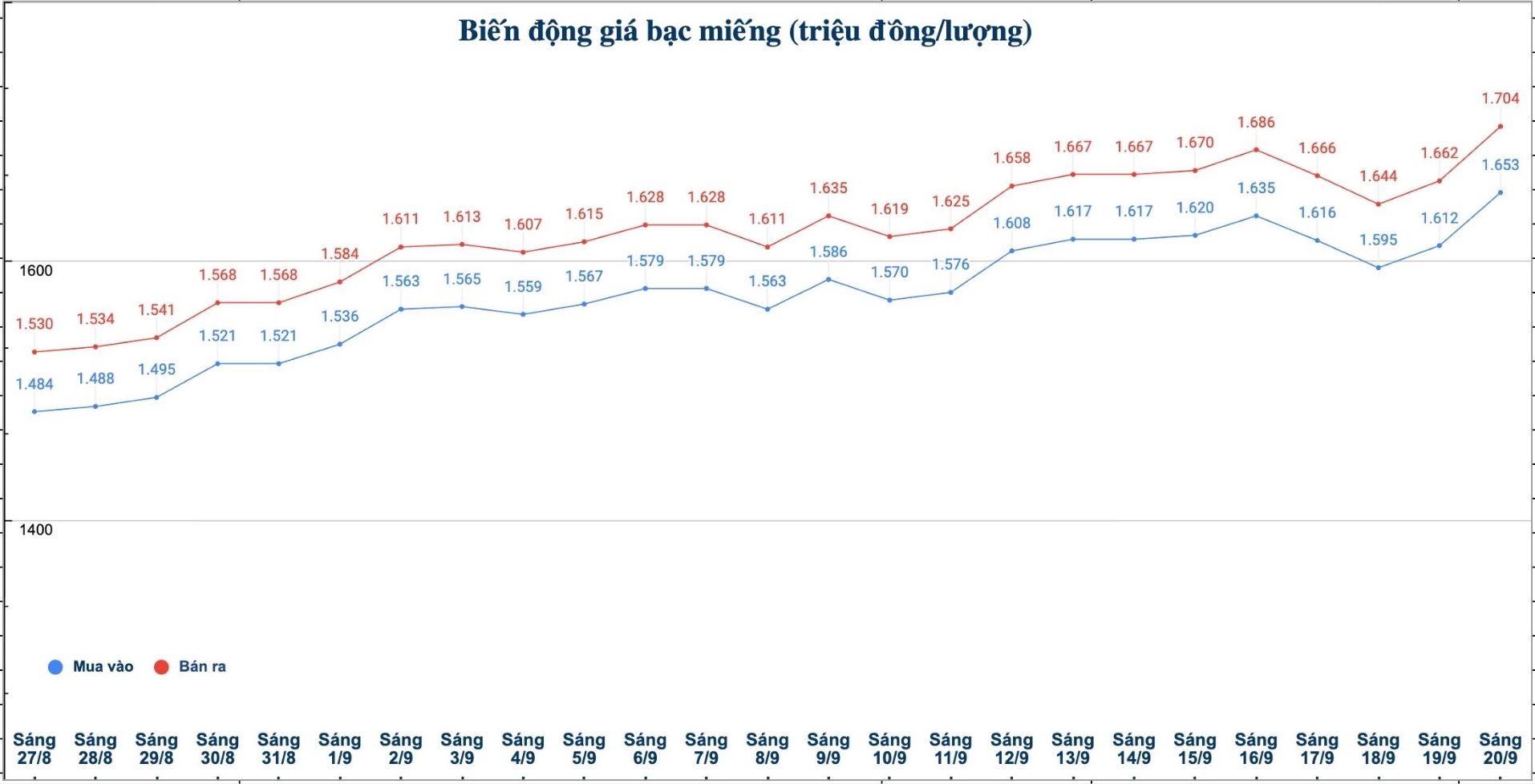

Domestic silver price

As of 9:35 a.m. on September 20, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND1.653 - VND1.704 million/tael (buy - sell); an increase of VND41,000/tael for buying and an increase of VND42,000/tael for selling compared to yesterday morning.

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.653 - 1.704 million VND/tael (buy - sell); an increase of 41,000 VND/tael for buying and an increase of 42,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars (1kg) at Phu Quy Jewelry Group was listed at 44,079 - 45.439 million VND/kg (buy - sell); an increase of 1.093 million VND/kg for buying and an increase of 1.120 million VND/kg for selling compared to yesterday morning.

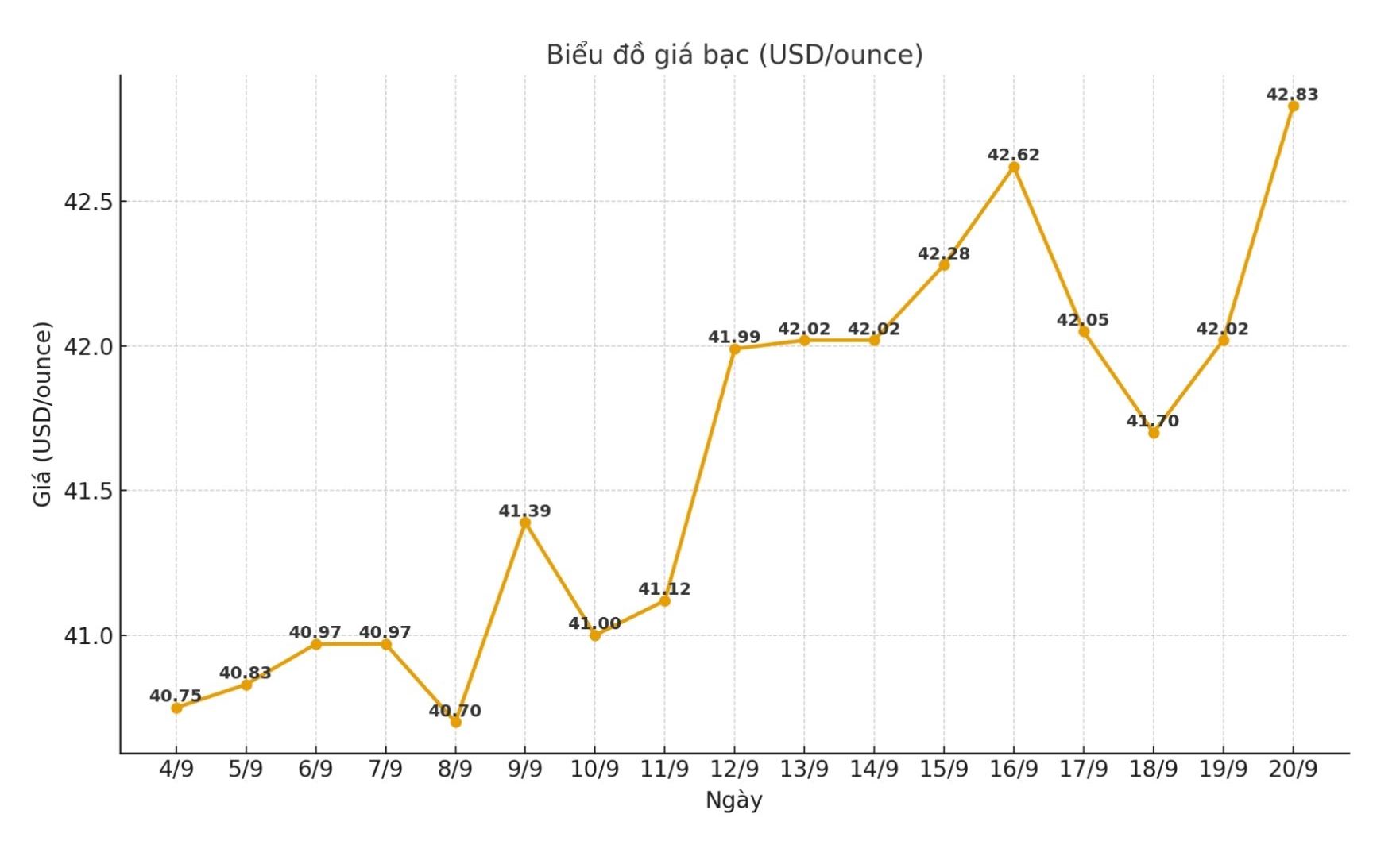

World silver price

On the world market, as of 9:35 a.m. on September 20 (Vietnam time), the world silver price was listed at 42.83 USD/ounce; up 0.81 USD compared to yesterday morning.

Causes and predictions

Silver prices maintained their upward momentum after the US Federal Reserve (FED) began a monetary easing cycle in the context of growing concerns about the US employment situation.

Earlier, on Wednesday, the Fed cut interest rates by 25 basis points to 4 - 4.25% and said it could continue to cut them by two more times in the remainder of the year.

According to FxStreet, the Fed's interest rate cuts often create favorable conditions for non-interest-bearing assets such as silver, because the opportunity cost of holding these precious metals decreases, thereby supporting silver prices to continue to increase.

In the long term, senior analyst Christopher Lewis believes that silver still has many factors supporting price increases, especially as demand for industrial production continues to be lacking.

"However, investors also need to be cautious because fluctuations in the US dollar could pose risks to this market," Christopher Lewis said.

See more news related to silver prices HERE...