Domestic silver price

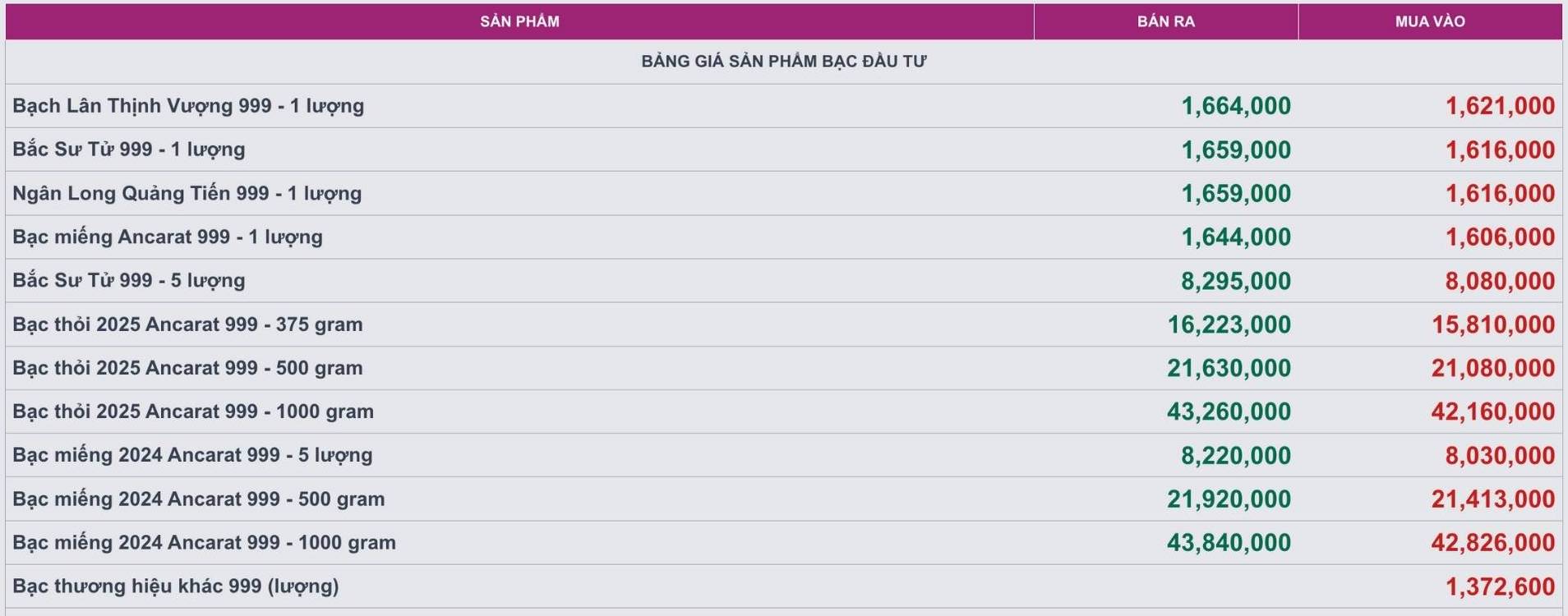

As of 9:40 a.m. on September 17, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at VND1.606 - 1.644 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 42.160 - 43.260 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 42.826 - 43.840 million VND/kg (buy - sell).

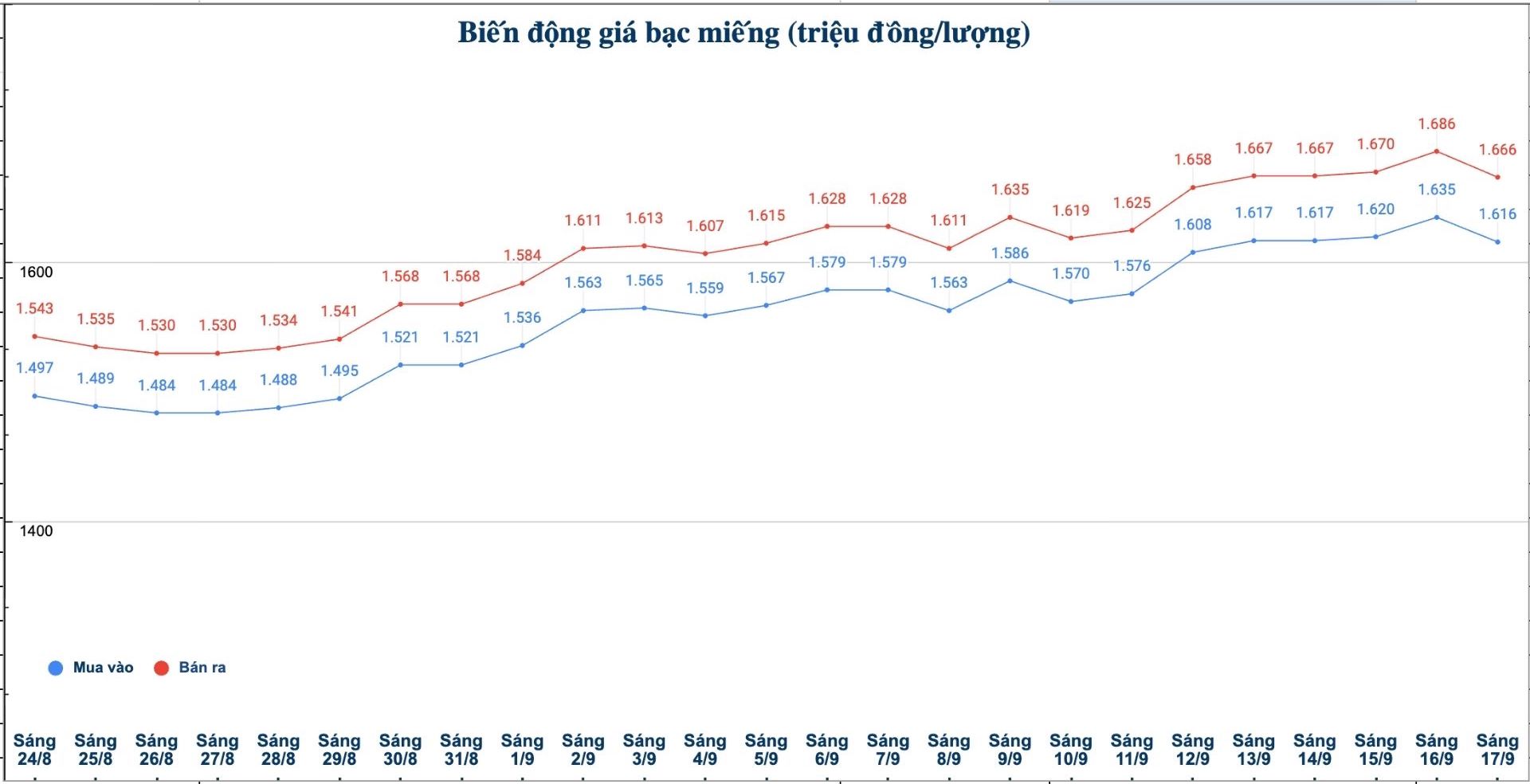

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.616 - 1.666 million VND/tael (buy - sell); down 19,000 VND/tael for buying and down 20,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.616 - 1.666 million VND/tael (buy - sell); down 19,000 VND/tael for buying and down 20,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 43,093 - 44,426 million VND/kg (buy - sell); down 506,000 VND/kg for buying and down 533,000 VND/kg for selling compared to yesterday morning.

World silver price

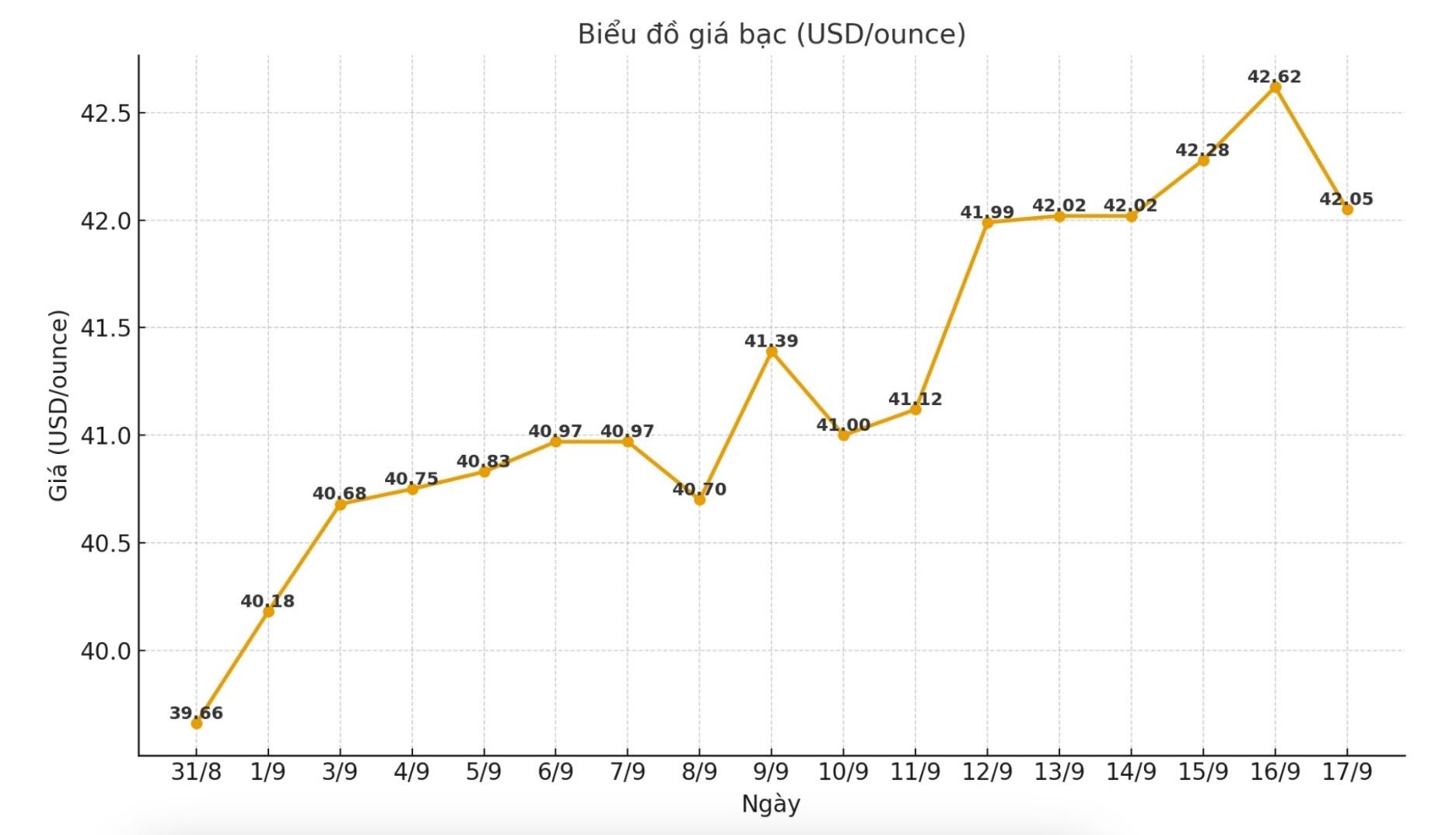

On the world market, as of 9:40 a.m. on September 17 (Vietnam time), the world silver price was listed at 42.05 USD/ounce; down 0.57 USD compared to yesterday morning.

Causes and predictions

The silver market is in a tight consolidation phase ahead of the US Federal Reserve's interest rate decision this week. According to analyst James Hyerczyk, traders are cautious, preparing for possible fluctuations depending on the upcoming monetary policy orientation.

James Hyerczyk said that the most recent silver support level is currently 41.59 USD/ounce, followed by 40.73 USD/ounce and 40.40 USD/ounce. In particular, 38.78 USD/ounce is considered an important milestone to maintain the long-term uptrend of this metal.

The expert added that this week, all eyes are on the Fed's decision. The majority predict the Fed will cut interest rates by 25 basis points, while the CME FedWatch tool shows a high chance of another easing by the end of the year.

"However, what investors are waiting for is not only the decision to cut, but also Chairman Jerome Powell's voice: whether the Fed will continue its easing trend or take a break to monitor more economic data" - James Hyerczyk said.

James Hyerczyk said that until Fed Chairman Jerome Powell announces the orientation, silver prices are likely to continue to fluctuate within a narrow range. If the Fed signals strongly, silver could retreat to $40.40/ounce. Conversely, if the tone is moderate, the metal could soon expand upward and head towards 44.22 USD/ounce.

See more news related to silver prices HERE...