Domestic silver price

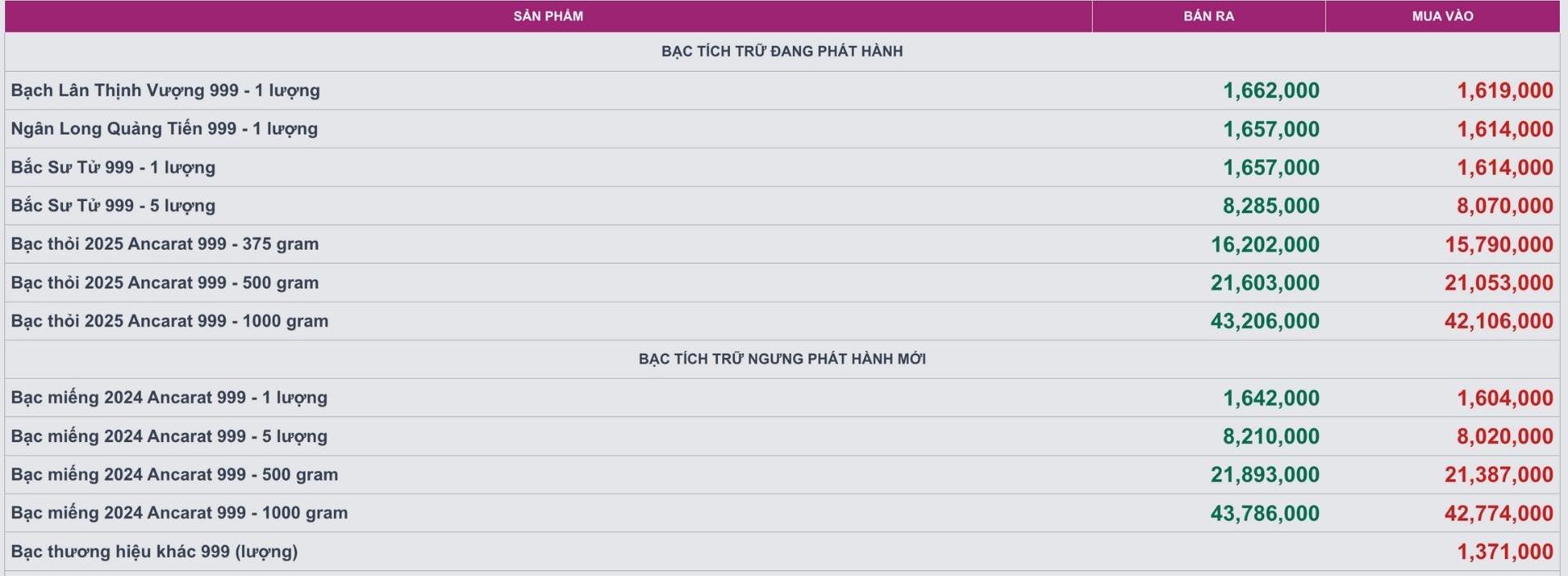

As of 10:35 a.m. on September 19, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 1.604 - 1.642 million/tael (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 42.774 - 43.786 million VND/kg (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 42.106 - 43.206 million VND/kg (buy - sell).

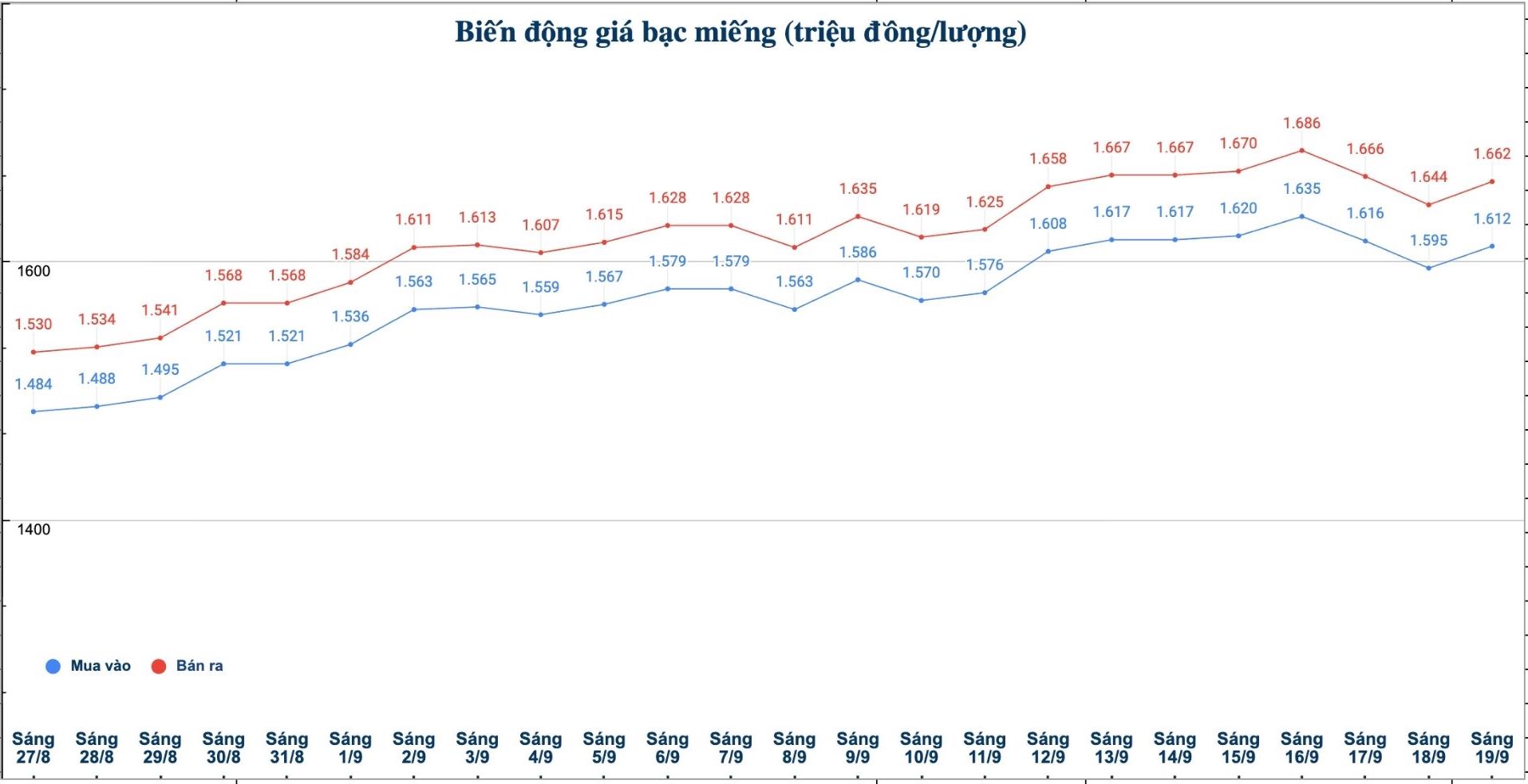

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.612 - 1.662 million VND/tael (buy - sell); an increase of 17,000 VND/tael for buying and an increase of 18,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.612 - 1.662 million VND/tael (buy - sell); an increase of 17,000 VND/tael for buying and an increase of 18,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 42.986 - 44.319 million VND/kg (buy - sell); an increase of 453,000 VND/kg for buying and an increase of 480,000 VND/kg for selling compared to yesterday morning.

World silver price

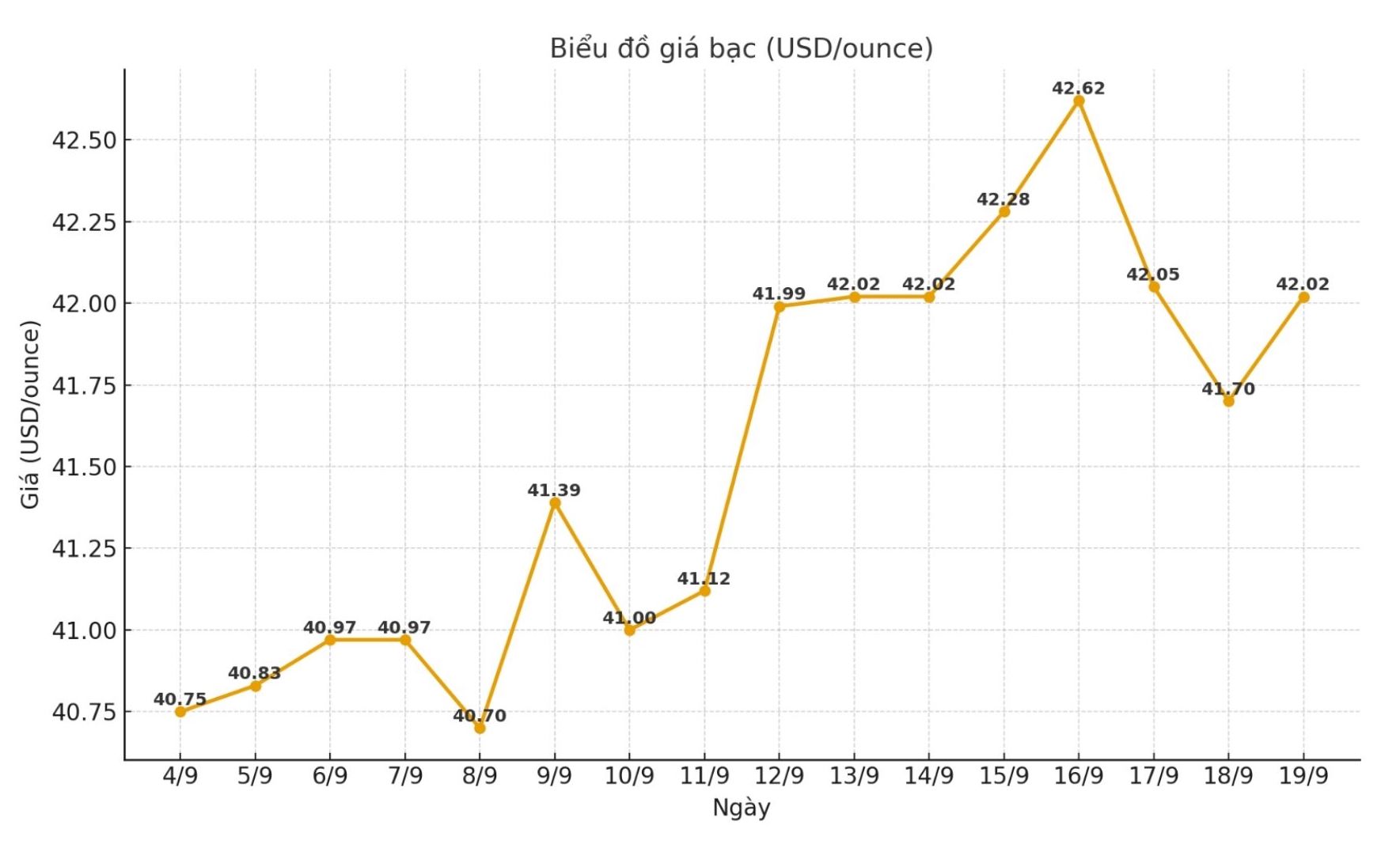

On the world market, as of 10:38 a.m. on September 19 (Vietnam time), the world silver price was listed at 42.02 USD/ounce; up 0.32 USD compared to yesterday morning.

Causes and predictions

The silver market is consolidating after the US Federal Reserve's 0.25 percentage point interest rate cut.

According to analyst James Hyerczyk, the trend is still considered positive if the main support zones are maintained and macro factors continue to be favorable. The Fed has cut interest rates to 4.00 - 4.25% as expected, but Chairman Jerome Powell said that upcoming decisions will be considered at each meeting.

"Despite caution, the CME FedWatch tool still shows a 90% chance of the Fed cutting another 25 basis points in October. The overall easing of monetary policy is a supporting factor for non-yielding precious metals such as silver," said James Hyerczyk.

The expert added that a weak US dollar and falling yields make silver more attractive as holding costs decrease.

"Investors can buy if prices break out clearly to above 42.97 USD/ounce, or wait for prices to adjust to the 39.96 - 39.59 USD/ounce range to accumulate. The 39.11 USD/ounce threshold will be an important support level; as long as the price remains at this level, the general trend will still tend to increase" - the expert gave his opinion.

James Hyerczyk assessed that with the Fed's dovish policy and the pressure of the USD decreasing along with yields, silver is likely to retest the 42.97 USD/ounce zone.

See more news related to silver prices HERE...