Domestic silver price

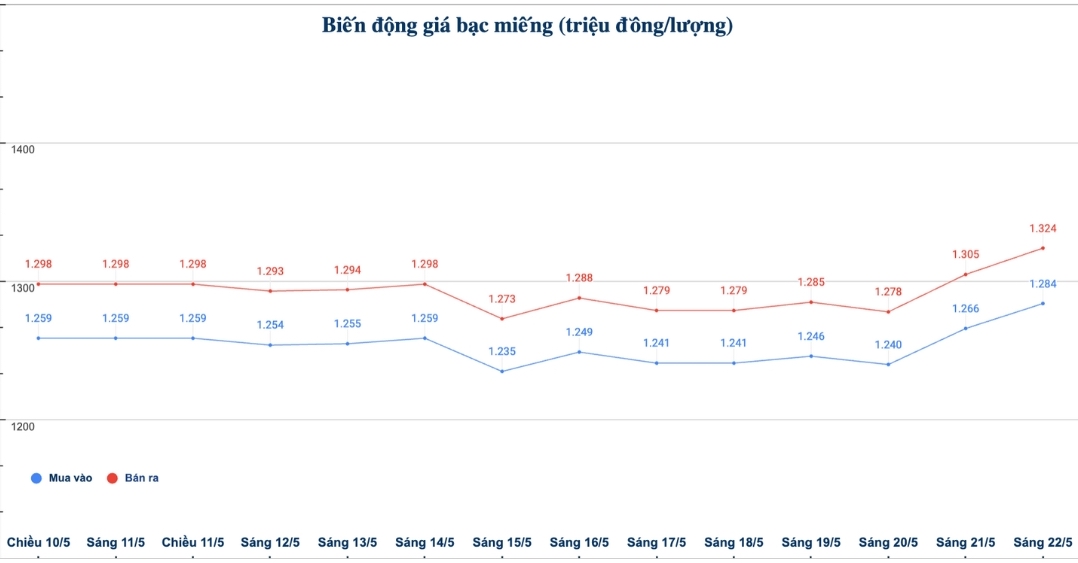

As of 9:15 a.m. on May 22, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.284 - 1.324 million/tael (buy - sell); an increase of VND18,000/tael for buying and an increase of VND19,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at VND 1.284 - 1.324 million/tael (buy - sell); an increase of VND 18,000/tael for buying and an increase of VND 19,000/tael for selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at VND34.239 - 35.306 million/kg (buy - sell); an increase of VND480,000/kg for buying and an increase of VND507,000/kg for selling compared to early this morning.

World silver price

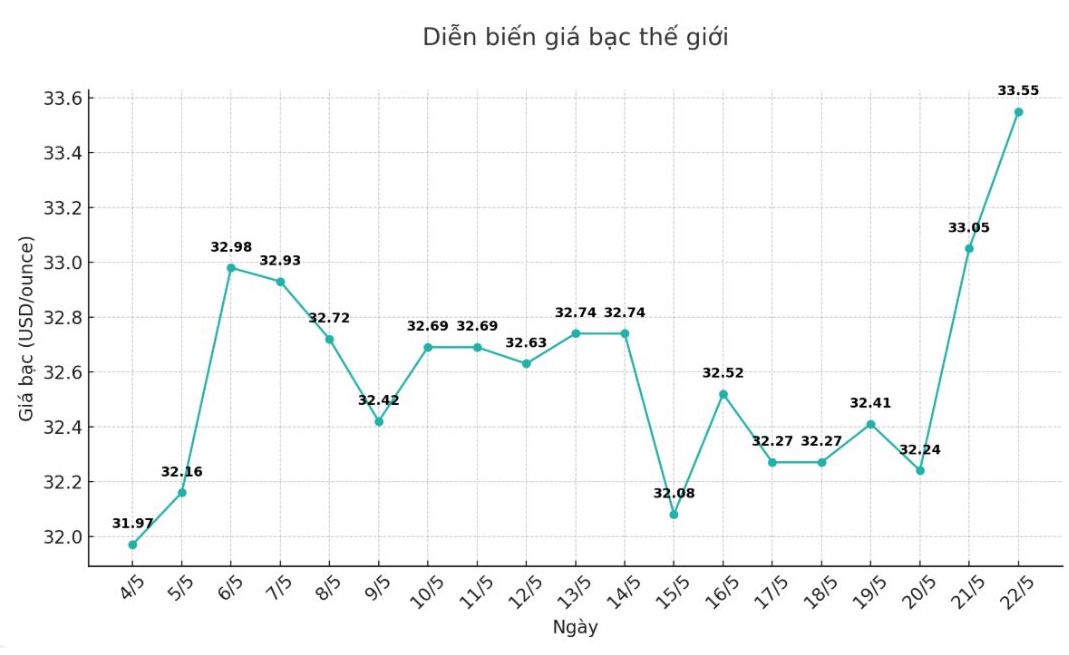

On the world market, as of 9:20 a.m. on May 22 (Vietnam time), the world silver price listed on Goldprice.org was at 33.55 USD/ounce; an increase of 0.5 USD compared to early this morning.

Causes and predictions

According to FX Empire, silver prices are trying to maintain their upward momentum thanks to support from the weakening of the USD and financial concerns from Washington (USA).

James Hyerczyk - market analyst at FX Empire - commented: "As silver prices hold on to the 50-day average, the market trend is leaning up.

Traders are paying attention to resistance levels at 33.25 USD/ounce and 33.70 USD/ounce. If it breaks through these levels, silver prices could move into a higher target range of $24.59/ounce to $24.87/ounce.

He said that the decline of the US dollar has increased the attractiveness of USD-denominated assets such as silver to foreign buyers.

"Current traders are watching financial discussions between the US and Japan, especially as Finance Minister Scott Bessent is expected to meet with his Japanese counterpart.

Any signal that weakens the US dollar could boost silver prices, especially as gold - the market leader - is approaching a breakout level," said James Hyerczyk.

See more news related to silver prices HERE...