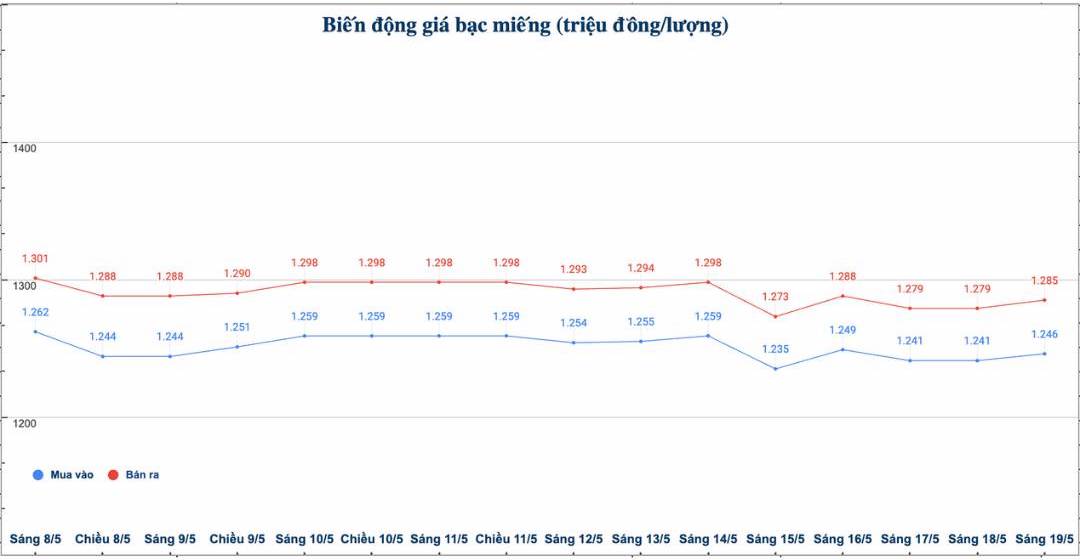

Domestic silver price

As of 9:10 a.m. on May 19, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.246 - VND1.285 million/tael (buy - sell); an increase of VND5,000/tael for buying and an increase of VND6,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.246 - 1.285 million VND/tael (buy - sell); increased by 5,000 VND/tael for buying and increased by 6,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 33.226 - 34.266 million VND/kg (buy - sell); an increase of 133,000 VND/kg for buying and an increase of 160,000 VND/kg for selling compared to early this morning.

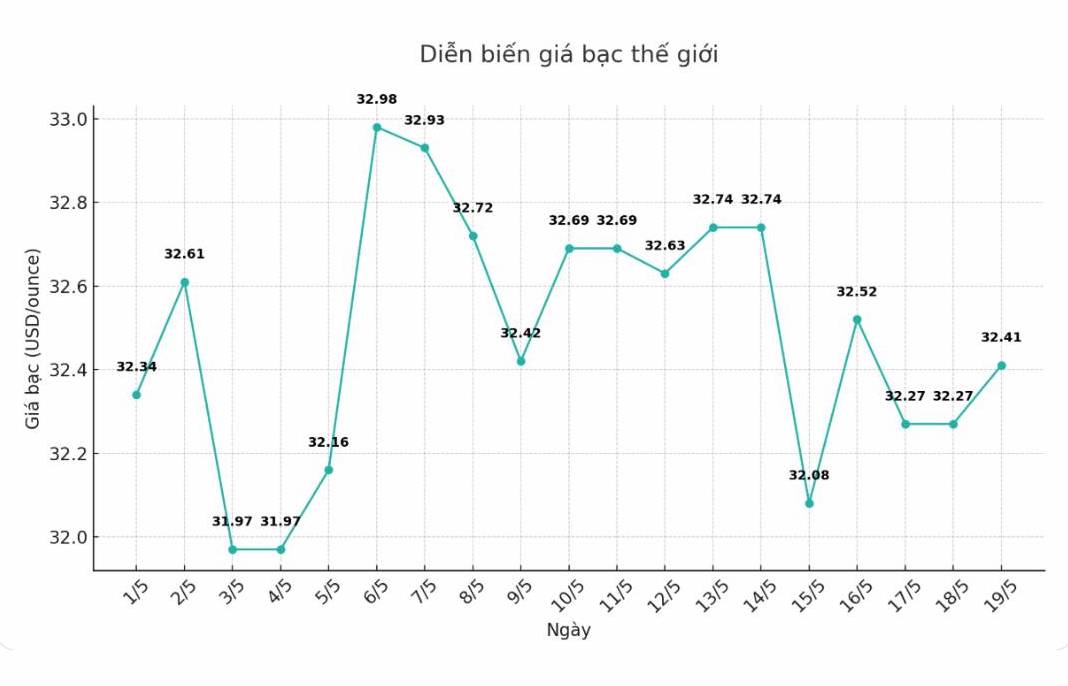

World silver price

On the world market, as of 9:10 a.m. on May 19 (Vietnam time), the world silver price listed on Goldprice.org was at 32.41 USD/ounce.

Causes and predictions

Silver prices recovered slightly this morning. However, James Hyerczyk - market analyst at FX Empire - commented that silver is still weakening in parallel with gold, in the context of the precious metal under pressure to make a profit after reaching a record high in April.

"Although the gold- silver ratio has begun to correct, silver is still weighed down by macro factors and market sentiment is gradually becoming more disadvantaged for the precious metal group," he said.

James Hyerczyk said that the stronger US dollar continues to be a major factor in the decline of silver prices. As the greenback enters its fourth consecutive week of price increases, the attractiveness of USD-denominated assets such as silver has declined, especially in the context of improved risk-off sentiment globally.

"The temporary tariff ceasefire between the US and China has contributed to boosting the stock market and easing geopolitical concerns. As a result, demand for safe-haven assets such as silver and gold has declined significantly," he said.

The expert added that silver entered the new week with a downward trend, due to weak safe-haven demand and unclear expectations of the US Federal Reserve (FED) cutting interest rates.

"Unless upcoming data, including new inflation figures or the Fed's comments, changes policy outlook or weakens the US dollar, silver prices are likely to continue to be under pressure. Currently, the selling side is still taking the initiative" - James Hyerczyk said.

See more news related to silver prices HERE...