Domestic silver price

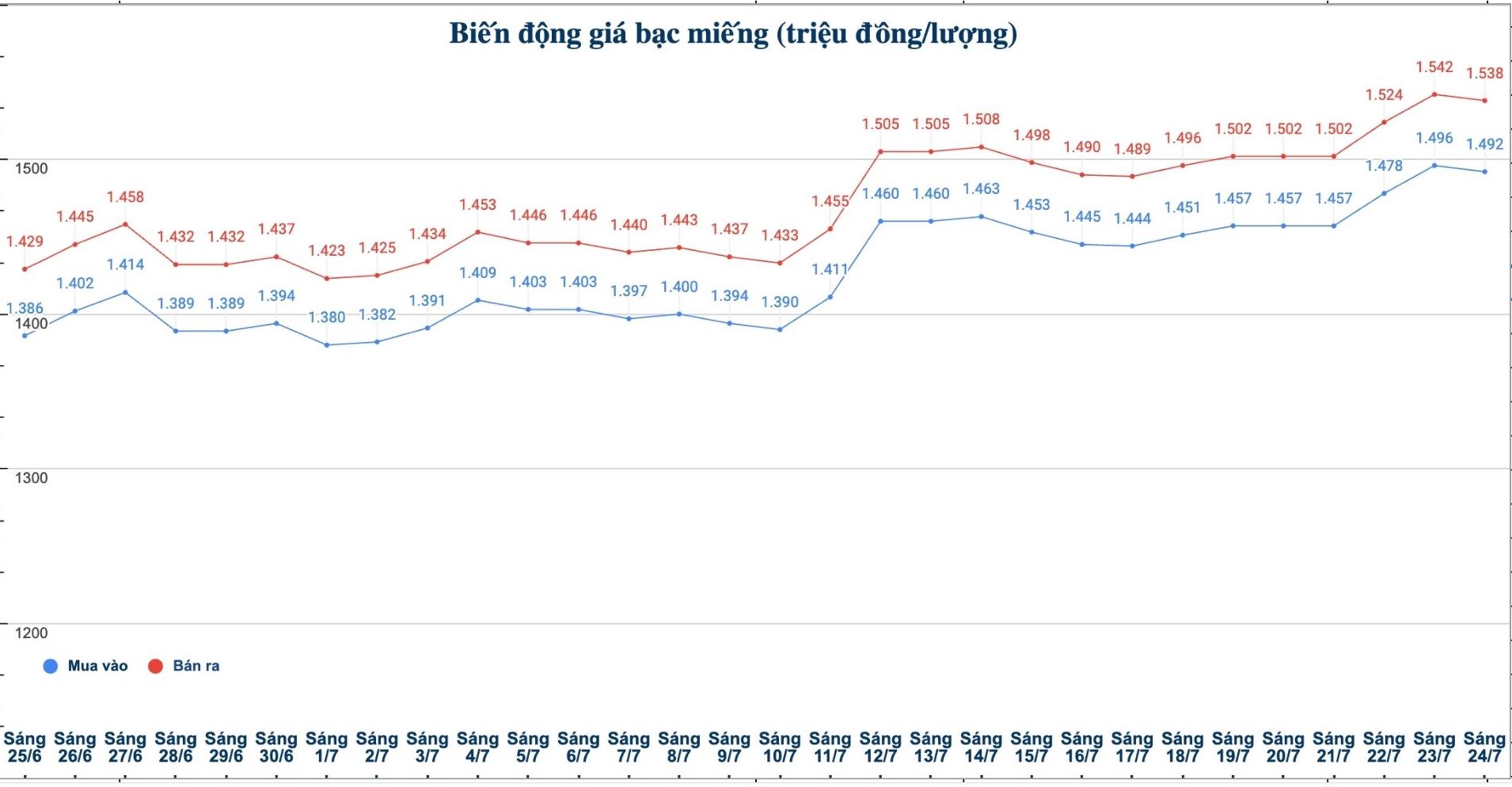

As of 9:28 a.m. on July 24, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.492 - 1.538 million/tael (buy - sell); down VND4,000/tael for buying and down VND6,000/tael for selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.492 - 1.538 million VND/tael (buy - sell); down 4,000 VND/tael for buying and down 6,000 VND/tael for selling compared to yesterday morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 39,786 - 41,013 million VND/kg (buy - sell); down 107,000 VND/kg for buying and down 106,000 VND/kg for selling compared to yesterday morning.

World silver price

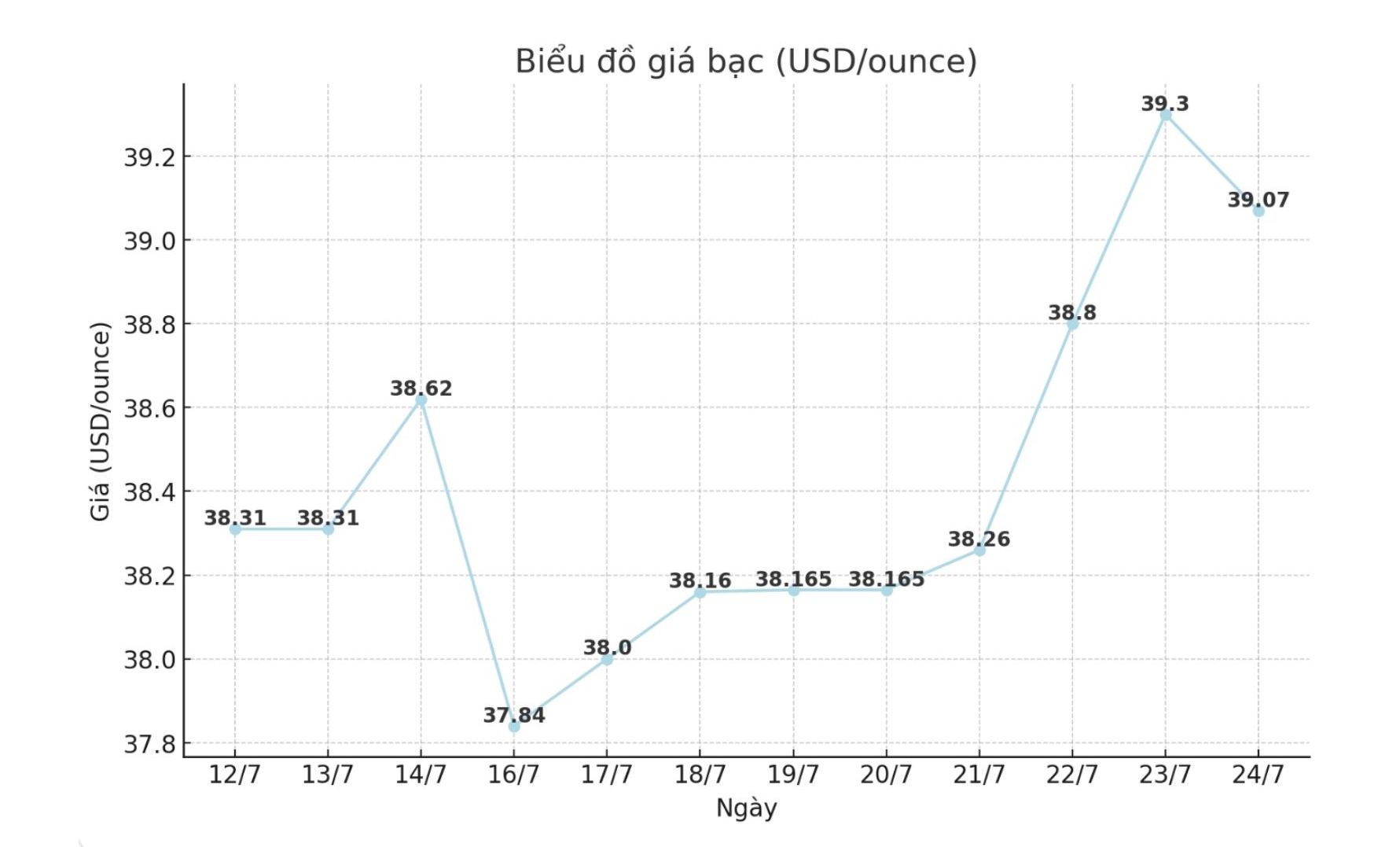

On the world market, as of 9:28 a.m. on July 24 (Vietnam time), the world silver price was listed at 39.07 USD/ounce; down 0.09 USD compared to yesterday morning.

Causes and predictions

Silver prices suddenly reversed and decreased. However, despite profit-taking activities causing the increase to stagnate below the $40 threshold, the technical trend of silver is still positively assessed.

Since the start of the year, silver has risen 36%, up from 31% for gold, said market analyst James Hyerczyk. The gold- silver price ratio has also narrowed from 105 to 87, showing that silver is increasingly favored by investors as a cheaper lever option, both rare and serviceable for industry".

The expert added that the increase in silver was further boosted after President Donald Trump announced that he would impose a 50% tax on imported copper from August 1.

"Although silver is not directly taxed, the market is concerned that the tax will disrupt the metal supply chain, especially in the US. This has caused the price of silver futures in the US to increase higher than the international price in London, causing the spot silver price to increase, contributing to strengthening investor optimism" - James Hyerczyk said.

In addition, instability from tariff policies also causes cash flow to seek silver as a replacement asset.

Meanwhile, rising industrial demand and a prolonged shortage of supply for the fifth year are the main factors supporting silver's increase.

"Investors are closely watching signs of tightening supply, especially rising insurance rates in Asia, which could accelerate silver. If gold is stable and the USD continues to weaken, silver is completely likely to reach the 42 USD/ounce mark in the coming time" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...