Domestic silver price

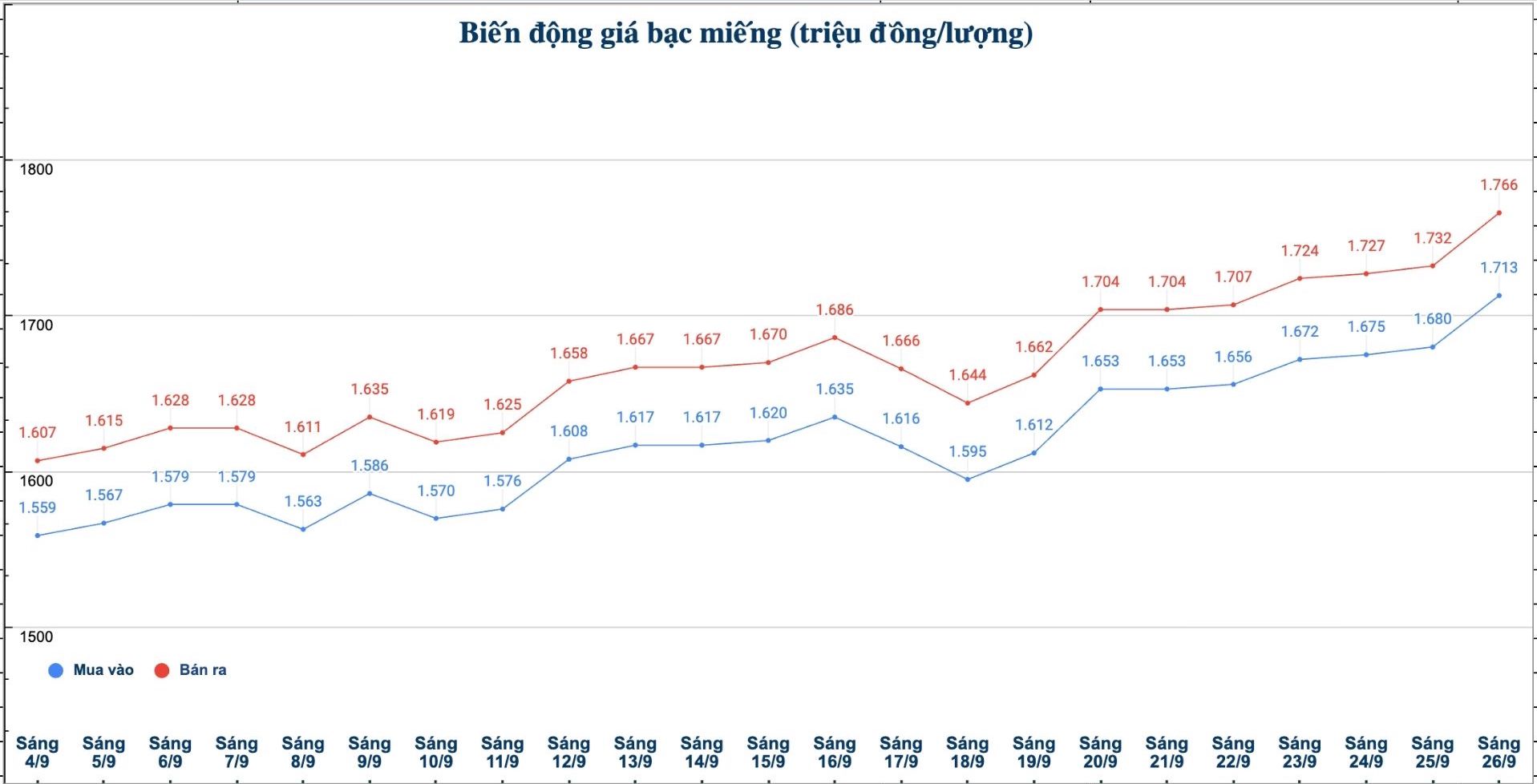

As of 10:10 on September 26, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.713 - 1.766 million VND/tael (buy - sell); an increase of 33,000 VND/tael for buying and an increase of 34,000 VND/tael for selling compared to yesterday morning (September 15).

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.713 - 1.766 million VND/tael (buy - sell); an increase of 33,000 VND/tael for buying and an increase of 34,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 45.679 - 47.093 million VND/kg (buy - sell); an increase of 880,000 VND/kg for buying and an increase of 907,000 VND/kg for selling compared to yesterday morning.

World silver price

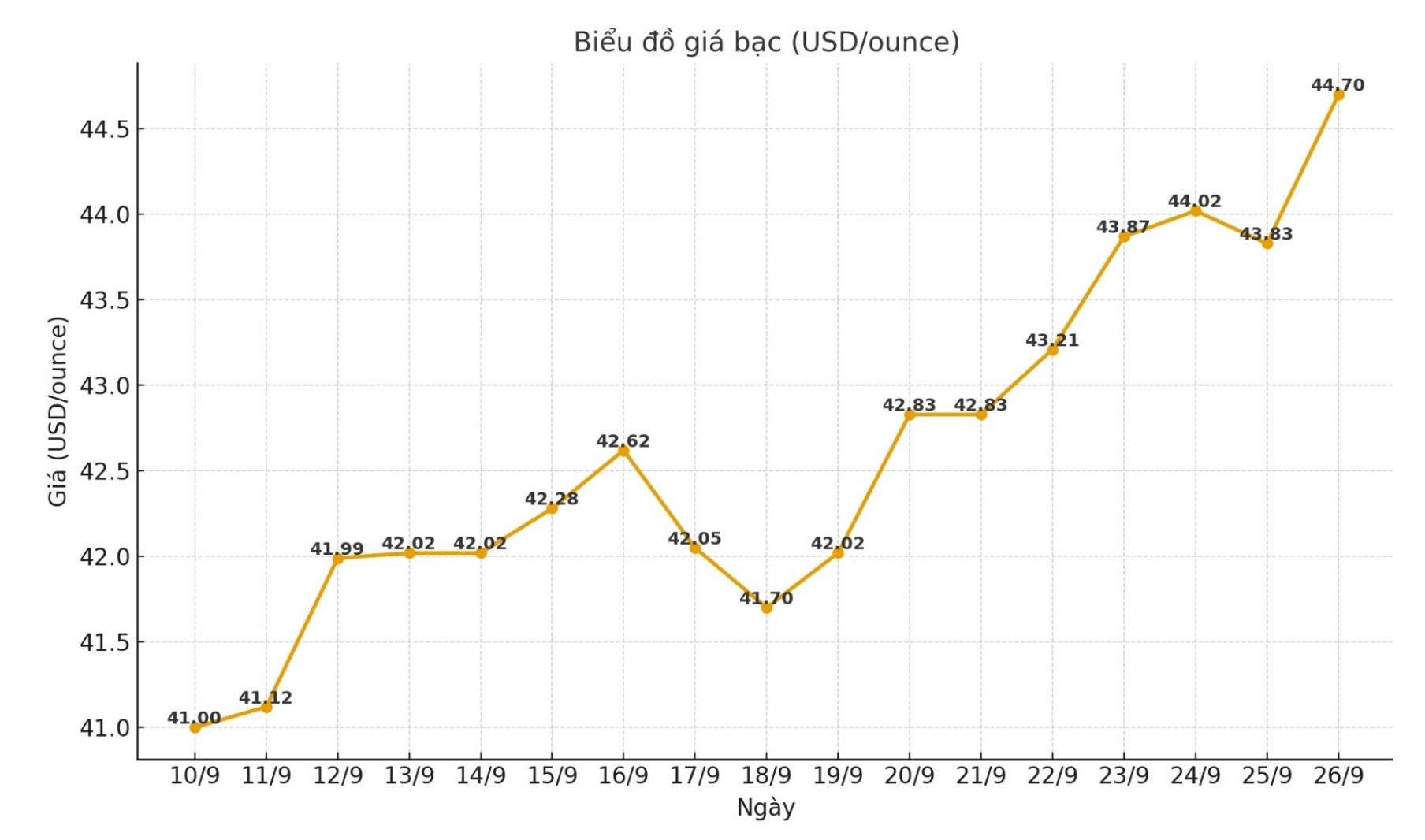

On the world market, as of 10:10 on September 26 (Vietnam time), the world silver price was listed at 44.70 USD/ounce; up 0.87 USD compared to yesterday morning.

Causes and predictions

The silver market broke out, maintaining its upward momentum despite the USD still moving sideways. According to senior analyst Christopher Lewis, this is a clear sign that silver's purchasing power does not depend on the weakness of the greenback.

He said that the $44/ounce zone has repeatedly proven its ability to hold prices and continue to be an important support level if there is a correction. Although he acknowledged that the correction could come sooner or later, Christopher Lewis stressed that the main trend for silver is still up.

Therefore, selling forge is not the choice of the majority of investors, unless the price drops below $40/ounce, which is considered a new bottom of the silver market.

Referring to the long-term outlook, he said the $42/ounce zone, which was once the peak of the "priced flag" model, continues to play a pivotal role in pullbacks. At the same time, chart analysis also shows that the V-shaped recovery model is gradually taking shape: each time prices decrease, it will create a new, stronger increase.

"This development reinforces expectations that the resilience of silver has not stopped, especially as cash flow seeks safe-haven assets amid fluctuations in the global economy," Christopher Lewis emphasized.

See more news related to silver prices HERE...