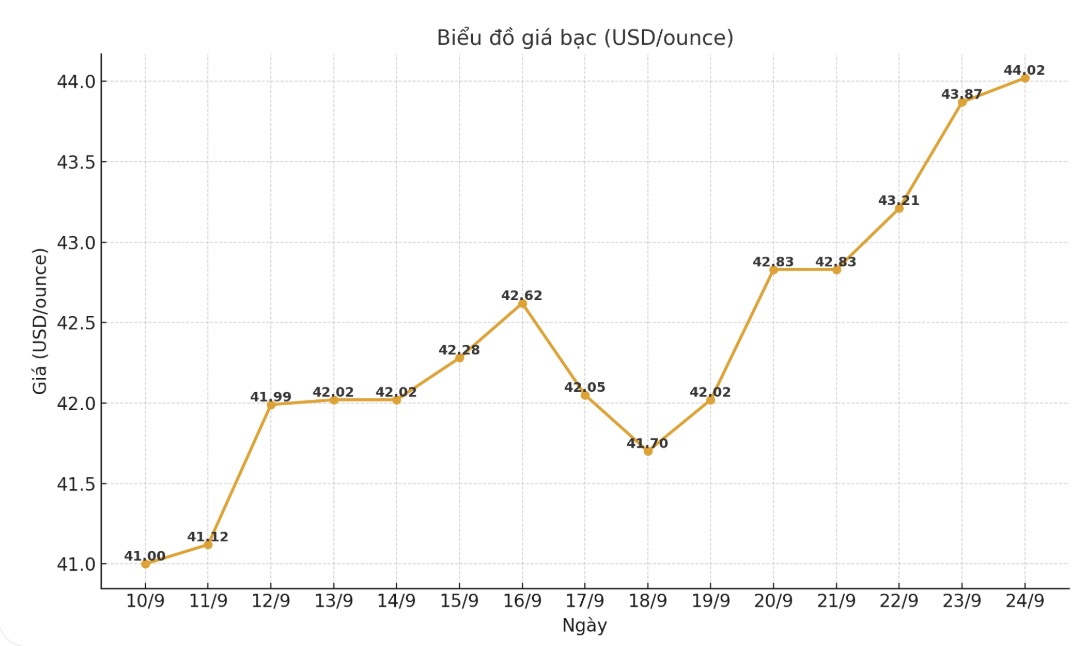

Silver prices have just hit a 14-year peak, surpassing $44/ounce. While many investors are focusing on the historical peak of $50/ounce, one expert said that this increase is only in the early stages and that silver still has room to increase in price.

In a recent interview, Mr. Shree Kargutkar - senior portfolio manager and silver expert at Sprott Asset Management said that another precious metal has paved the way for silver prices to rise.

In early 2016, palladium traded around 500 USD/ounce; by May 2021, the price had exceeded 3,000 USD/ounce. After several months of strong fluctuations, palladium peaked in March 2022 at $3,425/ounce.

According to Kargutkar, the fact that palladium has increased by nearly 600% in 6 years shows that the 52% increase in silver since the beginning of the year is still modest and may not be the end.

"The important thing to emphasize is the sustained increase in silver prices since the beginning of the year. In our opinion, this is just the beginning," he said.

Kar gutkar noted that palladium's nearly decade-long breakthrough was led by a significant supply-demand imbalance, and this is also a key factor in this year's silver price increase.

"In the period of 2012'2016, the demand for palladium increased continuously while the supply remained almost unchanged. However, prices have not reacted, because the market at that time had not yet recognized the imbalance between supply and demand, until 2016 when investors seemed to have "turned off the switch", when they suddenly realized that palladium was running low" - this expert said.

He said that although it is difficult to pinpoint the amount of silver still stored on the ground, the large deficit that has lasted for the past 5 years has begun to leave consequences, and that is the reason why the rising price of silver reflects this situation.

According to the fund management company, over the past 5 years, the supply deficit of silver has been around 800 million ounces. If the trend continues, this year alone the expected deficit is about 187 million ounces.

Kargutkar said he does not see any change in the market momentum anytime soon, as mining output cannot keep up with demand. He added that silver has become a material of vital significance to the global economy.

A typical area is the energy transition and the growing demand for solar power, where silver is a key metal in photovoltaic cells.

Solar energy has become an important choice, with lower costs than heavy fuel. It is difficult to say that sunlight can be used as a foundation load, but it is certainly a very good supplementary element in the overall energy structure" - he said.

Kargutkar added that much of the demand for green energy comes from emerging markets, with India emerging as a leader.

However, he emphasized that the biggest application of silver is still industrial consumption in the electricity - electronics sector.

If we go back 5-10 years ago, the investment expenditure (CapEx) of the majority of enterprises on the S&P 500 or NASDAQ was leaning towards technology; now, we are in a model where the technology is the entire CapEx. All of that makes me believe that the imbalance between supply and demand current demand is unlikely to be resolved soon - he commented.

Kargutkar also noted that even as inventories increase, the global economic decline will continue to create phase difference in the supply chain.

Update on domestic silver prices

As of 8:15 a.m. on September 24, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.687 - 1.725 million/tael (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 44,986 - 46 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 silver bars (500 grams) at Ancarat Jewelry Company is listed at 22.493 - 23 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.679 - 1.731 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 44.773 - 46.159 million VND/kg (buy - sell).