Domestic silver price

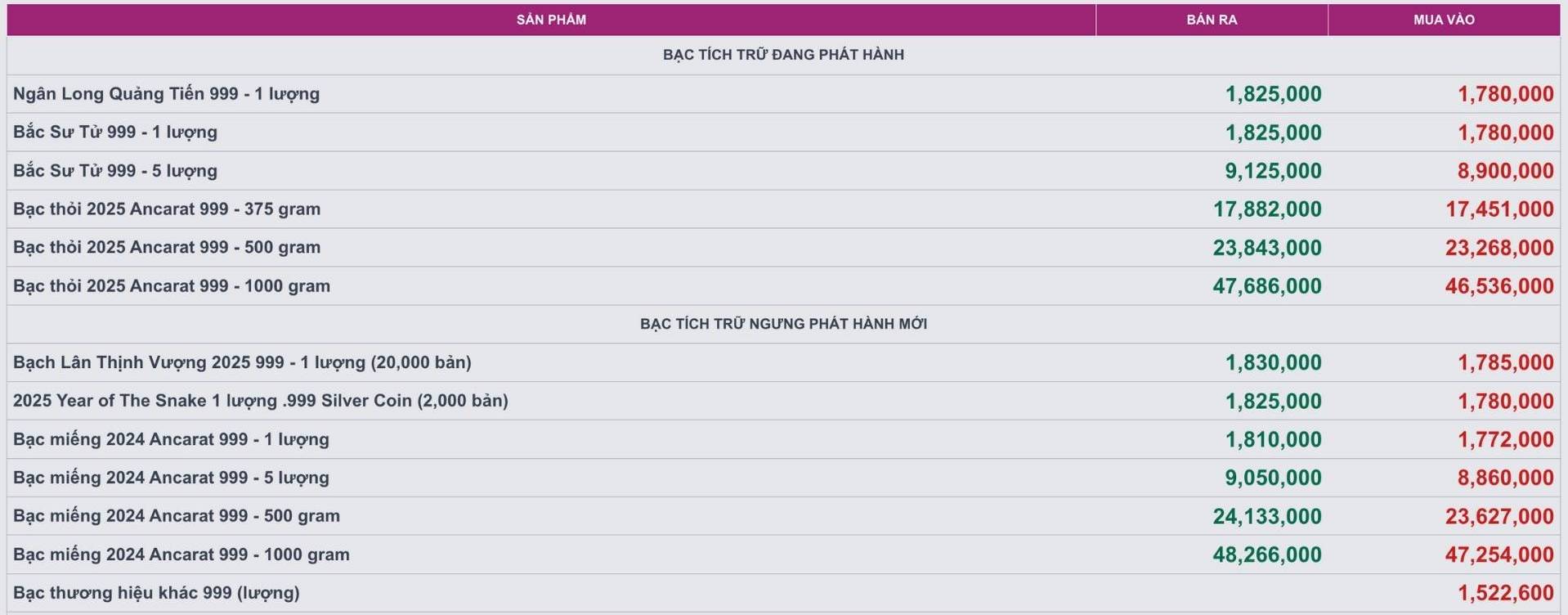

As of 9:30 a.m. on September 29, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.772 - 1.810 million/tael (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at VND 47.254 - 48.266 million/kg (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 46.536 - 47.686 million VND/kg (buy - sell).

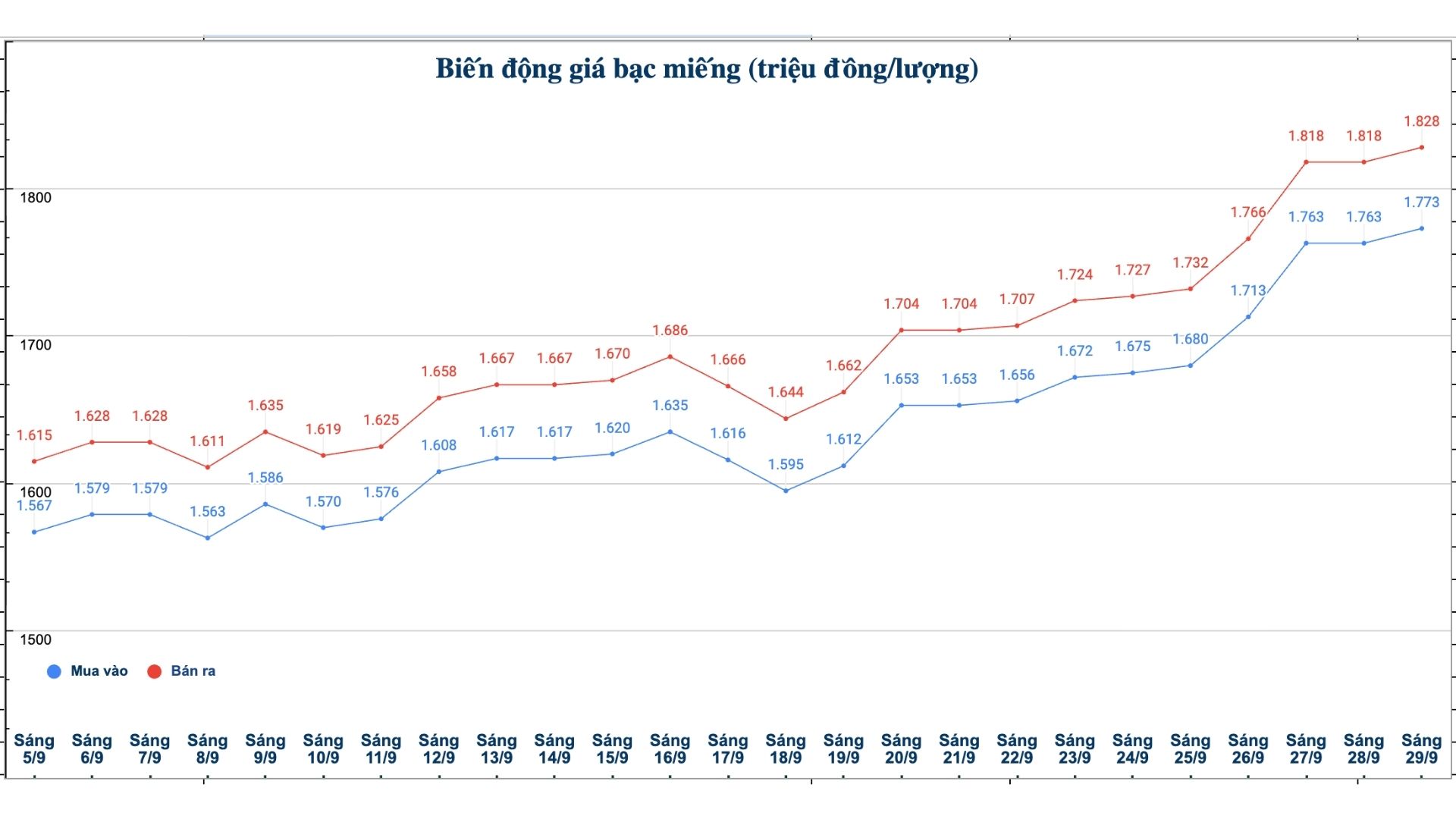

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.773 - 1.828 million VND/tael (buy - sell); an increase of 10,000 VND/tael for both buying and selling compared to yesterday morning (September 28).

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.773 - 1.828 million VND/tael (buy - sell); increased by 10,000 VND/tael for both buying and selling compared to yesterday morning (September 28).

The price of 999 gold bars (1kg) at Phu Quy Jewelry Group was listed at 47.279 - 48.746 million VND/kg (buy - sell); an increase of 266,000 VND/kg for buying and an increase of 267,000 VND/kg for selling compared to yesterday morning (September 28).

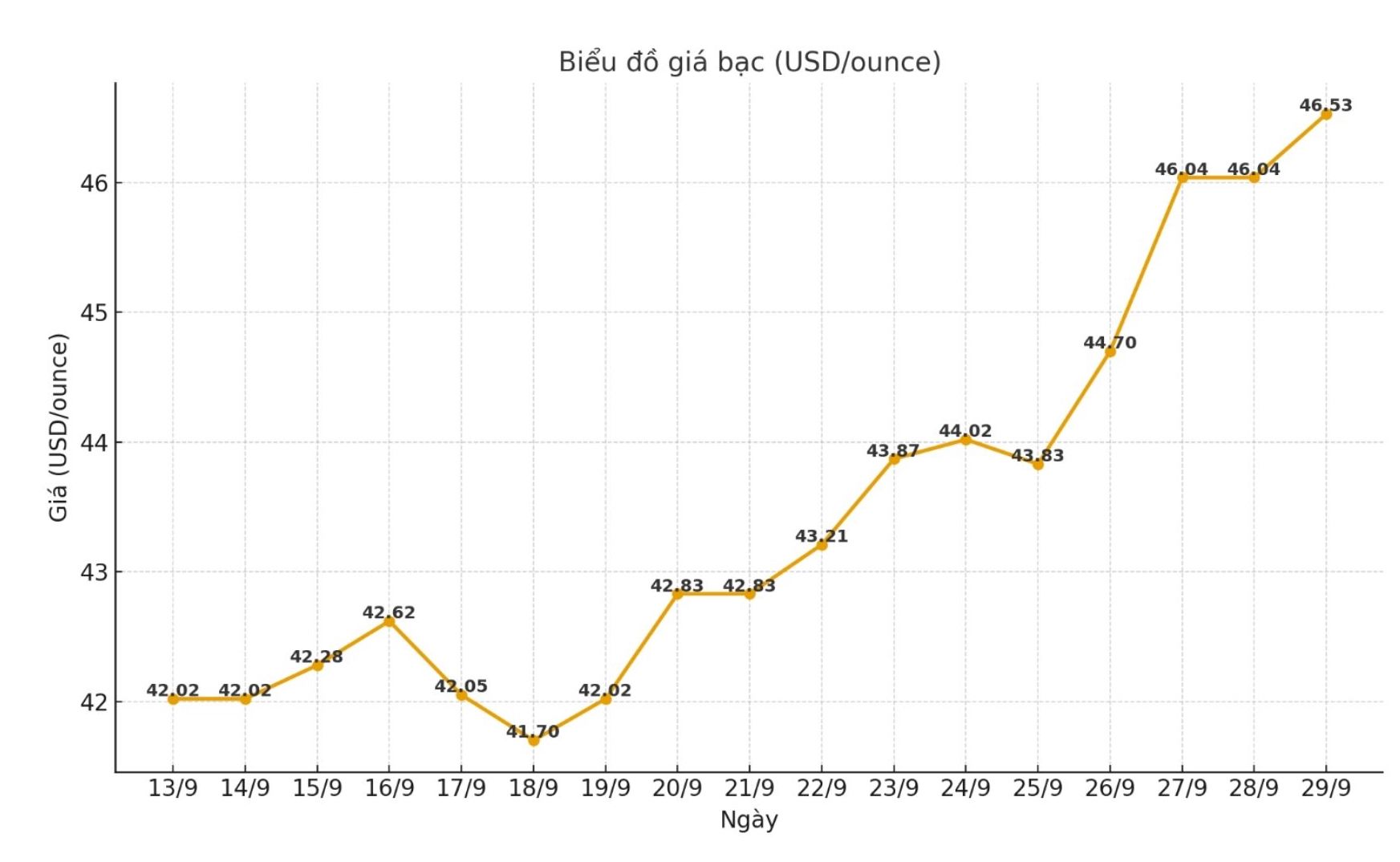

World silver price

On the world market, as of 9:32 a.m. on September 29 (Vietnam time), the world silver price was listed at 46.53 USD/ounce; up 0.49 USD compared to yesterday morning.

Causes and predictions

Silver prices continued to break the peak, recording the sixth consecutive week of increase. Last week, prices hit a peak of 14 years at 46.63 USD/ounce after surpassing the long-term resistance level of 44.22 USD/ounce.

According to analyst James Hyerczyk, the next target for market attention is 49.81 USD/ounce, close to the psychological mark of 50 USD/ounce.

"The increase in silver is supported by expectations that the US Federal Reserve (FED) will also cut interest rates this year, along with rising industrial demand and the risk of tightening supply," he said.

However, the expert noted that some figures such as GDP adjustment increase, new houses sell well, unemployment benefits decrease... make the possibility of interest rate cuts questioned. August core PCE increased by only 0.21% compared to the previous month and 2.9% compared to the same period, not strong enough to reverse loose expectations.

Regarding supply and demand, James Hyerczyk said that China's push for solar power continues to increase demand for silver. At the same time, Freeport's Grasberg field declared force majeure, increasing the risk of supply shortages in the context of thin inventories. ETF inflows and physical demand in Asia remained steady.

Technically, the expert said, silver prices could head towards 49.81 USD/ounce and the current price of 44.22 USD/ounce should be the support zone. "However, after a strong increase and being at its highest level since 2011, prices may stagnate or adjust for 2-3 weeks before continuing" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...